- United States

- /

- Media

- /

- NasdaqGS:FOXA

Fox (NasdaqGS:FOXA) Shines With Impressive Earnings Amid Economic Challenges

Reviewed by Simply Wall St

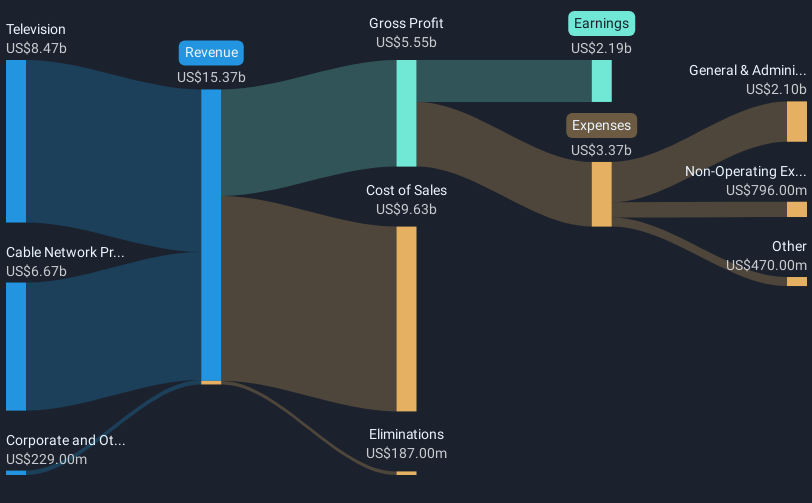

Fox (NasdaqGS:FOXA) recently experienced a price move of 1% over the last quarter, during which several influential events unfolded. The company made significant executive appointments, with Stephano Kim and John Nallen joining to strengthen its strategic operations. Fox's impressive earnings report showed substantial growth, outpacing market expectations amidst turbulent economic conditions marked by broad market declines influenced by tariff uncertainties. The announcement of a dividend and an update on its share buyback program further contributed to Fox's stability. Despite the market's challenges, these factors have helped Fox maintain its position, reflecting positively on its shareholder returns.

We've identified 1 weakness for Fox that you should be aware of.

The executive appointments and earnings report have bolstered Fox's stability and market position, as highlighted by the 1% share price increase over the last quarter. These developments, alongside dividend announcements and share buyback updates, could support near-term investor confidence. However, future revenue growth may face challenges due to the discontinuation of the Venu joint venture and competitive pressures in sports rights, potentially impacting affiliate revenue streams. Analysts anticipate a slight decline in profit margins and revenue growth, emphasizing the importance of Fox's investments in Tubi and its direct-to-consumer services for long-term prospects.

Over the past five years, Fox's total shareholder return, including dividends, was 104.95%, showcasing strong performance. In the last year, Fox outperformed the US market, which returned a 3.4% decline, and exceeded the US Media industry, which experienced an 11.9% decline. Fox's approach to revenue growth, affiliate renewals, and new offerings positions it well amidst these industry challenges. Despite analysts forecasting a decline in earnings over the next three years, the company aims for sustained market expansion.

The current share price stands at US$55.82, closely aligned with the consensus analyst price target of US$56.72, indicating a fair valuation by the market. This proximity suggests that while Fox's recent strategic actions and revenue performance are positively recognized, investors are cautiously weighing future growth potentials against existing market conditions. As the company seeks to enhance its market reach through new digital ventures, the impact of these moves on revenue and earnings forecasts remains a critical area for observation.

Understand Fox's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fox, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FOXA

Fox

Operates as a news, sports, and entertainment company in the United States (U.S.).

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives