- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:GOOGL

Alphabet (Nasdaq:GOOGL) Misses, While Microsoft (Nasdaq: MSFT) Warns of Slowdown and Rising Costs - Our Takes on Big Tech Earnings

Reviewed by Michael Paige

Earning’s season took a rocky turn last week after four out of the five ‘Big Tech’ firms disappointed investors. Companies reported slowing growth, headwinds from the strong USD, and rising costs. While the broader market shrugged off the news, the Nasdaq lagged as some of its largest components fell by more than 10%.

Alphabet faces ad spending slowdown

Alphabet’s ( Nasdaq: GOOGL ) revenue of $57.27 billion was slightly lower than expected, while year-over-year growth fell to 6%, the slowest rate since June 2020. EPS were also lower than expected at $1.06 vs the $1.25 consensus estimate. YouTube’s revenue fell for the first time since its numbers have been reported separately.

Our take: Alphabet is primarily an advertising business, and ad spending is cyclical - ie. it rises and falls with the business cycle. So it isn’t really surprising to see revenue growth slowing down in the current economic environment. For context, the third quarter last year - against which this quarter is being measured - was one of the best quarters in the company’s history. Revenue is up 75% since the start of the pandemic.

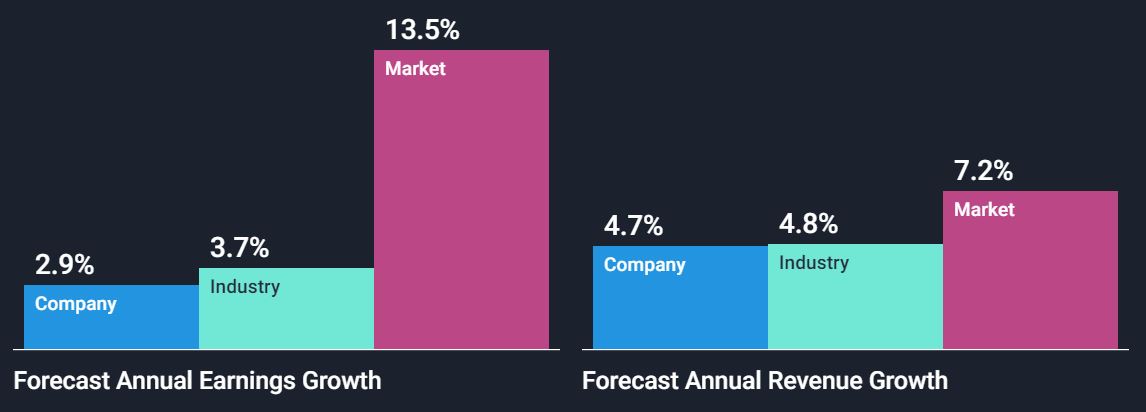

The important question for investors: What is the likely growth rate over the next 5 to 10 years? Over the last decade, revenues grew at around 20% a year, and it's probably unrealistic to expect such a big company to keep that up.

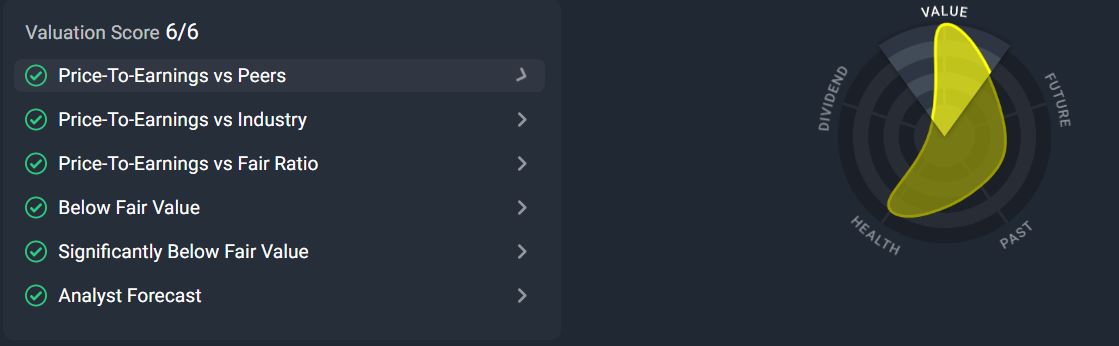

Analyst forecasts are fairly consistent with their estimates and see revenues growing at 11% a year going forward. If that turns out to be correct the stock ticks all the Simply Wall St valuation boxes - click on the image below for more details.

Microsoft warns of rising costs and revenue headwinds ahead

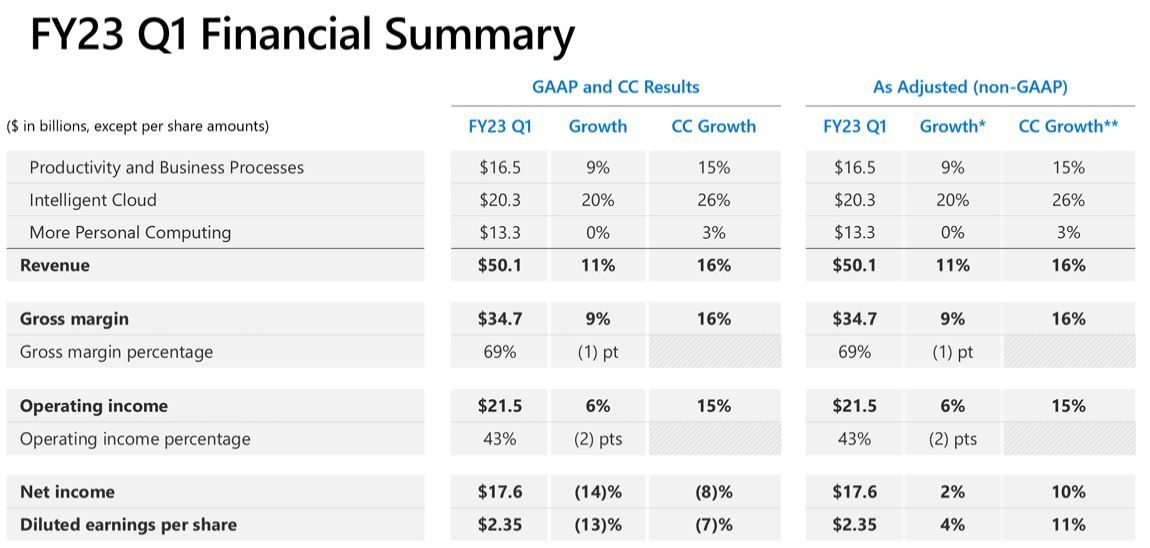

Microsoft’s ( Nasdaq: MSFT ) Q1 2023 results were better than expected and in line with management’s previous guidance. Overall revenue increased by 11% year-on-year to $50.1 billion. Adjusted EPS fell 13.5% to $2.35 which was slightly better than expected.

The cloud business is still the growth driver, while revenue for the ‘more personal computing’ segment which includes Windows licensing, devices, and gaming, increased by just 3%.

But, it was the company’s guidance for the next quarter that caused investors to sell the stock, which closed 7.8% lower on Wednesday. The company said it expects continued pressure from the PC market to weigh on revenue growth. The company also sees growth in the cloud segment slowing slightly. In addition, the company expects operating costs to increase by 17 to 18%.

Our take: Microsoft is facing margin pressure in the next quarter and one of the reasons for that is the combined effect of inflation and the strong USD. About half of Microsoft’s revenue comes from outside the US, and that revenue is worth less in dollars. At the same time operating expenses, which are mostly in USD, are rising with inflation. If the USD happens to reverse during the next quarter, net income and margins would be better than the current guidance suggests.

So far companies like Microsoft and Alphabet haven't brought up cost cutting - but that could change if margins remain under pressure. And that would have knock-on effects throughout the economy.

Meta’s Big, Virtual Bet

There was more pain for Meta ( Nasdaq: META ) shareholders as the stock price fell as much as 25% after the company reported slower revenue growth and rising costs. Year-on-year revenue growth fell by 4% and EPS were down 49%.

The company's ad business is facing a slowing market for ad spending and increased competition. At the same time, adding and even keeping users is very difficult for platforms that already count nearly 30% of the world's population as users.

Our take: Meta’s legacy assets (mainly being Facebook and Instagram) are still very profitable. Operating income for the trailing 12-month period has fallen by 25% in the last year, but it’s still a massive $35 bln. But the company has invested most of that in AI and Reality Labs (ie. the Metaverse) with capital expenditure rocketing from $17 bln to $27 bln, and set to rise to $33 bln next year.

This really is an all-in bet, which could pay off in spectacular fashion - or bomb.

Amazon: Slowing Growth and Little in the Way of Profits

Amazon’s ( Nasdaq: AMZN ) revenue growth during its third quarter was slightly lower than expected, while EPS were well above consensus estimates. Revenue growth for AWS was a little slower than expected, while ad revenue was higher than expected and notable given what Meta and Alphabet have experienced.

Amazon warned that it expects revenue growth in the fourth quarter to slow to between 2 and 4%, and also said it expects a weaker holiday shopping period.

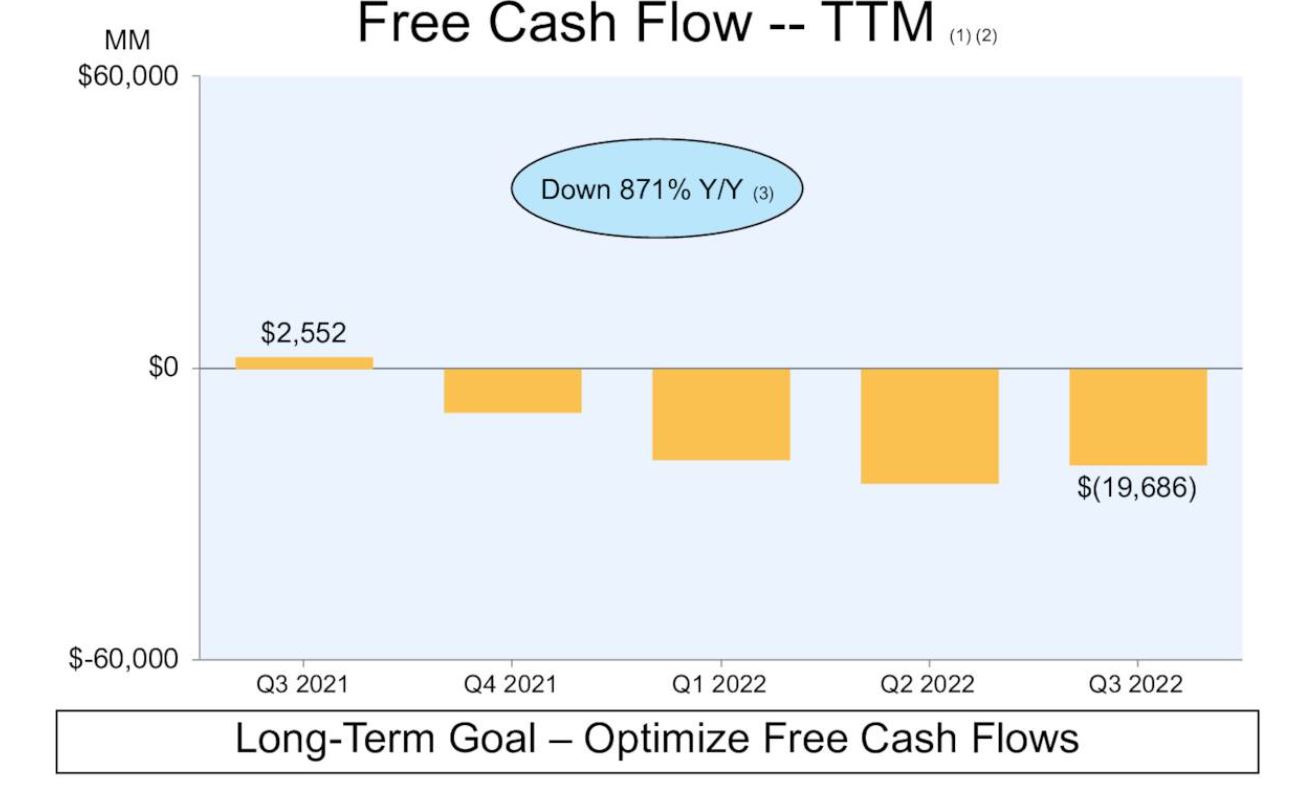

Our take: Amazon’s share price fell as much as 15%, which many have attributed to the weak guidance and slowing growth at AWS. But, Amazon’s profitability is something that may also be frustrating investors.

In 2021 Amazon increased its investment in fulfillment capacity which resulted in the free cash flow margin falling to the lowest level in a decade. In May this year, the company suggested the current investment cycle was slowing down, which presumably meant margins should start improving. That hasn’t really been the case - Capex is still high and free cash flow is still negative.

Apple: Cash is King

Apple ( Nasdaq: AAPL ) was the only Big Tech company to survive unscathed, and with good reason. Fourth-quarter revenue and EPS were slightly better than expected, and revenue and EPS for the last 12 months were both up around 8%.

Performance from individual business segments was mixed, but largely in line with what analysts expected. Revenue from iPhones, iPads, and services was slightly lower than expected, while revenue from Macs and other products was also better than expected.

Our take: Apple is an incredibly profitable business, having generated over $90 billion in free cash flow over the last year. But, as it stands right now, growth forecasts are low for the next few years and aren’t expected to get back to double digits until 2028.

The share is currently trading on a price multiple of 24.8x which is reasonable based on historical growth rates, but very high if we assume the current forecasts are correct. If growth isn’t higher than expected, returns could be disappointing for the next few years.

If you're looking to trade Alphabet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:GOOGL

Alphabet

Offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives