- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TBLA

Taboola (TBLA): Assessing Valuation After New LG Ad Solutions Partnership Targets Stronger Cross-Platform Ad Performance

Reviewed by Simply Wall St

Taboola.com (TBLA) just teamed up with LG Ad Solutions to launch Performance Enhancer, a new tool that links connected TV campaigns with measurable digital results and potentially deepens advertiser demand across Taboola’s broader open web footprint.

See our latest analysis for Taboola.com.

With the latest LG Ad Solutions partnership, Taboola.com’s story is starting to line up more with its numbers, as the $4.03 share price follows a 90 day share price return of 20.3 percent and a three year total shareholder return above 50 percent. This suggests momentum is gradually rebuilding after a choppy few years.

If this kind of ad tech momentum has your attention, it might be a good time to scan other high growth tech names using high growth tech and AI stocks for new ideas.

Yet despite improving momentum and a sizable intrinsic discount estimate, margins and returns on capital still look fragile. This raises the key question for investors: is Taboola now a mispriced turnaround, or is the market already baking in its next leg of growth?

Most Popular Narrative: 10.4% Undervalued

With the narrative fair value pinned at 4.50 dollars against a 4.03 dollar close, the story leans toward modest upside anchored in improving fundamentals.

The launch of Realize, Taboola's new performance advertising platform, is enabling entry into a much larger pool of display and social ad budgets, positioning the company to capture incremental revenue growth outside of traditional native ad formats. This is expected to materially expand the addressable market and drive a return to double digit revenue growth in the coming years.

Curious how a platform refresh, rising margins and shrinking share count combine into that upside case? Want to see the growth, profitability and multiple assumptions behind it?

Result: Fair Value of $4.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on Realize scaling successfully and open web traffic holding up, with any stumble potentially derailing those margin and growth expectations.

Find out about the key risks to this Taboola.com narrative.

Another Lens on Value

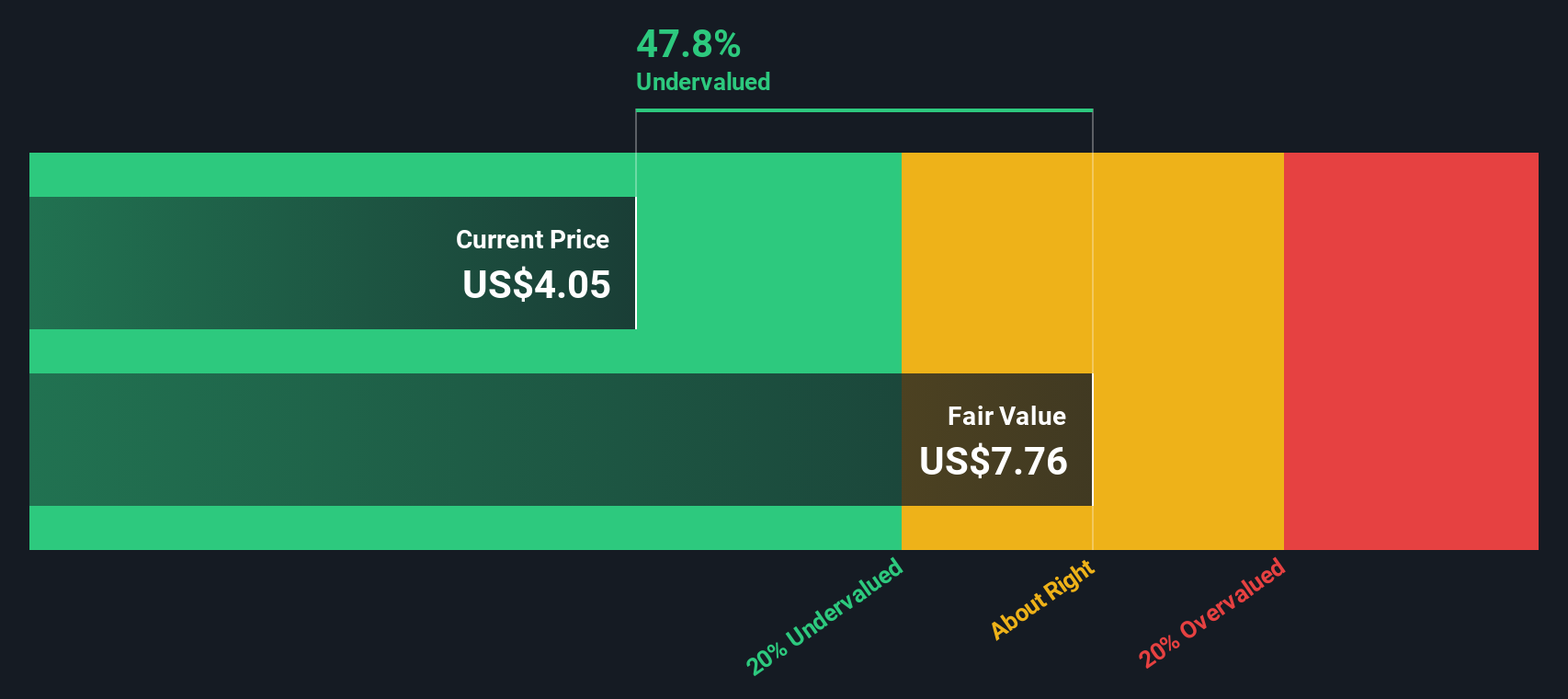

Our SWS DCF model paints a very different picture, suggesting Taboola.com is trading around 48 percent below its estimated fair value of 7.76 dollars per share. If long term cash flows really look that strong, is the market mispricing a slow burner or sensing risks the model smooths over?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Taboola.com Narrative

If you see things differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Taboola.com.

Ready for your next investing move?

Before you move on, consider a few more high conviction ideas with the Simply Wall St Screener, so you are not leaving potential returns on the table.

- Explore steady income potential by reviewing these 11 dividend stocks with yields > 3% that can support long term compounding with reliable cash payouts.

- Look into cutting edge growth themes through these 30 healthcare AI stocks combining innovation in medicine with scalable software economics.

- Assess valuation opportunities using these 907 undervalued stocks based on cash flows that may be pricing in too much pessimism relative to their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taboola.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBLA

Taboola.com

Operates an artificial intelligence-based algorithmic engine platform in Israel, the United States, the United Kingdom, Germany, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026