- United States

- /

- Software

- /

- NasdaqGS:NTNX

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but it is up 15% over the past year with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks can be crucial as they often offer potential for significant returns due to their innovative capabilities and alignment with market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Ardelyx | 21.16% | 61.61% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.64% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.97% | 59.13% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.33% | 105.07% | ★★★★★★ |

Click here to see the full list of 222 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Trade Desk (TTD)

Simply Wall St Growth Rating: ★★★★★☆

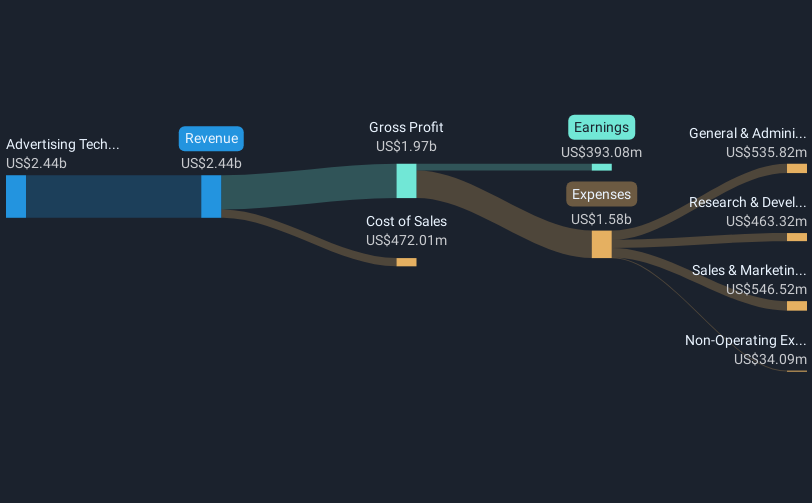

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising platform, with a market capitalization of approximately $39.43 billion.

Operations: The company generates revenue primarily from its advertising technology platform, which brought in approximately $2.57 billion.

Trade Desk's recent inclusion in multiple S&P indices underscores its robust position in the digital advertising landscape, reflecting investor confidence and market validation. With a striking 104.7% earnings growth over the past year, significantly outpacing the Media industry's -0.4%, TTD is not only expanding but also innovating; for instance, its partnership with Rembrand enhances ad placements through AI-driven creative optimization. Furthermore, TTD’s R&D commitment is evident from its continuous product enhancements like Deal Desk and OpenSincera, ensuring it remains at the forefront of ad tech innovation while fostering a seamless advertising experience across various platforms.

Nutanix (NTNX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nutanix, Inc. offers an enterprise cloud platform across various global regions including North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa with a market cap of $20.25 billion.

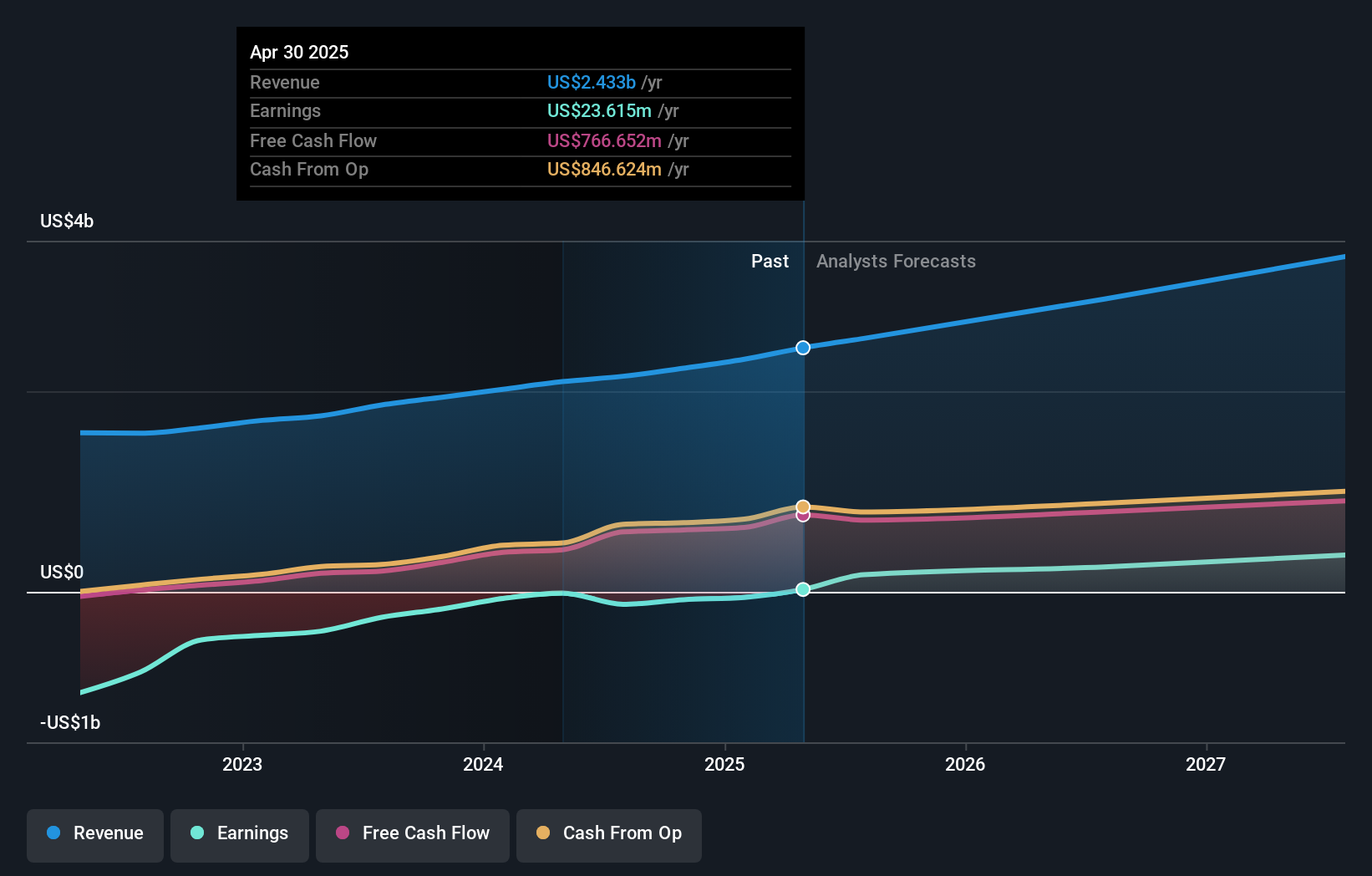

Operations: The company's primary revenue stream is from its Internet Software & Services segment, generating $2.43 billion.

Nutanix has demonstrated a notable turnaround, transitioning to profitability this year with a net income of $63.36 million in Q3 2025, up from a loss the previous year. This shift is underscored by robust annual revenue growth of 14.1% and even more impressive earnings growth forecasted at 69.1% per annum, signaling strong operational improvements and market acceptance. Recent strategic moves include significant share repurchases totaling $188.65 million, reinforcing confidence in its financial health and future prospects. Moreover, Nutanix's commitment to innovation is evident in its R&D investments which have supported the development of advanced solutions like the Cloud Native AOS, enhancing its competitive edge in the cloud technology space.

- Navigate through the intricacies of Nutanix with our comprehensive health report here.

Evaluate Nutanix's historical performance by accessing our past performance report.

Pure Storage (PSTG)

Simply Wall St Growth Rating: ★★★★★☆

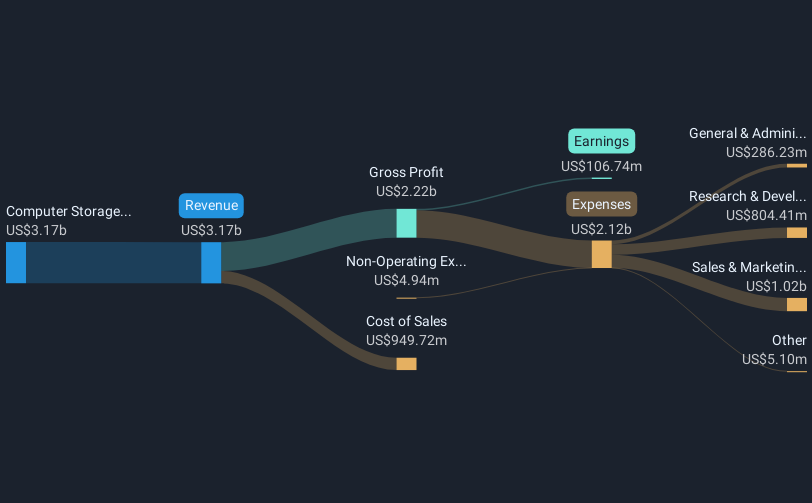

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market capitalization of approximately $18.99 billion.

Operations: Pure Storage focuses on delivering data storage and management solutions, generating revenue primarily from computer storage devices, which contributed approximately $3.25 billion.

Pure Storage is capitalizing on the evolving demands of data management with its recent product launches and strategic executive appointments. The introduction of the Enterprise Data Cloud (EDC) and enhancements in next-generation storage products underscore a commitment to addressing the complexities of modern data environments, highlighted by a robust 11.2% annual revenue growth. This innovation trajectory is complemented by the appointment of Tarek Robbiati as CFO, whose extensive experience in transforming financial and operational frameworks at major tech firms positions Pure Storage favorably for future scalability and market responsiveness. Moreover, recent collaborations like that with SK hynix emphasize Pure's strategic focus on high-capacity, energy-efficient storage solutions critical for hyperscaler environments, aligning with industry shifts towards more sustainable and performance-oriented data management solutions.

- Click here to discover the nuances of Pure Storage with our detailed analytical health report.

Examine Pure Storage's past performance report to understand how it has performed in the past.

Summing It All Up

- Explore the 222 names from our US High Growth Tech and AI Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)