- United States

- /

- Entertainment

- /

- NasdaqGS:NFLX

Does the AB InBev Partnership Redefine Netflix’s (NFLX) Subscriber Strategy Amid Controversy?

Reviewed by Sasha Jovanovic

- On September 22, 2025, AB InBev and Netflix announced a global partnership to collaborate on co-marketing campaigns, consumer activations, and advertising integrations for major events and entertainment titles across both companies' portfolios.

- A unique aspect of this alliance is the integration of iconic beverage brands with Netflix's most popular global content, expanding cross-industry engagement through live sporting and entertainment events on a worldwide scale.

- We'll explore how heightened public controversy around Netflix’s content could pose new risks to its earnings growth and subscriber strategy.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Netflix Investment Narrative Recap

To be a Netflix shareholder, I believe you need confidence in the company’s ability to expand global engagement, monetize its massive audience, and drive revenue through advertising and international partnerships. The new partnership with AB InBev supports Netflix’s push into live events and ad-supported features, but does not materially alter the near-term catalyst of ad revenue growth nor does it resolve the immediate risk of backlash and volatility from public content controversies, which remain a key threat to subscriber stability.

Among the company’s recent announcements, the AB InBev alliance stands out for its relevance. By directly enabling integrated ad activations and co-branded campaigns around major live events, this partnership reinforces the core ad revenue catalyst that’s at the center of Netflix’s short-term growth ambitions, especially as streaming competition intensifies and the company seeks new monetization streams beyond traditional subscriptions.

Yet, in contrast to these growth drivers, investors should also be aware of...

Read the full narrative on Netflix (it's free!)

Netflix's narrative projects $59.4 billion revenue and $17.7 billion earnings by 2028. This requires 12.5% yearly revenue growth and a $7.5 billion earnings increase from $10.2 billion.

Uncover how Netflix's forecasts yield a $1350 fair value, a 16% upside to its current price.

Exploring Other Perspectives

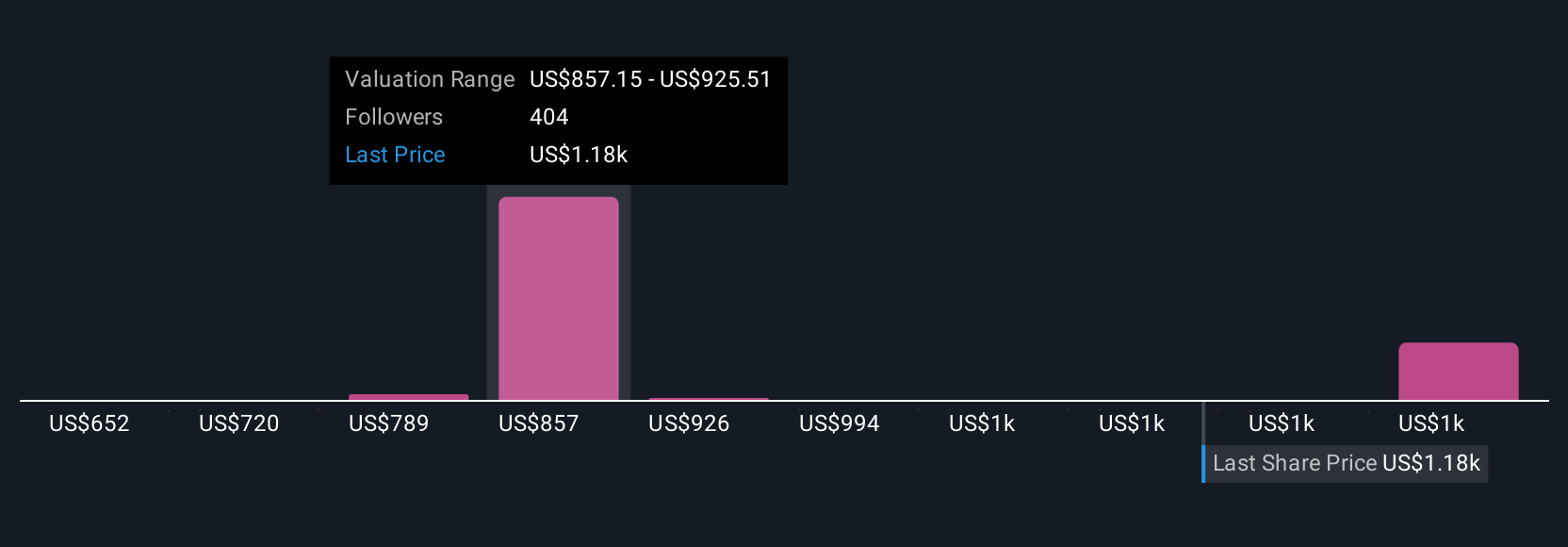

Fifty-six fair value estimates from the Simply Wall St Community for Netflix span from US$722 to US$1,600 per share. As streaming faces intensifying competition and rising content costs, consider how these varied outlooks may reflect shifting expectations for Netflix’s ability to protect profit margins.

Explore 56 other fair value estimates on Netflix - why the stock might be worth as much as 38% more than the current price!

Build Your Own Netflix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netflix research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Netflix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netflix's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netflix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFLX

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives