- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

From Growth to Profitability - Analyzing the Turn of Meta's (NASDAQ:FB) Story

Key takeaways:

- Meta's stock price is dropping, likely because investors anticipate a reduction in spend by advertisers, directly impacting the future bottom line.

- The company is attempting to counter this by lowering expenses, freezing hiring till the end of 2022, and shifting the priority from growth to profit.

- The pessimistic outlook, presented by Snap Inc., served as a catalyst for the price drop, while investors that are bullish on Meta may consider this as a possible opportunity.

Meta Platforms, Inc.'s (NASDAQ:FB) has been in the news lately, primarily centered around the partial hiring halt of the company, as uncertainties regarding the future growth and profitability mount. In this article, we will go through some key fundamentals of Meta, and see what the change in direction may mean for the company.

First, we need to establish the current performance of the company. Meta had an impressive track record in the last two years, mostly boosted by the pandemic along with a low interest rate environment. The stock peaked at about US$380 per share in September 2021, and gradually started declining, until the sudden drop in February 2022. Meta lost about 40% of its market cap in the last 12 months, and has been trading mostly flat ever since.

Analyzing Growth

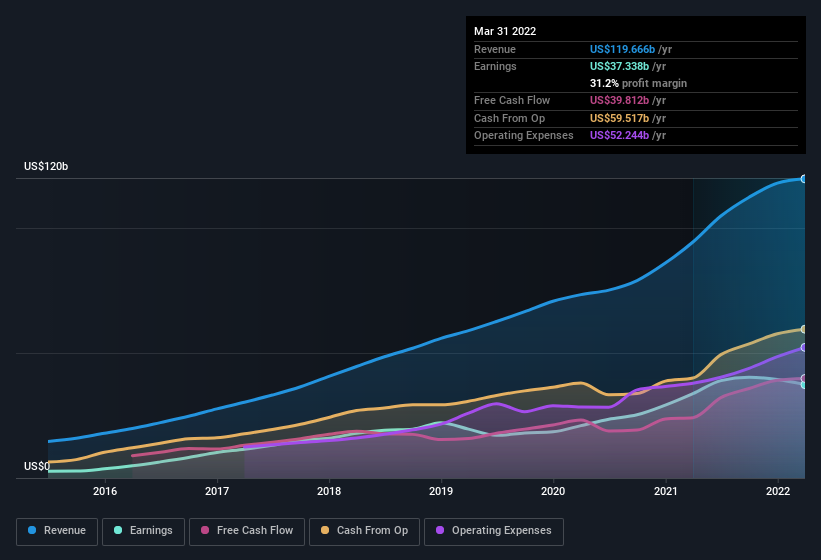

Considering the fundamentals, we can see that Meta has made large strides in growth since 2016, when the company made US$27.6b in revenue, to the first quarter of 2022, when Meta made US$120b in trailing twelve moth revenue. This reflects a total growth of about 330%.

Looking at the annual growth performance, we can see that Meta had a CAGR - (Compound Annual Growth Rate) of 31.6% in the last 5 years. This high growth rate is partly what was responsible for high investor enthusiasm when the stock was priced around US$1 Trillion.

In the chart below, we can see the jump in financial performance during this period.

View our latest analysis for Meta Platforms

Profitability

In the past 3 years, Meta's net income margin has slowly declined from 41% at the end of 2018, to 31.2% in the last twelve months.

The free cash flows however, paint a slightly different picture for investors, and are currently at US$39.8b. Investors seem to be pricing-in little to flat revenue growth for Meta, but as long as the cash flows don't decline, the company can regain investors' confidence.

That is why it is important to look at what analysts are forecasting in terms of both top and bottom line for Meta. Reviewing their forecasts, it seems that analysts expect the company to grow revenues at 12.7% annually, and earnings at 13.7%.

Should Meta's leadership manage to achieve these projections, then there is a case to be made that the company may be undervalued.

Potential Pressures

As we noted in the introduction, Meta announced a hiring freeze for mid-senior roles until the end of the year. This may indicate that the company is trying to save money in order to reach their target bottom line - After the small growth drop in the previous quarter, management may be understandably more strict with spending, and will attempt to make sure that the company is on track for shareholders.

The company seems to be internally changing course, as the press releases for the big Metaverse project have slowed down, possibly indicating that Meta is changing the short-term focus to profitability. The Reality Labs - their Metaverse project, are a drain on current profitability, and the company has revised their target spending from US$90-95b to US$87-92b. This may be interpreted as a sign that the company is bracing for economic headwinds, as was noted by the leaked letter of Meta's CFO to employees.

The second pressure, is the notable drop in Snap's (NYSE:SNAP) stock price of 40% in a day. This is seen as a precursor to lower economic activity, which has the effect of pulling companies like Meta and Alphabet (NASDAQ:GOOGL) down with it.

Investors are becoming more reserved when looking at the future of online advertisers, which could conversely make them oversold, and for bullish investors this can become an opportunity.

Conclusion

Meta has a very impressive historical performance, and even if the company only manages to retain current profitability levels, it may justify a higher market valuation.

The future is arguably becoming a looming threat for Meta, in case a larger than anticipated decline in earnings happens, we should remind ourselves that Meta is still making US$40b in free cash flows for investors, with a 31.2% net margin, giving it a significant amount of moat.

In this article, we've looked at a number of factors that can impair the utility of profit numbers. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives