- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:FAZE

FaZe Holdings (NASDAQ:FAZE shareholders incur further losses as stock declines 23% this week, taking one-year losses to 76%

As every investor would know, you don't hit a homerun every time you swing. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. It must have been painful to be a FaZe Holdings Inc. (NASDAQ:FAZE) shareholder over the last year, since the stock price plummeted 76% in that time. That'd be a striking reminder about the importance of diversification. FaZe Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. It's down 88% in about a quarter.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out the opportunities and risks within the US Interactive Media and Services industry.

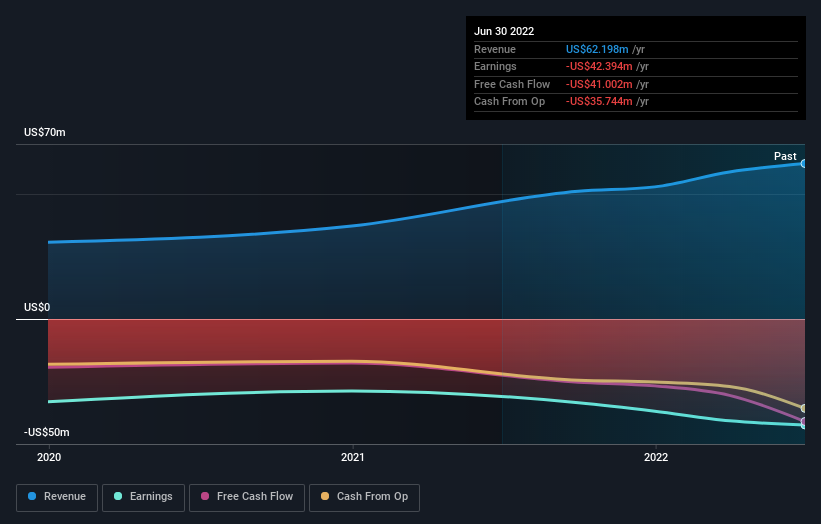

FaZe Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, FaZe Holdings increased its revenue by 34%. We think that is pretty nice growth. Unfortunately, the market wanted something better, given it sent the share price 76% lower during the year. One fear might be that the company might be losing too much money and will need to raise more. We'd posit that the future looks challenging, given the disconnect between revenue growth and the share price.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on FaZe Holdings' earnings, revenue and cash flow.

A Different Perspective

We doubt FaZe Holdings shareholders are happy with the loss of 76% over twelve months. That falls short of the market, which lost 24%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Notably, the loss over the last year isn't as bad as the 88% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with FaZe Holdings , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FAZE

FaZe Holdings

FaZe Holdings Inc. operates lifestyle and media platform in gaming and youth culture.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives