- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:QNST

3 US Stocks Estimated To Be 44.8% Or More Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market shows signs of resilience with major indexes poised for gains following favorable inflation data, investors are keenly observing opportunities amid fluctuating corporate earnings and interest rate decisions. In this environment, identifying stocks that are undervalued compared to their intrinsic value can offer potential advantages, especially as the market continues to navigate economic shifts and technological advancements.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $25.16 | $48.65 | 48.3% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $30.84 | $59.21 | 47.9% |

| AGNC Investment (NasdaqGS:AGNC) | $10.08 | $19.70 | 48.8% |

| Array Technologies (NasdaqGM:ARRY) | $7.47 | $14.47 | 48.4% |

| Privia Health Group (NasdaqGS:PRVA) | $22.54 | $44.59 | 49.4% |

| Coastal Financial (NasdaqGS:CCB) | $89.93 | $172.68 | 47.9% |

| Verra Mobility (NasdaqCM:VRRM) | $26.73 | $51.91 | 48.5% |

| Ubiquiti (NYSE:UI) | $398.76 | $773.27 | 48.4% |

| BeiGene (NasdaqGS:ONC) | $226.89 | $439.58 | 48.4% |

| QuinStreet (NasdaqGS:QNST) | $24.44 | $47.65 | 48.7% |

Let's review some notable picks from our screened stocks.

Coastal Financial (NasdaqGS:CCB)

Overview: Coastal Financial Corporation, with a market cap of $1.34 billion, operates as the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Operations: Coastal Financial Corporation's revenue is composed of $192.73 million from CCBX, $78.94 million from Community Bank, and $12.45 million from Treasury & Administration segments.

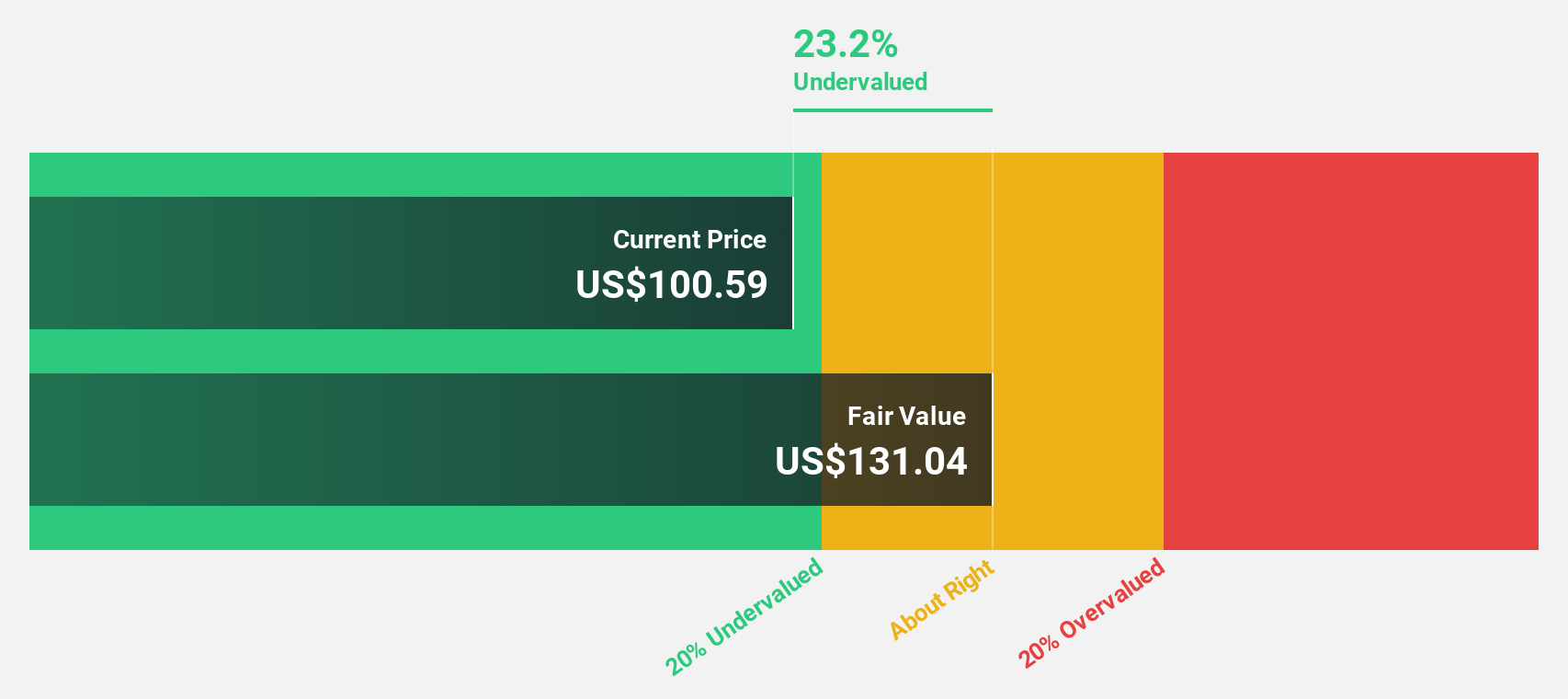

Estimated Discount To Fair Value: 47.9%

Coastal Financial is trading significantly below its estimated fair value of US$172.68, with a current price of US$89.93, reflecting a potential undervaluation based on cash flows. Revenue and earnings are forecast to grow rapidly at 40.9% and 49.2% per year respectively, outpacing the broader U.S. market growth rates. However, recent net charge-offs increased to US$55.9 million in Q4 2024 from US$44.9 million the previous year, which could pose a risk factor.

- Upon reviewing our latest growth report, Coastal Financial's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Coastal Financial.

Palomar Holdings (NasdaqGS:PLMR)

Overview: Palomar Holdings, Inc. is a specialty insurance company that offers property and casualty insurance to residential and business clients in the United States, with a market cap of approximately $2.87 billion.

Operations: The company's revenue is primarily derived from its Earthquake, Wind, and Flood Insurance Products segment, which generated $503.50 million.

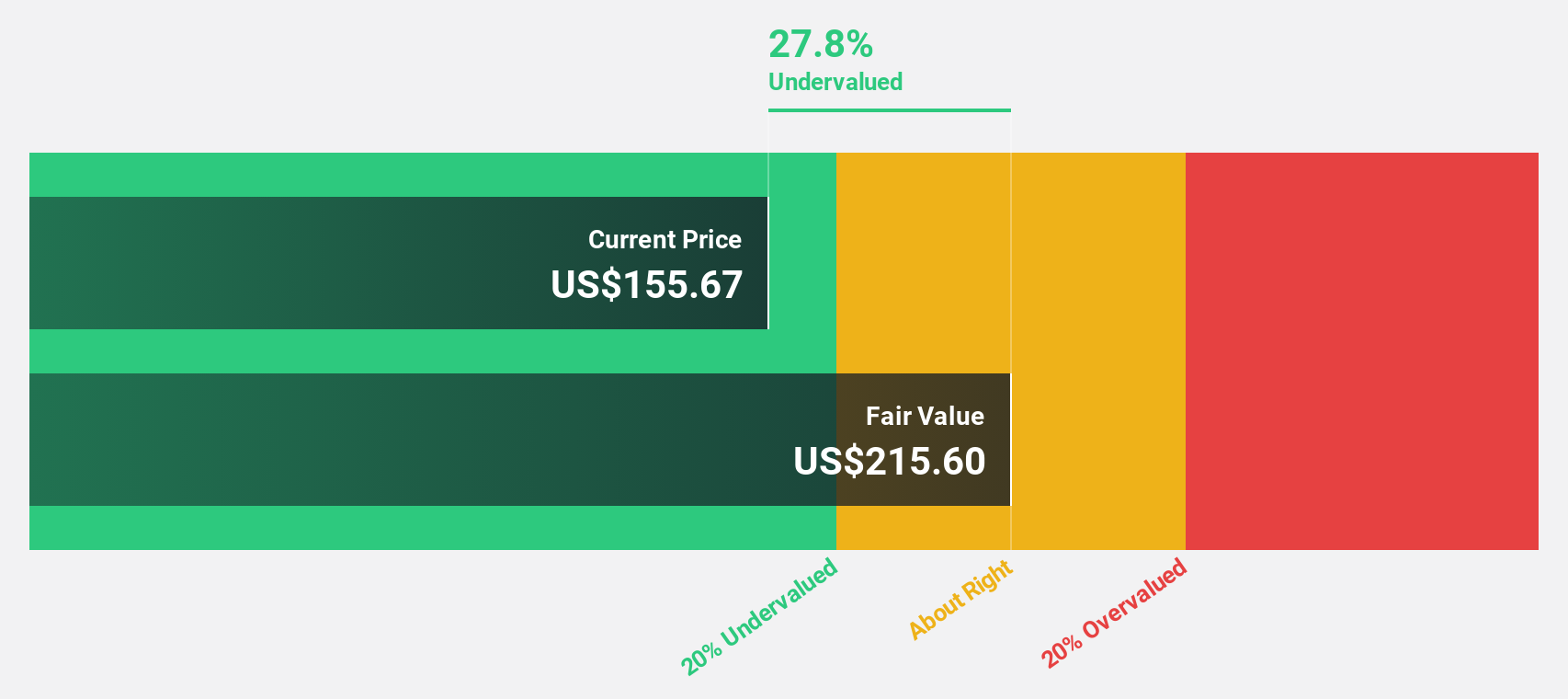

Estimated Discount To Fair Value: 44.8%

Palomar Holdings is trading at US$107.44, significantly below its estimated fair value of US$194.71, indicating potential undervaluation based on cash flows. Recent earnings growth of 50.6% and forecasted annual profit growth of 21.3% surpass the U.S. market average, highlighting robust financial performance despite insider selling concerns. Revenue for Q3 2024 increased to US$148.5 million from US$90.94 million a year ago, demonstrating strong upward momentum in its financial metrics.

- According our earnings growth report, there's an indication that Palomar Holdings might be ready to expand.

- Click here to discover the nuances of Palomar Holdings with our detailed financial health report.

QuinStreet (NasdaqGS:QNST)

Overview: QuinStreet, Inc. is an online performance marketing company that offers customer acquisition services both in the United States and internationally, with a market cap of approximately $1.33 billion.

Operations: The company's revenue primarily comes from its Direct Marketing segment, which generated $768.81 million.

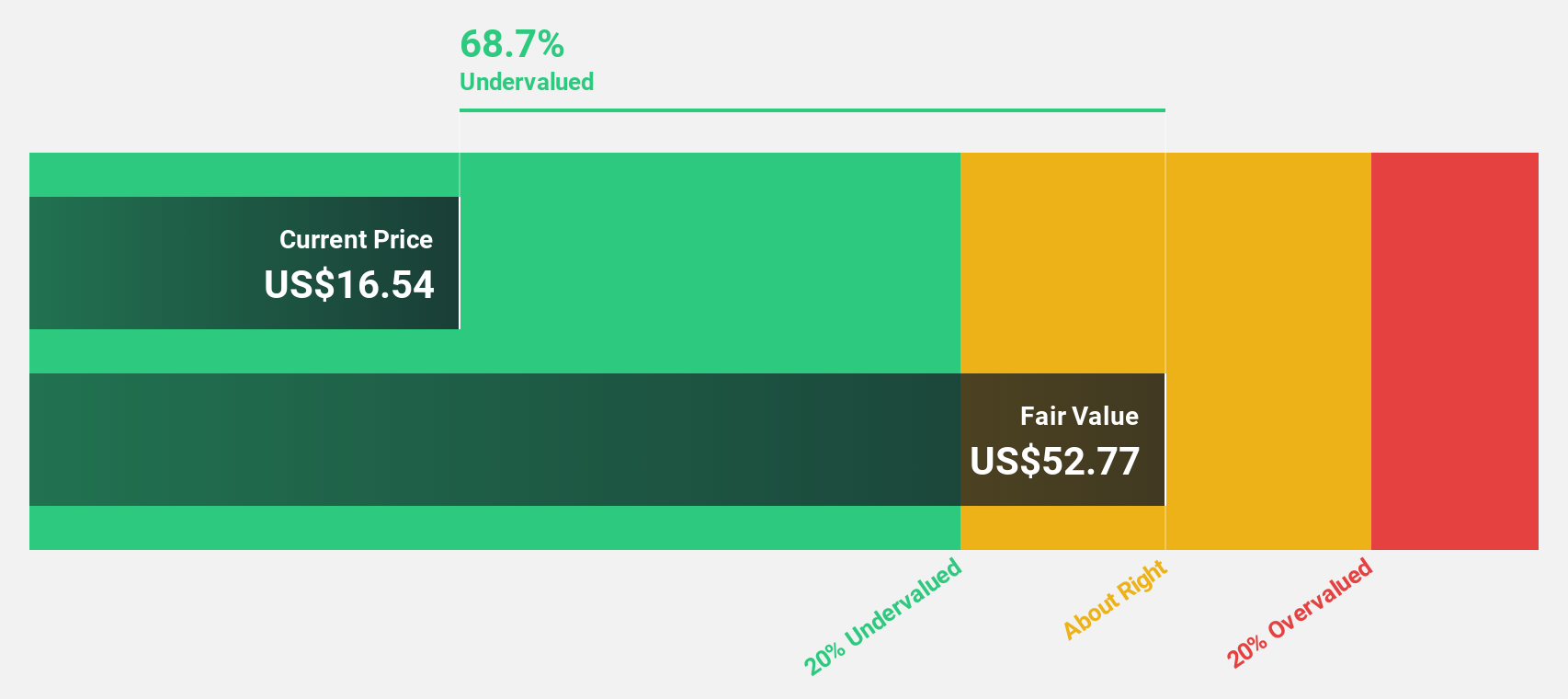

Estimated Discount To Fair Value: 48.7%

QuinStreet is trading at US$24.44, significantly below its estimated fair value of US$47.65, highlighting potential undervaluation based on cash flows. Despite recent insider selling, the company reported Q1 2024 sales of US$279.22 million, more than doubling from a year ago and reducing net loss to US$1.37 million from US$10.57 million previously. With forecasted annual earnings growth of over 100%, QuinStreet is expected to achieve profitability within three years, outpacing market averages.

- Our expertly prepared growth report on QuinStreet implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of QuinStreet.

Next Steps

- Click through to start exploring the rest of the 173 Undervalued US Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuinStreet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QNST

QuinStreet

An online performance marketing company, provides customer acquisition services for its clients in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives