- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

CarGurus, Inc.'s (NASDAQ:CARG) Business Is Trailing The Industry But Its Shares Aren't

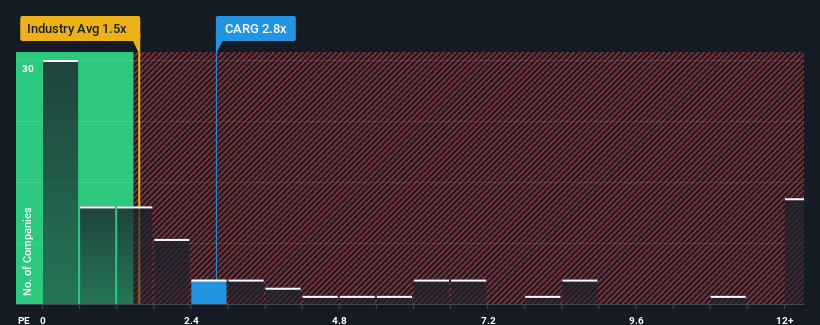

When you see that almost half of the companies in the Interactive Media and Services industry in the United States have price-to-sales ratios (or "P/S") below 1.5x, CarGurus, Inc. (NASDAQ:CARG) looks to be giving off some sell signals with its 2.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for CarGurus

How CarGurus Has Been Performing

While the industry has experienced revenue growth lately, CarGurus' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CarGurus will help you uncover what's on the horizon.How Is CarGurus' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like CarGurus' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's top line. Even so, admirably revenue has lifted 59% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 9.1% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% per annum, which is noticeably more attractive.

With this information, we find it concerning that CarGurus is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From CarGurus' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for CarGurus, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with CarGurus, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on CarGurus, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives