- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:WB

Is Weibo’s Recent Share Price Drop Creating Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

If you’re holding Weibo stock or just weighing your next move, it’s a fascinating moment to pay attention. This isn’t one of those stocks that just glides along unnoticed. Instead, Weibo has been catching eyes thanks to some serious moves over the past year. Sure, the past week and month have seen a bit of turbulence, dropping by 9.4% and 11.0% respectively, but that comes after a robust rally earlier in the year. Year to date, the stock is up 20.8%, with an eye-catching 42.0% gain over the last twelve months. If you zoom out even further, though, the story gets more complicated, with a three-year return of 15.1% and a steep 63.5% slide over five years. That kind of volatility can make even the most experienced investor pause and consider what’s really driving the narrative.

Some of this action has to do with broader changes in the Chinese tech landscape, where shifts in regulations and market sentiment have altered how investors view household names like Weibo. There is a sense that risk perceptions are changing, and growth potential is being reassessed as the company adapts to the evolving digital scene.

But what about valuation? That is where things get exciting. According to a recent analysis, Weibo scores a strong 5 out of 6 on key undervaluation checks, a clear sign that the market might be overlooking some value here. Before you make your next move, let’s dig into each approach investors use to judge a stock’s true value. And by the end, you’ll discover a smarter way to make sense of it all.

Why Weibo is lagging behind its peers

Approach 1: Weibo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. In Weibo's case, this means looking at the cash the business is expected to generate and assessing what that is worth right now.

Currently, Weibo generates $541 million in free cash flow per year. Analyst forecasts suggest relatively steady growth, with free cash flow projected to reach $465 million in 2026 and $486 million in 2027. Beyond that, further projections by Simply Wall St estimate free cash flow could climb to over $629 million by 2035, reflecting modest annual growth.

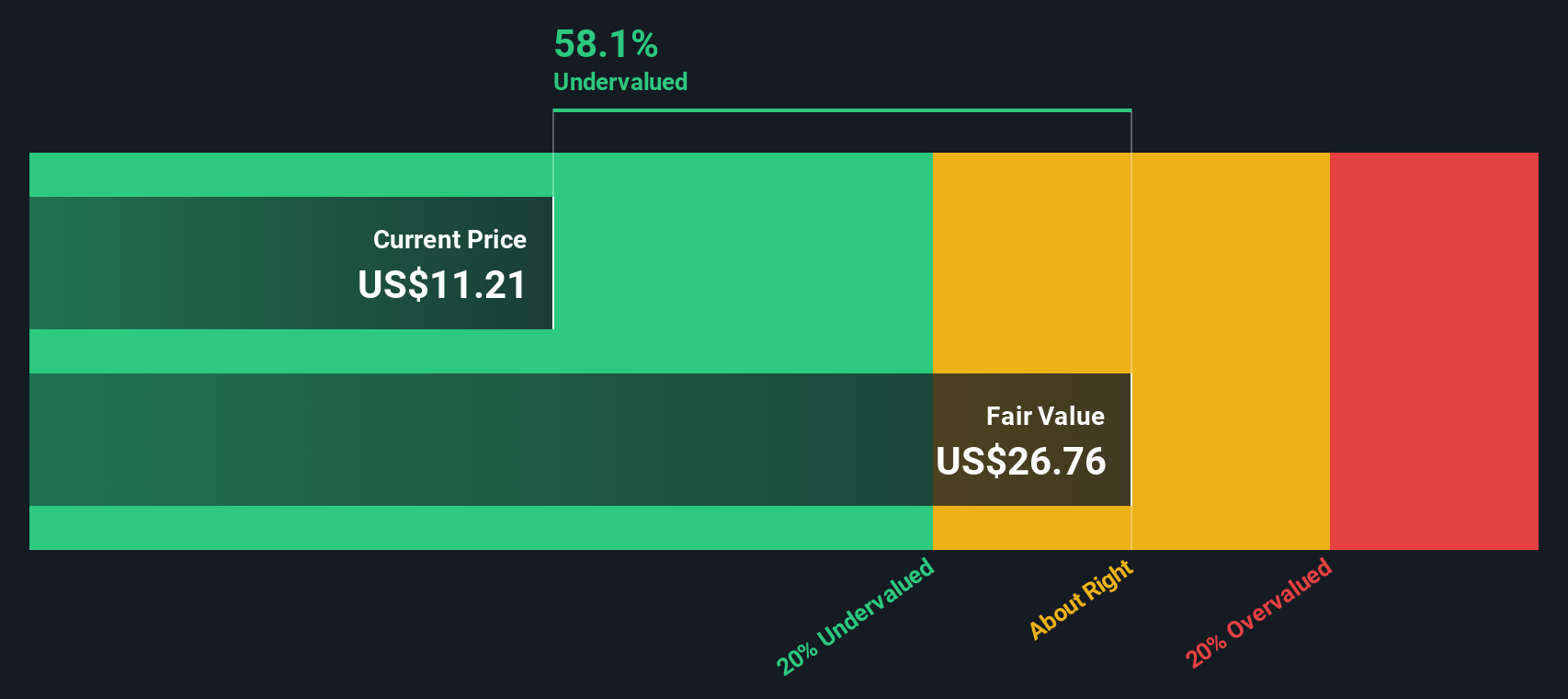

All these projected cash flows are discounted back to the present using a two-stage Free Cash Flow to Equity model. This results in an estimated intrinsic share value of $26.76. According to this methodology, the stock is trading at a significant 58.1% discount to its intrinsic value.

A valuation like this signals that the market may be underestimating Weibo’s ability to generate consistent cash flow and future growth, especially considering the challenging operating environment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Weibo is undervalued by 58.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Weibo Price vs Earnings

For profitable companies, the price-to-earnings (PE) ratio is often the most straightforward way to value a business. It tells you how much investors are willing to pay for each dollar of earnings, which makes it a popular tool for comparing similar companies.

However, a “normal” or “fair” PE ratio is not set in stone. It depends on growth expectations and risk. Companies with higher potential for earnings growth or lower perceived risk often command loftier PE multiples, while riskier or slower-growing firms usually trade at lower ratios.

Right now, Weibo trades at a PE ratio of 7.4x, which is notably lower than both the Interactive Media and Services industry average of 15.4x and the peer group average of 20.3x. This initially signals undervaluation compared to those benchmarks, but simple comparisons can miss the full picture.

That is where Simply Wall St’s Fair Ratio comes in. This proprietary metric estimates the PE you would expect a company to trade at, taking into account not just its sector but crucial variables like growth outlook, profitability, market cap and risk factors. For Weibo, the Fair Ratio is calculated at 16.4x, which is much higher than its current ratio.

Since Weibo’s actual PE is well below its Fair Ratio, the market appears to be undervaluing its earnings power, even after considering company-specific risks and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

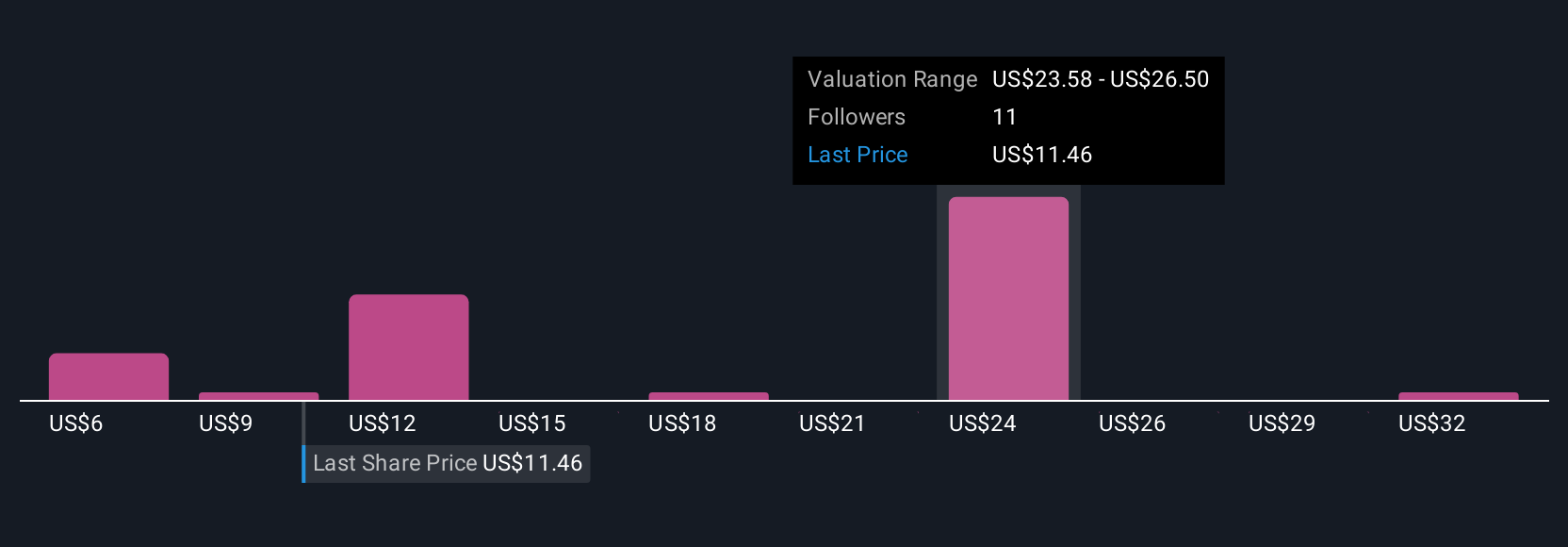

Upgrade Your Decision Making: Choose your Weibo Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is your written perspective or “story” about a company’s future. It ties together your assumptions about what will drive revenue, earnings, and margins, and explains why you believe a particular fair value makes sense.

Narratives allow you to connect the dots between Weibo’s business developments, future financial forecasts, and your estimate of fair value, all in one place. Think of it as a roadmap that builds on your view of what matters most, rather than just relying on standard ratios or industry averages. The best part is that Narratives are designed to be accessible to anyone and are available right within Simply Wall St’s Community page, a space used by millions of investors globally.

With Narratives, you can quickly compare your Fair Value estimate to Weibo’s current price to decide whether it is time to buy, sell, or hold, based on your personal outlook. As new information (like earnings, news, or regulatory changes) comes in, these Narratives update dynamically, so your story and valuation stay relevant.

For example, one investor might believe that Weibo’s aggressive AI and influencer strategies will drive value, estimating a fair value as high as $18.31. Another might focus on competition and regulatory risks, coming up with a more conservative fair value of $8.60.

Do you think there's more to the story for Weibo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weibo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WB

Through its subsidiaries, operates as a social media platform for people to create, discover, and distribute content in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives