- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

3 Undervalued Small Caps With Recent Insider Activity Across Regions

Reviewed by Simply Wall St

In the midst of significant market volatility, with major indices like the Dow and Nasdaq experiencing sharp declines following a brief rally, investors are increasingly focused on small-cap stocks as potential opportunities. The S&P 600 index for small-cap stocks has been particularly influenced by recent economic uncertainties and tariff developments, highlighting the importance of identifying companies that demonstrate resilience and potential for growth. In such an environment, a good stock might be characterized by strong fundamentals and strategic insider activity that suggests confidence in its future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| S&T Bancorp | 9.7x | 3.3x | 48.73% | ★★★★★★ |

| MVB Financial | 10.4x | 1.4x | 38.95% | ★★★★★☆ |

| Flowco Holdings | 6.0x | 0.9x | 41.35% | ★★★★★☆ |

| Thryv Holdings | NA | 0.6x | 32.82% | ★★★★★☆ |

| PDF Solutions | 171.5x | 3.9x | 23.16% | ★★★★☆☆ |

| Columbus McKinnon | 38.8x | 0.4x | 48.98% | ★★★☆☆☆ |

| Franklin Financial Services | 13.8x | 2.2x | 40.16% | ★★★☆☆☆ |

| Union Bankshares | 15.1x | 2.8x | 47.08% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.2x | -3294.91% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -301.65% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Thryv Holdings (NasdaqCM:THRY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Thryv Holdings provides software as a service (SaaS) solutions and marketing services, with a market capitalization of approximately $0.89 billion.

Operations: Thryv Holdings generates revenue primarily through its SaaS and Marketing Services segments, with the latter contributing $480.68 million. The company has seen fluctuations in its gross profit margin, which reached 65.69% as of September 2024. Operating expenses have been a significant component of costs, with sales and marketing being a major expenditure at $275.74 million for the same period.

PE: -6.6x

Thryv Holdings, a smaller company in the U.S., recently showcased improved financial health with a turnaround from a net loss of US$257.54 million to a net income of US$7.88 million in Q4 2024. Despite lower annual sales at US$824.16 million, insider confidence is evident through recent share purchases by insiders during the past year. A strategic partnership with 1-800Accountant enhances their service offerings for small businesses, potentially boosting future revenue streams as they aim for SaaS revenue between US$464.5 million and US$474 million in 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of Thryv Holdings.

Review our historical performance report to gain insights into Thryv Holdings''s past performance.

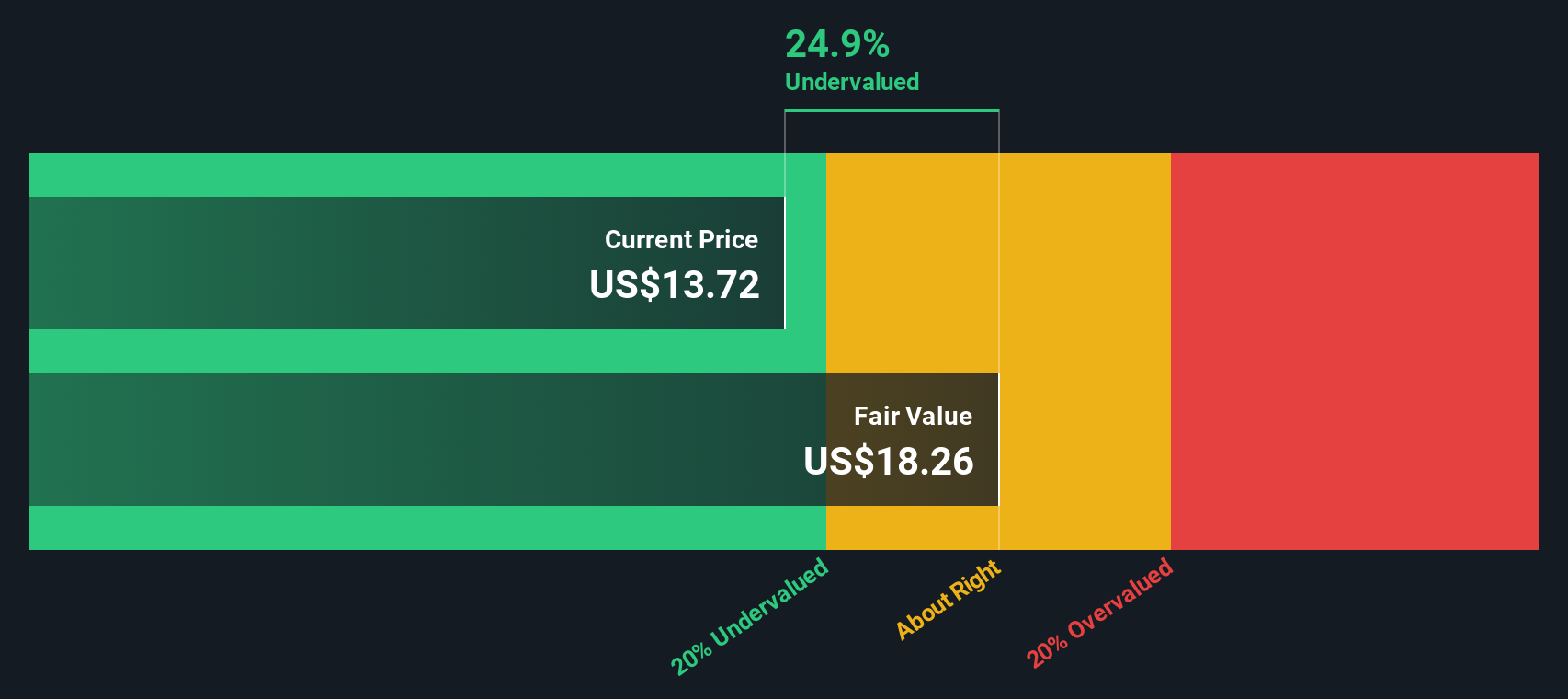

Tandem Diabetes Care (NasdaqGM:TNDM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Tandem Diabetes Care specializes in designing and manufacturing insulin pumps and related supplies, with a market capitalization of approximately $1.19 billion.

Operations: The company generates revenue primarily from insulin pumps and supplies, with recent figures reaching $940.20 million. The gross profit margin has shown variability, most recently recorded at 52.07%. Operating expenses are significant, with general and administrative costs being the largest component. Research and development expenses have also been substantial, reflecting ongoing investment in innovation.

PE: -11.8x

Tandem Diabetes Care, a smaller U.S. company, is gaining attention with its advanced Control-IQ+ technology, recently launched for type 2 diabetes. The company's pivotal trial showed significant improvements in glycemic control using this system. Despite reporting a net loss of US$96 million for 2024, Tandem's revenue grew to US$940 million from the previous year. Insider confidence was evident as insiders made share purchases in recent months, reflecting potential growth prospects amidst ongoing product innovations and expanding market reach.

- Unlock comprehensive insights into our analysis of Tandem Diabetes Care stock in this valuation report.

Assess Tandem Diabetes Care's past performance with our detailed historical performance reports.

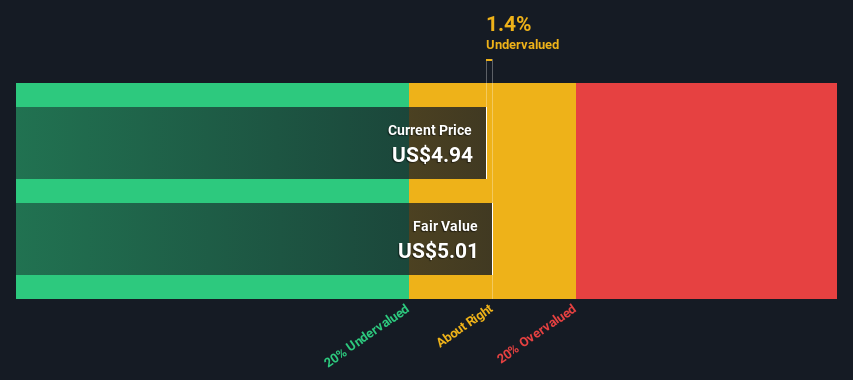

Materialise (NasdaqGS:MTLS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Materialise is a company specializing in 3D printing solutions, offering services across medical, software, and manufacturing segments with a market capitalization of approximately $0.85 billion.

Operations: Materialise generates revenue primarily from its three segments: Medical, Software, and Manufacturing. The company has seen fluctuations in net income margin over time, with recent figures showing positive trends. Sales & Marketing and R&D are significant components of operating expenses. Gross profit margin has shown variability, recently recorded at 56.54%.

PE: 16.8x

Materialise, a smaller player in the 3D printing industry, presents intriguing prospects. Despite recent share price volatility, its financials show promise: full-year 2024 sales rose to €266.77 million from €256.13 million previously, with net income doubling to €13.44 million. The company forecasts revenue growth in 2025 between €270 million and €285 million. While reliant on external borrowing for funding, insider confidence is evident through recent purchases, suggesting belief in future growth potential despite current risks.

- Navigate through the intricacies of Materialise with our comprehensive valuation report here.

Understand Materialise's track record by examining our Past report.

Taking Advantage

- Embark on your investment journey to our 77 Undervalued US Small Caps With Insider Buying selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Tandem Diabetes Care, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TNDM

Tandem Diabetes Care

Designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives