- United States

- /

- Capital Markets

- /

- NYSE:AC

Undiscovered Gems SBC Medical Group Holdings and 2 Other Small Caps with Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 4.0% decline, yet it has shown resilience with a 24% rise over the past year and an anticipated annual earnings growth of 15%. In this dynamic environment, identifying stocks like SBC Medical Group Holdings and other small caps with strong potential can provide investors with opportunities for growth by focusing on companies that are positioned to capitalize on these positive earnings forecasts.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

SBC Medical Group Holdings (NasdaqGM:SBC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SBC Medical Group Holdings Incorporated offers management services to cosmetic treatment centers across Japan, Vietnam, the United States, and other international locations with a market capitalization of $616.50 million.

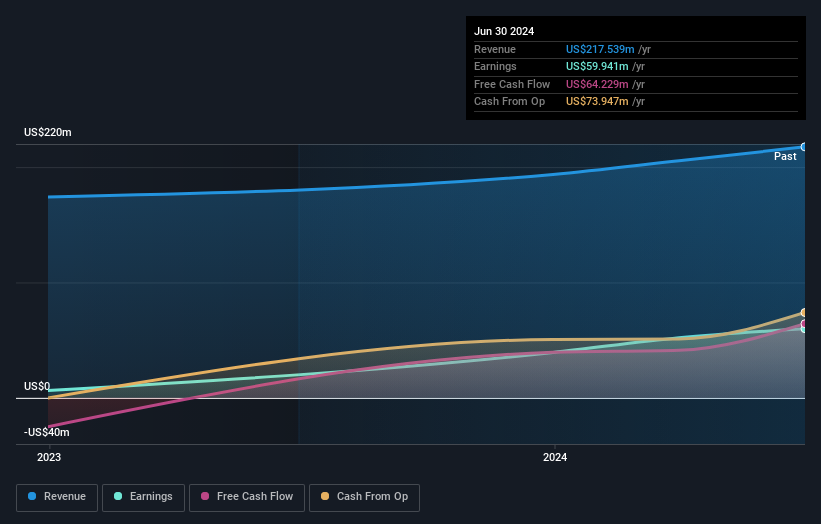

Operations: SBC Medical Group Holdings generates revenue primarily from its healthcare facilities and services segment, amounting to $223.34 million.

SBC Medical Group Holdings is making waves with a 75% earnings growth over the past year, outpacing the healthcare industry average of 10%. Trading at nearly 80% below its estimated fair value, it presents a compelling opportunity. The company boasts high-quality earnings and maintains more cash than total debt, ensuring financial stability. Recent strategic moves include launching SBC Wellness for corporate clients and forming an alliance with MEDIROM Healthcare Technologies to expand customer reach. Despite share price volatility, these initiatives position SBC as a promising player in the evolving wellness market.

- Click here and access our complete health analysis report to understand the dynamics of SBC Medical Group Holdings.

Learn about SBC Medical Group Holdings' historical performance.

Travelzoo (NasdaqGS:TZOO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Travelzoo, along with its subsidiaries, functions as an Internet media company offering travel, entertainment, and local experiences globally, with a market cap of $250.84 million.

Operations: The company generates revenue primarily from Travelzoo North America ($54.97 million) and Travelzoo Europe ($24.90 million), with additional contributions from Jack's Flight Club ($4.27 million) and New Initiatives ($0.24 million).

Travelzoo, a nimble player in the travel deals space, is making waves with its strategic initiatives. The company recently reported a net income of US$3.18 million for Q3 2024, up from US$2.35 million the previous year, showcasing robust earnings growth despite slightly lower sales of US$20.1 million compared to US$20.6 million last year. Travelzoo's debt-free status enhances its financial flexibility and value proposition, trading at 77.8% below estimated fair value while executing a share repurchase program that saw 10.52% of shares bought back for US$12.57 million this year alone, potentially boosting shareholder returns further.

Associated Capital Group (NYSE:AC)

Simply Wall St Value Rating: ★★★★★★

Overview: Associated Capital Group, Inc. offers investment advisory services in the United States and has a market capitalization of approximately $778.98 million.

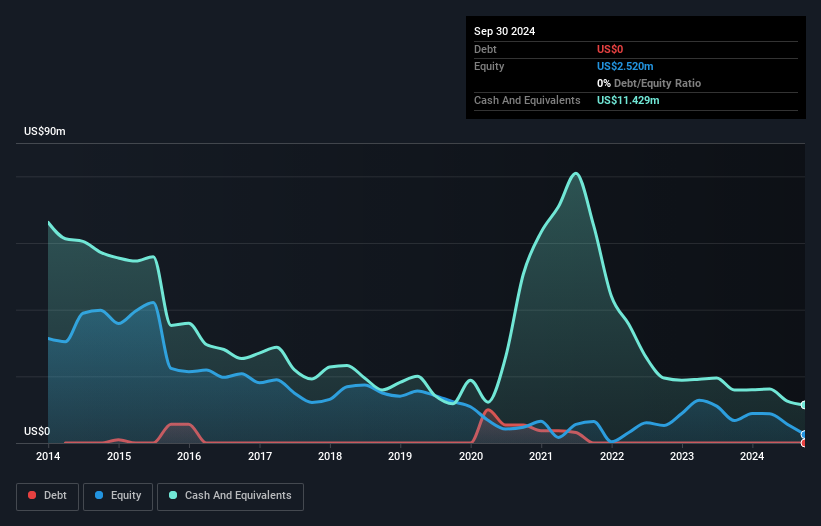

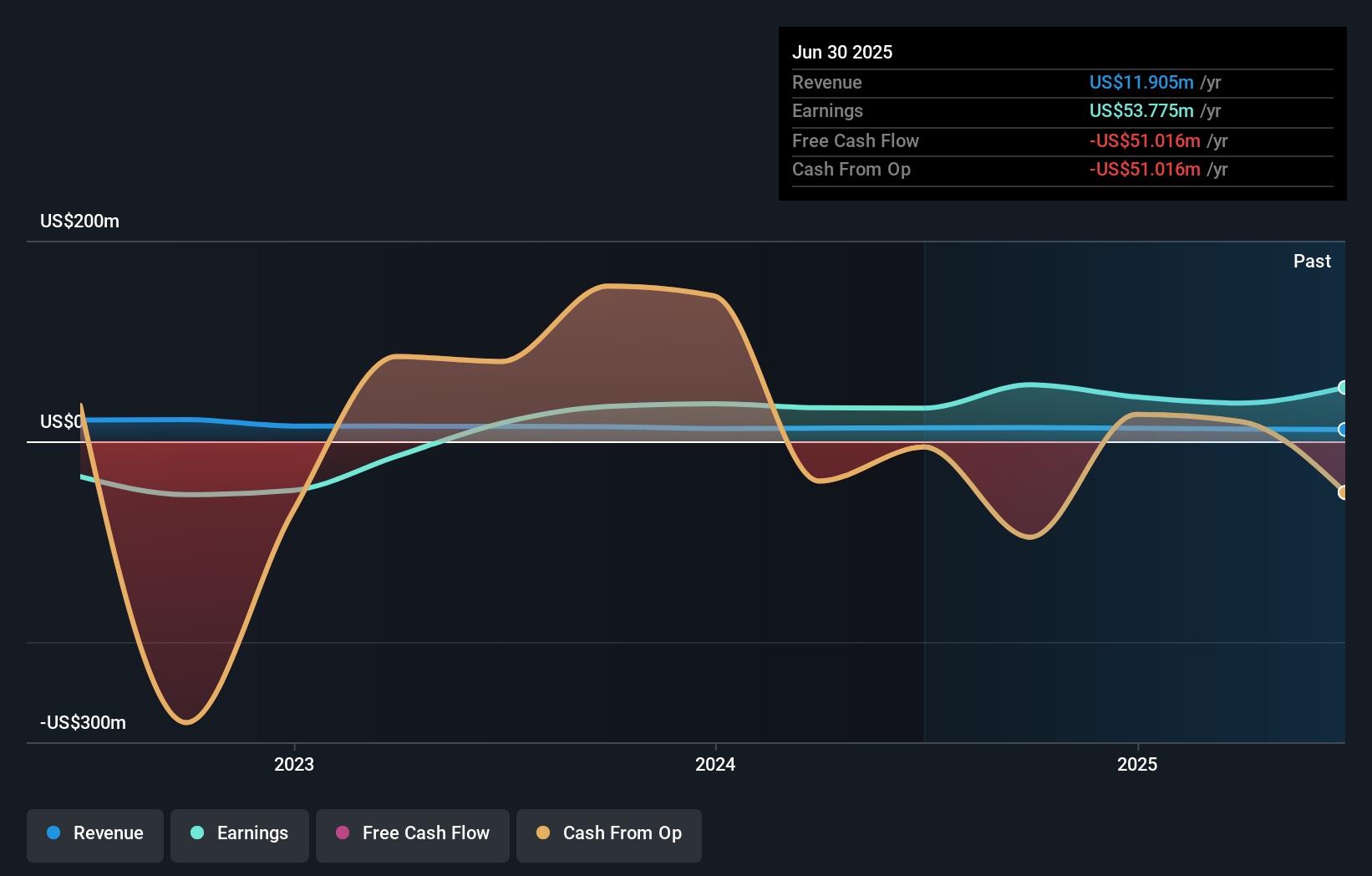

Operations: The primary revenue stream for Associated Capital Group comes from its investment advisory and asset management services, generating approximately $13.66 million.

Associated Capital Group, a nimble player in the financial sector, showcases robust earnings growth of 62.2% over the past year, outpacing its industry by a significant margin. With no debt on its books for five years and a price-to-earnings ratio of 13.5x below the US market average, it appears attractively valued. Recent activities include repurchasing 121,843 shares for $3.94 million and declaring dividends totaling $2.10 per share this year, including a special dividend of $2 per share paid in November 2024. Despite lacking free cash flow positivity, its high non-cash earnings quality underscores potential resilience amidst market fluctuations.

- Unlock comprehensive insights into our analysis of Associated Capital Group stock in this health report.

Understand Associated Capital Group's track record by examining our Past report.

Where To Now?

- Discover the full array of 242 US Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AC

Associated Capital Group

Provides investment advisory services in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives