- United States

- /

- Media

- /

- NasdaqGM:TTD

Can The Trade Desk’s (TTD) New AI Tools Deepen Its Edge in Programmatic Advertising?

Reviewed by Sasha Jovanovic

- On September 29, 2025, The Trade Desk announced the launch of Audience Unlimited, an artificial intelligence-powered solution designed to enhance the selection and scoring of data segments, along with the introduction of Koa Adaptive Trading Modes for more flexible and AI-guided advertising performance.

- This move underscores The Trade Desk's commitment to making third-party data more accessible and effective, further reinforcing its leadership in programmatic and connected TV advertising through advanced automation.

- We'll explore how the rollout of Audience Unlimited may reshape The Trade Desk's investment narrative by elevating its AI-powered platform advantage.

Find companies with promising cash flow potential yet trading below their fair value.

Trade Desk Investment Narrative Recap

At its core, being a shareholder in The Trade Desk means believing that their investments in AI-enabled automation and data transparency will help them lead digital advertising, especially as brands seek measurable ROI across open internet platforms. The recent launch of Audience Unlimited furthers this narrative by enhancing data access and campaign precision, supporting CTV growth, the key near-term catalyst, but does not fundamentally change the most important short-term risk, which remains exposure to macro-driven ad spend reductions by major enterprise clients.

Among recent developments, the introduction of Audience Unlimited stands out due to its alignment with the ongoing shift toward data-driven, high-ROI advertising and the growing importance of CTV. This product, by deepening AI’s role in optimizing ad performance, may complement existing efforts to sustain margins and drive higher campaign spend among core customers as CTV adoption expands globally.

However, while AI advancements create new opportunities, investors should also be mindful of how Trade Desk’s reliance on large advertisers could affect results if those clients cut digital ad budgets in response to...

Read the full narrative on Trade Desk (it's free!)

Trade Desk's narrative projects $4.3 billion in revenue and $823.2 million in earnings by 2028. This requires 17.1% annual revenue growth and an earnings increase of $406 million from current earnings of $417.2 million.

Uncover how Trade Desk's forecasts yield a $69.53 fair value, a 29% upside to its current price.

Exploring Other Perspectives

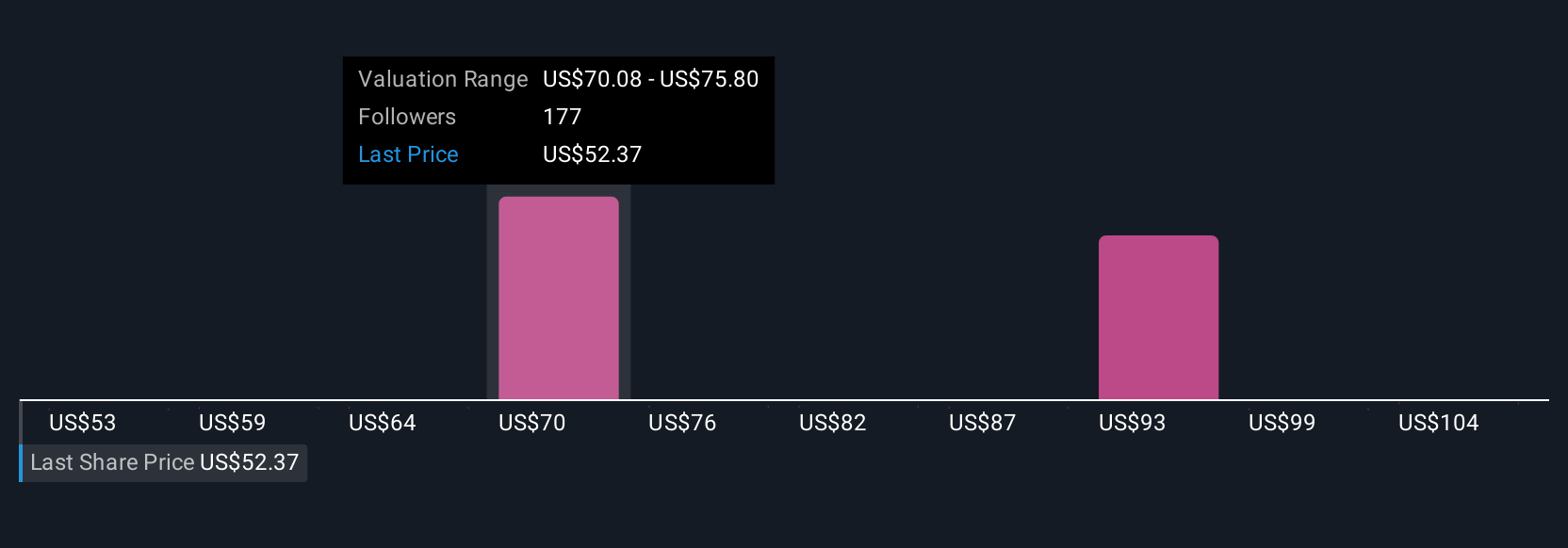

39 members of the Simply Wall St Community assessed The Trade Desk’s fair value between US$39.48 and US$111.31 per share. As investors weigh these opinions, attention remains on whether continued CTV adoption can outweigh the risk posed by concentrated enterprise ad spend, inviting you to compare a broader range of perspectives.

Explore 39 other fair value estimates on Trade Desk - why the stock might be worth over 2x more than the current price!

Build Your Own Trade Desk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trade Desk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trade Desk's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)