- United States

- /

- Media

- /

- NasdaqGS:CMCSA

Comcast (NasdaqGS:CMCSA) Expands Network in Indiana with Multi-Million US$ Investment

Reviewed by Simply Wall St

Comcast (NasdaqGS:CMCSA) recently announced the construction of a next-generation network in several Indiana counties, as part of its significant business expansions across the U.S., reflecting the company's focus on enhancing digital infrastructure. Over the past month, Comcast's stock price increased 3%, aligning with a mixed market response which saw the S&P 500 secure its largest gains since late 2023. Additionally, the company's declared quarterly dividend and recent efforts in bridging broadband gaps could support investor interest amid ongoing market uncertainty, while a governance proposal on voting structure and new debt issuance added further context to its corporate activities.

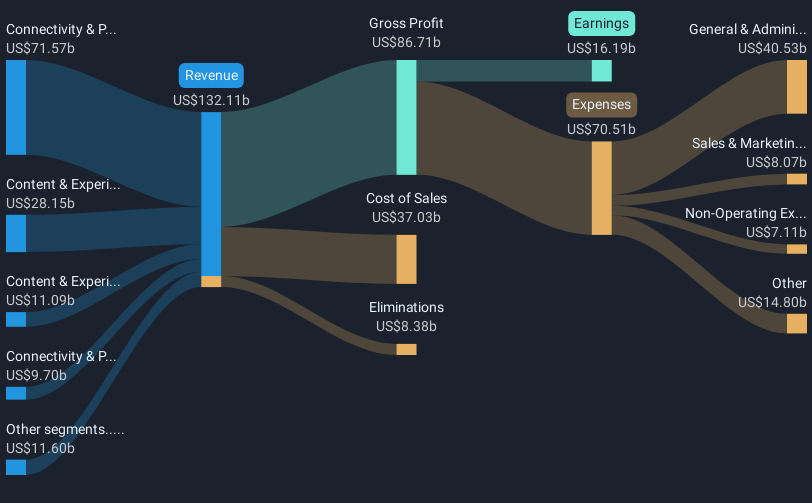

The recent announcement of Comcast's next-generation network in Indiana underscores its commitment to enhancing digital infrastructure, potentially affecting its revenue and earnings forecasts. These expansions could bolster the company's position despite challenges in broadband and wireless segments. However, with competition intensifying and reliance on pricing strategies, any revenue uplift from these initiatives might face constraints. Additionally, the declared dividend and corporate activities such as new debt issuance could influence investor perceptions, affecting demand for shares.

Over the past five years, Comcast's total return, including share price and dividends, recorded a 4.42% decline, contrasting with the broader market's performance that returned 11.5% over the past year. Within the US Media industry, Comcast also underperformed, with the industry returning 1% over the past year. This performance could suggest underlying challenges despite recent strategic moves aimed at fostering growth.

In terms of price targets, Comcast's current share price of US$34.49 is at a discount to the analyst consensus price target of US$40.17, indicating potential upside if revenue and earnings forecasts align positively with growth expectations. Conversely, the bearish price target of US$30 reflects expectations of subdued earnings and revenue growth. The company's projected earnings downturn, driven by intensified competition and challenges in various segments, sets a cautious tone for future price movement. Investors may need to weigh these factors when evaluating Comcast's long-term prospects amidst ongoing market dynamics.

Understand Comcast's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCSA

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion