- United States

- /

- Media

- /

- NasdaqGM:CDLX

Why Investors Shouldn't Be Surprised By Cardlytics, Inc.'s (NASDAQ:CDLX) 30% Share Price Plunge

Unfortunately for some shareholders, the Cardlytics, Inc. (NASDAQ:CDLX) share price has dived 30% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 90% loss during that time.

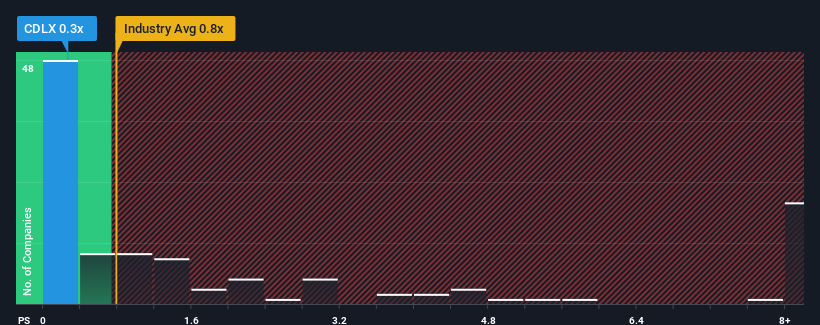

After such a large drop in price, Cardlytics may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Media industry in the United States have P/S ratios greater than 0.8x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Cardlytics

How Cardlytics Has Been Performing

While the industry has experienced revenue growth lately, Cardlytics' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Cardlytics' future stacks up against the industry? In that case, our free report is a great place to start .Is There Any Revenue Growth Forecasted For Cardlytics?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cardlytics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10.0% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.0% during the coming year according to the six analysts following the company. Meanwhile, the broader industry is forecast to expand by 0.3%, which paints a poor picture.

With this information, we are not surprised that Cardlytics is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

The southerly movements of Cardlytics' shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Cardlytics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you settle on your opinion, we've discovered 3 warning signs for Cardlytics that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CDLX

Cardlytics

Operates an advertising platform in the United States and the United Kingdom.

Very undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)