- United States

- /

- Software

- /

- NasdaqGS:NTNX

High Growth Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 1.2%, driven by gains of 1.3% in the Information Technology sector, and in the last year, it has climbed 30%. With earnings forecasted to grow by 15% annually, identifying high growth tech stocks that align with these robust market conditions can be crucial for investors looking to capitalize on this momentum.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.46% | 66.34% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| Clene | 71.89% | 60.05% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.80% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 251 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bilibili (NasdaqGS:BILI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilibili Inc. offers online entertainment services tailored for young generations in the People’s Republic of China and has a market cap of $6.59 billion.

Operations: Bilibili Inc. generates revenue primarily from its Internet Information Providers segment, amounting to CN¥23.95 billion. The company focuses on delivering online entertainment services specifically designed for the youth in China.

Despite Bilibili's current unprofitability, the company is making notable strides in its financial trajectory. In Q2 2024, it significantly reduced its net loss to CNY 608.7 million from CNY 1,546.71 million a year earlier, reflecting tighter operational control and potential efficiency gains. This improvement accompanies an encouraging revenue uptick of 11.7% per year, outpacing the US market's growth rate of 8.7%. Moreover, with earnings expected to surge by approximately 80.3% annually, Bilibili is setting a robust foundation for future profitability which could reshape its standing in the tech sector if sustained alongside strategic R&D investments that fuel innovation and competitive edge.

Flex (NasdaqGS:FLEX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flex Ltd. offers manufacturing solutions to various brands across Asia, the Americas, and Europe with a market cap of $13.08 billion.

Operations: Flex Ltd. generates revenue primarily from two segments: Flex Agility Solutions ($13.69 billion) and Flex Reliability Solutions ($12.15 billion). The company operates across Asia, the Americas, and Europe, providing manufacturing solutions to various brands.

Flex's recent strategic maneuvers, including a substantial fixed-income offering of $498.9 million and aggressive share repurchases totaling $1.44 billion, underscore its robust financial engineering to bolster growth. The company's R&D focus is evident with a significant investment in innovative energy solutions for AI data centers, collaborating with Musashi Energy Solutions to introduce advanced capacitor-based storage systems. This initiative not only addresses critical power stability challenges but also positions Flex at the forefront of supporting high-density AI computations, reflecting a clear vision for future tech infrastructure needs. With an expected earnings growth of 21.7% per year and R&D expenses meticulously aligned with strategic goals, Flex is crafting a niche in high-tech solutions amidst evolving market demands.

- Click here and access our complete health analysis report to understand the dynamics of Flex.

Review our historical performance report to gain insights into Flex's's past performance.

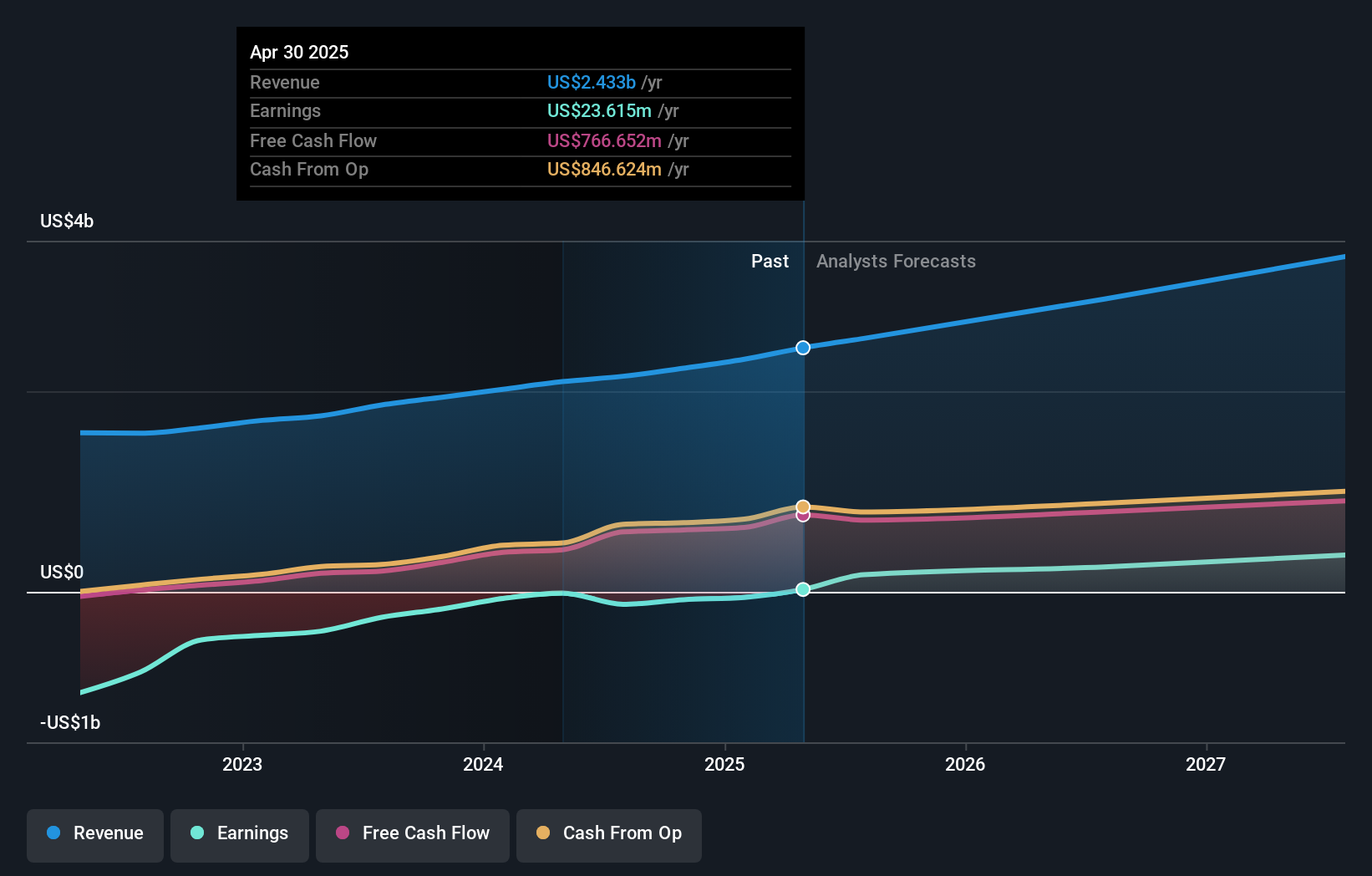

Nutanix (NasdaqGS:NTNX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nutanix, Inc. offers an enterprise cloud platform across multiple regions including North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa with a market cap of $16.13 billion.

Operations: Nutanix, Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $2.15 billion. The company operates across multiple global regions including North America, Europe, and the Asia Pacific.

Nutanix, amidst a challenging fiscal landscape marked by a net loss of $124.78 million this year, continues to invest heavily in innovation, with R&D expenses reflecting a strategic focus on future growth areas. This commitment is underscored by an impressive 85.0% allocation of resources towards developing cutting-edge solutions, positioning the company well within the competitive tech sector. Additionally, Nutanix's recent filing for a substantial Shelf Registration suggests proactive capital management aimed at fueling these expansive efforts. With revenue projections set to increase to between $2.435 billion and $2.465 billion next year and an anticipated revenue growth rate of 13.1%, Nutanix is strategically poised to transition from current unprofitability towards promising financial horizons driven by robust technological advancements and market adaptations.

- Navigate through the intricacies of Nutanix with our comprehensive health report here.

Assess Nutanix's past performance with our detailed historical performance reports.

Taking Advantage

- Discover the full array of 251 US High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

Undervalued with high growth potential.