- United States

- /

- Entertainment

- /

- NasdaqGM:RSVR

Reservoir Media (RSVR) Turns Profitable, Challenging Bearish Growth and Valuation Narratives

Reviewed by Simply Wall St

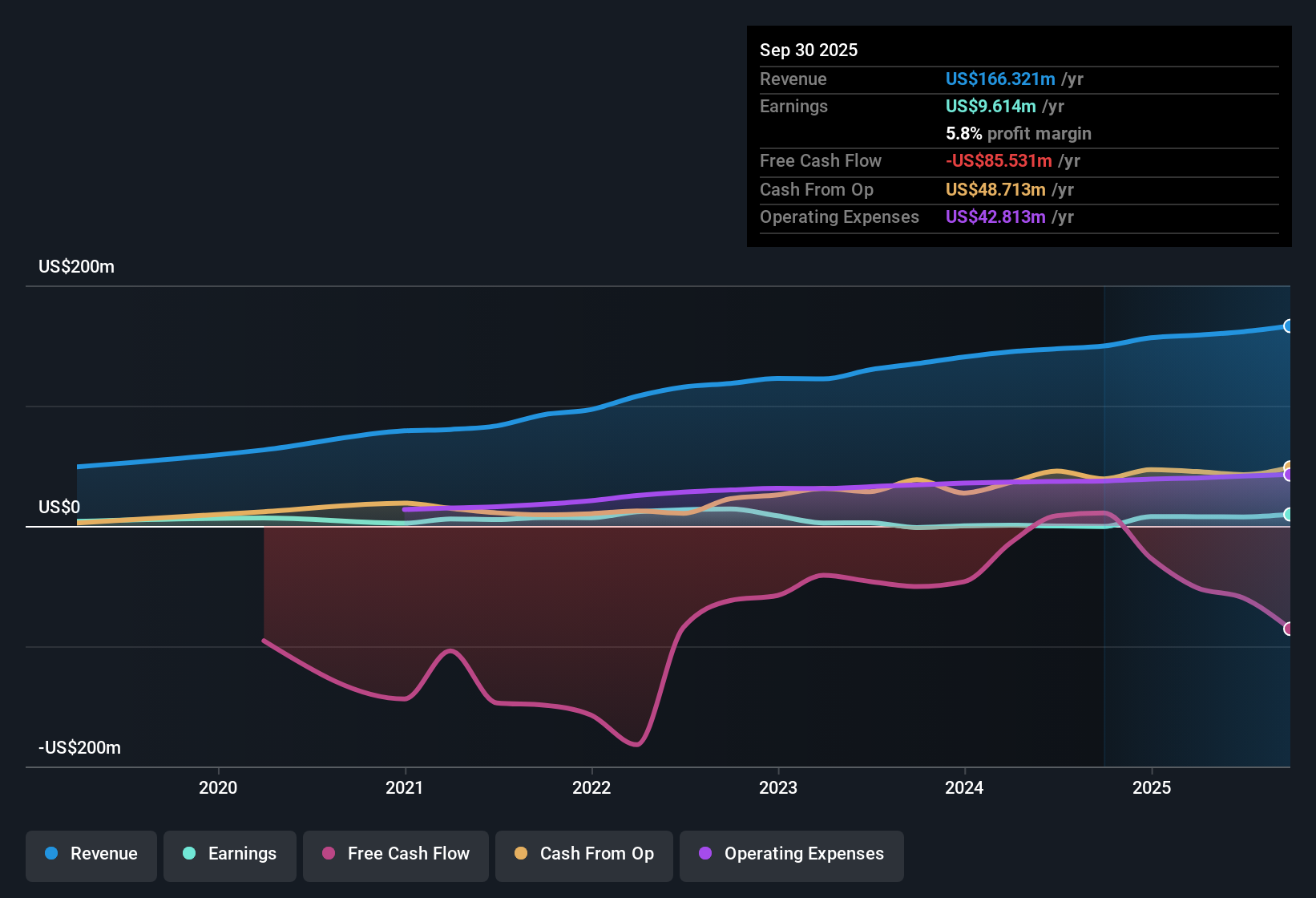

Reservoir Media (RSVR) posted a shift to profitability in the most recent year, marking a milestone after years of earnings pressure. Over the last five years, however, earnings have declined by 8.3% per year, and forward estimates suggest earnings could fall another 22.6% annually for the next three years. At the same time, revenue is forecast to grow by just 3.7% per year, trailing the broader US market rate of 10.5%. This leaves investors weighing slow top-line expansion against ongoing profit pressures.

See our full analysis for Reservoir Media.Next up, we will see how these recent numbers compare to the leading market narratives and investor expectations for Reservoir Media.

See what the community is saying about Reservoir Media

Profit Margins Expected to Tighten

- Analysts project Reservoir Media’s profit margins will slip from 4.7% today to just 3.2% in three years, highlighting mounting cost pressures and industry shifts that threaten future profitability.

- Analysts' consensus view calls out two key drivers affecting this trend:

- Inflation and rising admin expenses, such as higher compensation and technology costs, are likely to structurally raise the company’s cost base and keep margins under pressure.

- The expansion into immersive entertainment, while offering future growth optionality, comes with execution and integration risk due to Reservoir’s minority stake and unproven monetization track record.

Consensus sees profitability challenges driven by cost headwinds, even as the company invests in diversification.

📊 Read the full Reservoir Media Consensus Narrative.

Recurring Revenue Streams Strengthen

- Strategic catalog acquisitions and expansion into new formats such as immersive entertainment and indie labels are poised to boost recurring royalty streams and improve global monetization opportunities for future growth.

- Analysts' consensus view draws on several reinforcing points:

- Off-market, relationship-driven M&A deals are helping preserve margins by reducing exposure to inflated auction prices and increasing return on investment.

- Partnerships with major artists and songwriters are expanding the company’s IP value, industry relevance, and the resilience of its royalty streams in an evolving digital landscape.

Trading Below Analyst Target, Yet At a Premium

- Reservoir Media trades at $7.41 per share, below the $13.25 analyst target and the DCF fair value of $13.73. However, its 50.5x Price-to-Earnings ratio is still a premium to the industry average (25.5x), but a discount to its peer group (82.1x).

- Analysts' consensus view highlights mixed valuation signals:

- The current share price offers upside to targets, but the implied 2028 PE of 208.6x assumes bullish earnings growth and margin stability, which remains under debate given revenue growth headwinds and analyst caution on surprise risks.

- To justify analyst price targets, investors must believe in asset diversification and margin preservation offsetting concerns around slowing organic growth and a rising cost base.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Reservoir Media on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from another angle? You can take just a few minutes to form your own perspective and share your narrative. Do it your way.

A great starting point for your Reservoir Media research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Reservoir Media faces shrinking profit margins, slow revenue growth, and valuation pressures that could weigh on future returns and investor confidence.

If you want more stable performance, focus on companies showing steady earnings and growth with stable growth stocks screener (2077 results) that aren't facing the same headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RSVR

Fair value with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in