- United States

- /

- Entertainment

- /

- NasdaqCM:RDI

Should You Review Recent Insider Transactions At Reading International, Inc. (NASDAQ:RDI)?

It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So before you buy or sell Reading International, Inc. (NASDAQ:RDI), you may well want to know whether insiders have been buying or selling.

What Is Insider Buying?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But it is perfectly logical to keep tabs on what insiders are doing. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

View our latest analysis for Reading International

The Last 12 Months Of Insider Transactions At Reading International

In the last twelve months, the biggest single sale by an insider was when the President, Ellen Cotter, sold US$183k worth of shares at a price of US$7.30 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. The good news is that this large sale was at well above current price of US$4.98. So it may not tell us anything about how insiders feel about the current share price.

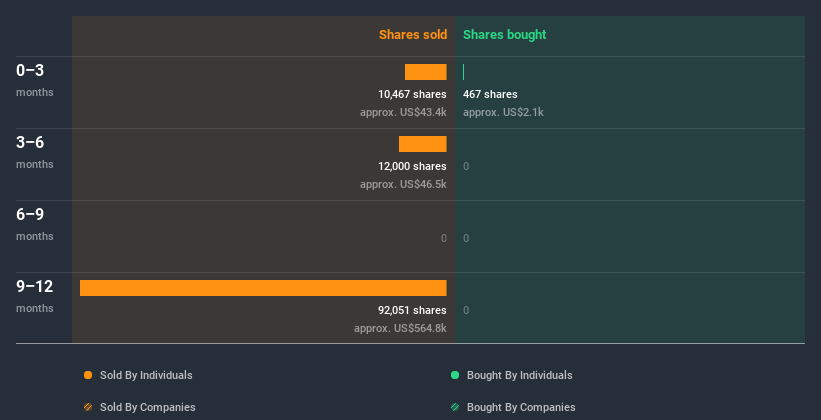

Over the last year we saw more insider selling of Reading International shares, than buying. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insiders at Reading International Have Sold Stock Recently

Over the last three months, we've seen a bit of insider selling at Reading International. In total, insiders sold US$42k worth of shares in that time. But CFO, Executive VP & Treasurer Gilbert Avanes spent US$2.1k on buying, too. While it's not great to see insider selling, the net amount sold isn't enough for us to want to read anything into it.

Does Reading International Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Insiders own 10% of Reading International shares, worth about US$14m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Reading International Insider Transactions Indicate?

Our data shows a little more insider selling than buying in the last three months. But the difference is small, and thus, not concerning. Recent insider selling makes us a little nervous, in light of the broader picture of Reading International insider transactions. But we do like the fact that insiders own a fair chunk of the company. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. To that end, you should learn about the 2 warning signs we've spotted with Reading International (including 1 which can't be ignored).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Reading International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:RDI

Reading International

Focuses on the ownership, development, and operation of entertainment and real property assets in the United States, Australia, and New Zealand.

Fair value with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)