- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

Unveiling Three US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the Nasdaq and S&P 500 continue to set records, reflecting a robust appetite for growth among investors, it's an opportune time to explore companies where high insider ownership aligns closely with corporate ambitions and investor interests. In this context, firms with substantial insider stakes can be particularly compelling, as they often signal confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. operates as an online entertainment platform primarily targeting younger audiences in China, with a market capitalization of approximately $6.31 billion.

Operations: The company generates its revenue primarily from internet information providers, totaling CN¥23.12 billion.

Insider Ownership: 20.8%

Bilibili, despite its recent earnings report showing a net loss of CNY 748.55 million, remains a growth-oriented company with insider ownership interests aligned with shareholders. The firm is trading at 6.5% below its estimated fair value and has promising forecasts, with earnings expected to grow significantly in the coming years. However, Bilibili's share price has been highly volatile recently, and its revenue growth, while above market average at 10.9% annually, is not exceeding the 20% threshold often associated with high-growth entities.

- Unlock comprehensive insights into our analysis of Bilibili stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Bilibili shares in the market.

Duolingo (NasdaqGS:DUOL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Duolingo, Inc. is a global mobile learning platform that offers language education services, with a market capitalization of approximately $8.42 billion.

Operations: The company generates revenue primarily through its educational software segment, amounting to $583.00 million.

Insider Ownership: 15%

Duolingo, recently added to several Russell indexes, shows robust growth prospects with its revenue expected to grow faster than the US market at 20.2% per year and earnings forecasted to surge by 48.12% annually. Despite recent shareholder dilution, the company is trading significantly below its estimated fair value and analysts anticipate a 30.1% rise in stock price. The appointment of tech veteran Mario Schlosser to the board could further enhance governance and strategic direction.

- Click here and access our complete growth analysis report to understand the dynamics of Duolingo.

- According our valuation report, there's an indication that Duolingo's share price might be on the cheaper side.

Madrigal Pharmaceuticals (NasdaqGS:MDGL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Madrigal Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company based in the United States, specializing in developing treatments for non-alcoholic steatohepatitis (NASH), with a market capitalization of approximately $5.95 billion.

Operations: The company does not currently generate revenue from its operations.

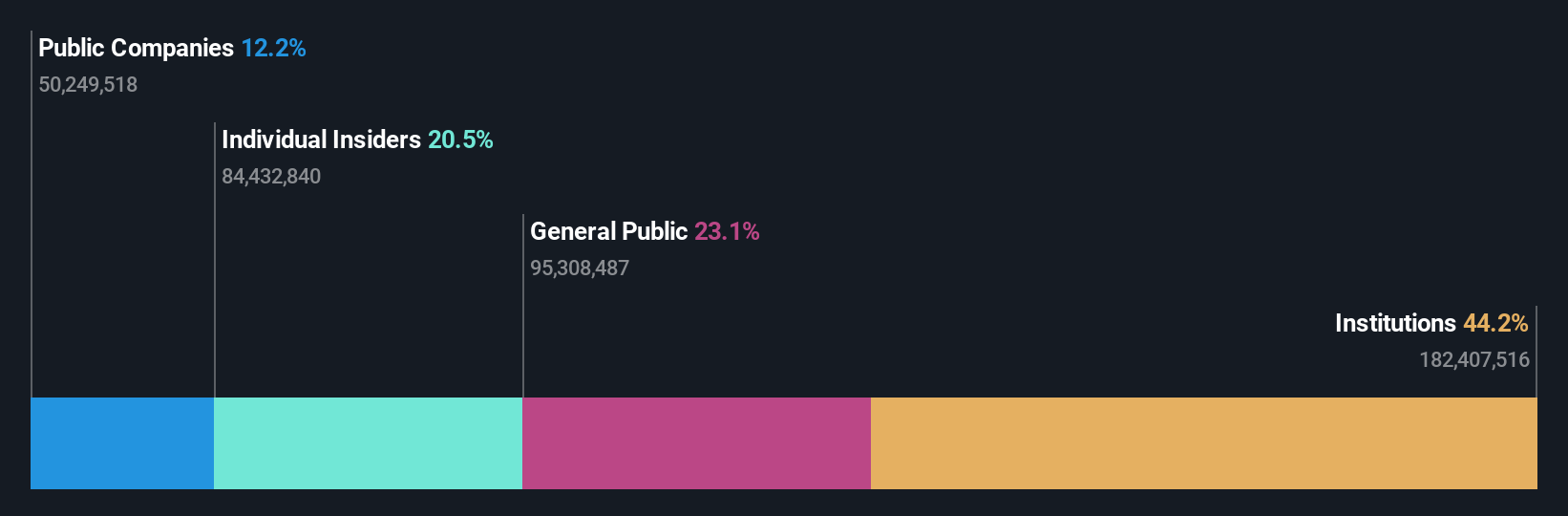

Insider Ownership: 10.1%

Madrigal Pharmaceuticals, a growth company with high insider ownership, recently highlighted promising results from its Phase 3 MAESTRO-NASH trial of Rezdiffra at the EASL Congress. Despite a substantial net loss of US$147.54 million in Q1 2024, the company is pioneering in NASH treatment with Rezdiffra, the first FDA-approved medication for this condition. While facing financial losses and shareholder dilution, Madrigal's innovative approach in treating advanced liver fibrosis offers potential clinical benefits pending ongoing trials' outcomes.

- Get an in-depth perspective on Madrigal Pharmaceuticals' performance by reading our analyst estimates report here.

- Our valuation report here indicates Madrigal Pharmaceuticals may be overvalued.

Next Steps

- Click through to start exploring the rest of the 180 Fast Growing US Companies With High Insider Ownership now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A clinical-stage biopharmaceutical company, focuses on the development of therapeutics for the treatment of non-alcoholic steatohepatitis (NASH) in the United States.

High growth potential with adequate balance sheet.