- United States

- /

- Biotech

- /

- NasdaqGS:CCCC

Outdoor Holding Leads This Trio Of Promising Penny Stocks

Reviewed by Simply Wall St

Amid a backdrop of fluctuating stock indices, with the Nasdaq recently hitting a record high before retreating due to geopolitical tensions, investors are keenly observing market dynamics. Penny stocks, often seen as relics of past trading eras, still hold potential for those willing to explore smaller or newer companies with strong financial foundations. These stocks can offer affordability and growth potential; here we examine three promising examples that may combine balance sheet strength with long-term prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.90 | $417.89M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.88 | $694.39M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.21 | $206.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.90 | $56.46M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.90 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.44 | $583.11M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.957485 | $6.94M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.65 | $86.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.58 | $10.25M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 363 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Outdoor Holding (POWW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Outdoor Holding Company operates an online marketplace business and has a market cap of $186.21 million.

Operations: The company generates revenue of $45.28 million from its online marketplace segment.

Market Cap: $186.21M

Outdoor Holding Company, with a market cap of US$186.21 million, operates an online marketplace generating US$45.28 million in revenue. Recent strategic moves include relocating its headquarters to Atlanta to cut costs and potentially improve operational efficiency. Despite being unprofitable with a net loss of US$6.46 million for the recent quarter, the company has reduced its debt-to-equity ratio significantly over five years and maintains sufficient short-term assets to cover liabilities. Leadership changes are underway with new board appointments and executive resignations, potentially impacting future strategic direction amidst an inexperienced management team.

- Dive into the specifics of Outdoor Holding here with our thorough balance sheet health report.

- Assess Outdoor Holding's future earnings estimates with our detailed growth reports.

C4 Therapeutics (CCCC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C4 Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing innovative therapies to degrade disease-causing proteins, with a market cap of $158.71 million.

Operations: The company generates revenue from its Pharmaceuticals segment, totaling $34.24 million.

Market Cap: $158.71M

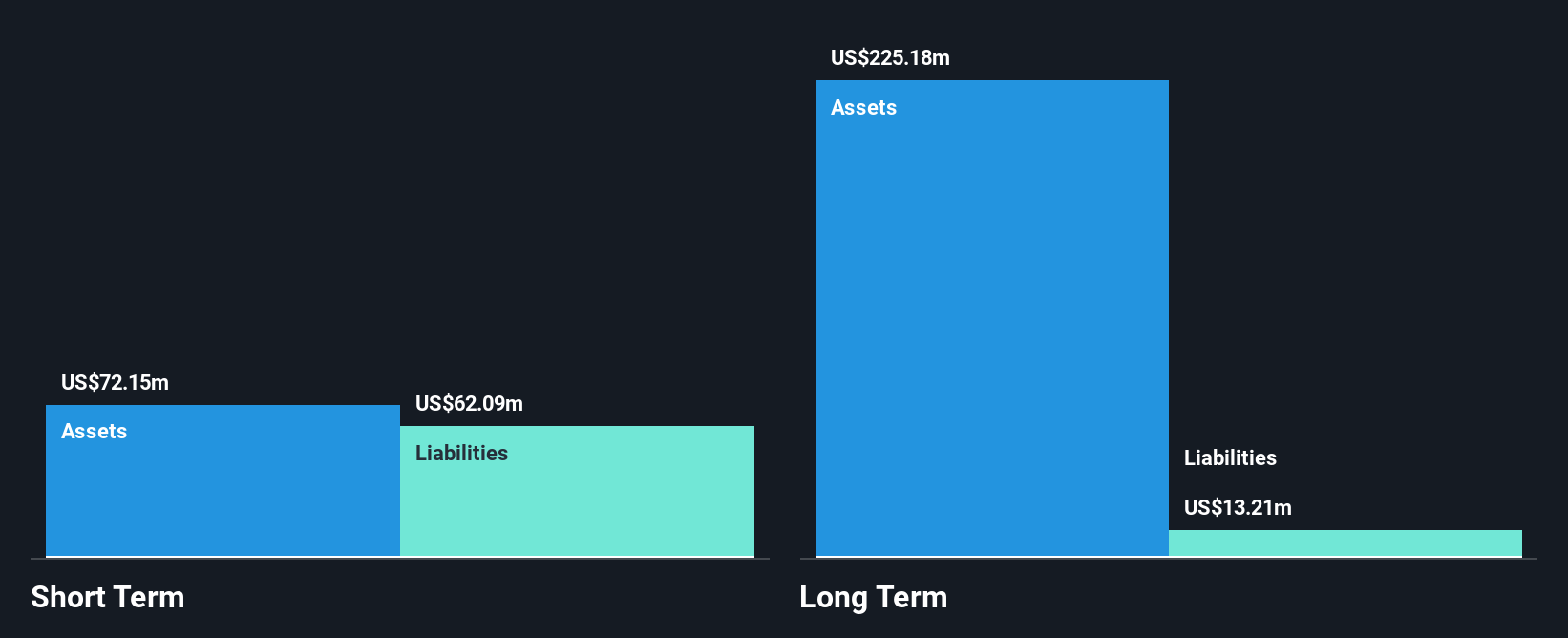

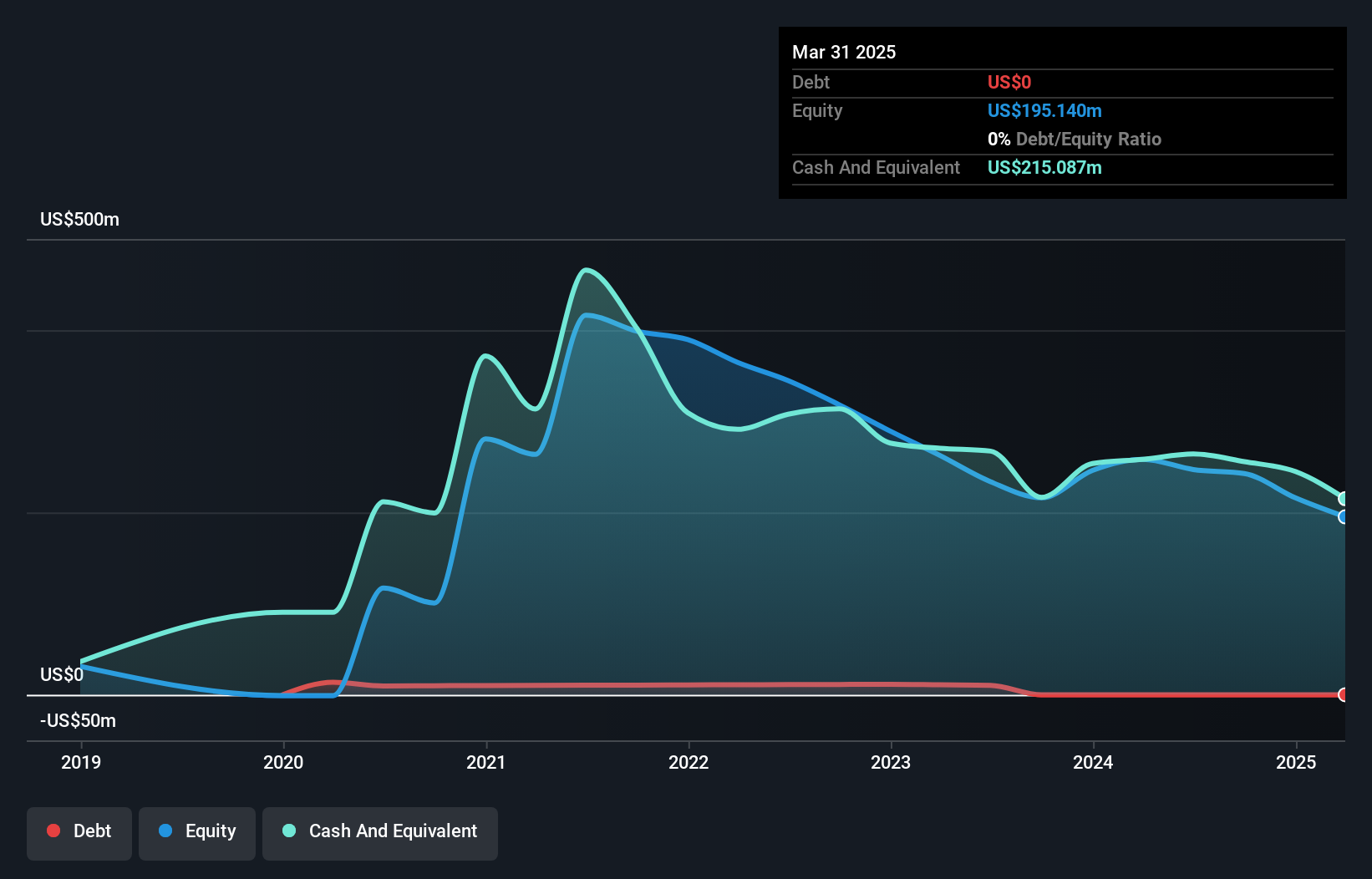

C4 Therapeutics, Inc., with a market cap of US$158.71 million, is advancing its innovative therapies despite being unprofitable and reporting a net loss of US$26.02 million for the recent quarter. The company has entered into a clinical trial collaboration with Pfizer to evaluate cemsidomide in multiple myeloma treatment, potentially enhancing its therapeutic pipeline. While revenues from its pharmaceuticals segment reached US$34.24 million, C4T remains focused on strategic partnerships and clinical advancements to drive growth. Its financial stability is supported by short-term assets exceeding liabilities and no debt burden, though share price volatility persists.

- Take a closer look at C4 Therapeutics' potential here in our financial health report.

- Evaluate C4 Therapeutics' prospects by accessing our earnings growth report.

Marchex (MCHX)

Simply Wall St Financial Health Rating: ★★★★★★

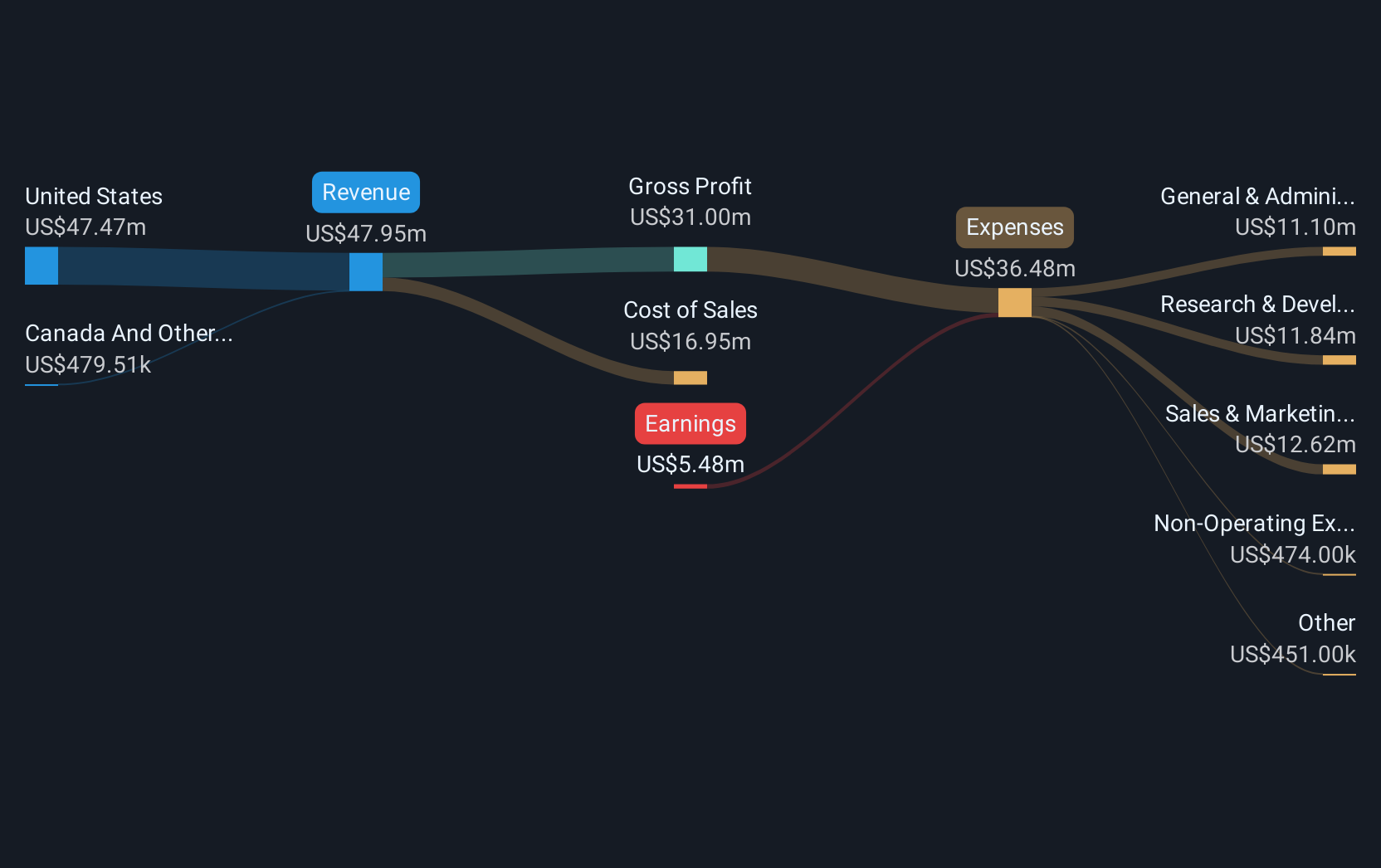

Overview: Marchex, Inc. is a conversation intelligence company offering conversational analytics and related solutions across the United States, Canada, and internationally, with a market cap of $87.18 million.

Operations: The company generates revenue of $47.53 million from its conversational analytics and related solutions segment.

Market Cap: $87.18M

Marchex, Inc., with a market cap of US$87.18 million, has made strides in conversation intelligence by launching Industry Benchmarking within its Marchex Engage Platform, offering businesses valuable insights into their performance relative to industry standards. Despite being unprofitable and not expected to achieve profitability in the next three years, Marchex has reduced its losses by 44.1% annually over the past five years and maintains a strong cash runway exceeding three years based on current free cash flow trends. Recent executive changes include new appointments for CFO and President roles, reflecting strategic leadership adjustments.

- Navigate through the intricacies of Marchex with our comprehensive balance sheet health report here.

- Explore Marchex's analyst forecasts in our growth report.

Taking Advantage

- Get an in-depth perspective on all 363 US Penny Stocks by using our screener here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCCC

C4 Therapeutics

A clinical-stage biopharmaceutical company, develops novel therapeutic candidates to degrade disease-causing proteins.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives