- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BIDU

Has Baidu’s AI Optimism Pushed Its Soaring 2025 Share Price Too Far?

Reviewed by Bailey Pemberton

- Wondering if Baidu is a bargain or a value trap at today’s price? Let’s break down what the market is really pricing in and where the opportunity might lie.

- Baidu’s share price has climbed 4.2% over the last week and is up a hefty 49.9% year to date, even though the last 30 days have been slightly negative at -1.6%. Over the past year it is still sitting on a 38.9% gain, despite only a modest 3 year return of 4.0% and a 5 year loss of -33.2%.

- Recent moves have been driven by growing optimism around Baidu’s AI ambitions and its position in China’s search and cloud markets. At the same time, headlines around regulatory risk and the broader Chinese tech crackdown have kept some investors cautious, creating a push and pull dynamic in the share price.

- On our checks, Baidu only scores 1/6 on valuation, meaning it screens as undervalued on just one of six metrics. Next, we will walk through those valuation approaches in detail and, toward the end of the article, explore a more complete way to think about what Baidu is really worth.

Baidu scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Baidu Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those CN¥ cash flows back to the present.

For Baidu, the latest twelve month free cash flow is negative, at roughly CN¥13.7 billion outflow. This means the valuation leans heavily on a recovery story. Analyst estimates, extended by Simply Wall St beyond the formal forecast window, see free cash flow climbing into positive territory and then stabilising, with projections around CN¥18.3 billion by 2035.

Using a two stage Free Cash Flow to Equity model, these future cash flows are discounted to today to arrive at an estimated intrinsic value of about $100.67 per share. Compared with the current market price, the DCF suggests Baidu is around 23.1% overvalued on this basis. This implies that a lot of the anticipated AI and cloud upside may already be reflected in the stock.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baidu may be overvalued by 23.1%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Baidu Price vs Earnings

For profitable companies like Baidu, the price to earnings ratio is often the cleanest way to gauge how much investors are willing to pay for each dollar of current earnings. A higher PE usually reflects stronger growth expectations or lower perceived risk, while slower growth or higher uncertainty typically justifies a lower, more conservative multiple.

Baidu currently trades on a PE of about 35.8x, which is roughly double the Interactive Media and Services industry average of 17.1x and below the broader peer group average of around 62.0x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what Baidu’s PE should be based on its growth outlook, profitability, industry position, market cap and company specific risks. For Baidu, this Fair Ratio sits at approximately 33.0x.

Because the Fair Ratio incorporates more of Baidu’s fundamentals than a blunt industry or peer comparison, it provides a more tailored anchor for valuation. With the actual PE only modestly above this level, Baidu screens as slightly expensive but not extreme on earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baidu Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to turn your view of Baidu into a structured story. This links what you believe about its AI cloud, chips and autonomous driving opportunity to a forecast for future revenue, earnings and margins, and then to a Fair Value estimate you can easily compare to today’s share price.

On Simply Wall St’s Community page, used by millions of investors, Narratives let you quickly plug in your assumptions and see how your Baidu story translates into numbers that update dynamically as new news or earnings arrive. This helps you decide whether the gap between Fair Value and the current price aligns with your preference for a buy, hold or sell stance.

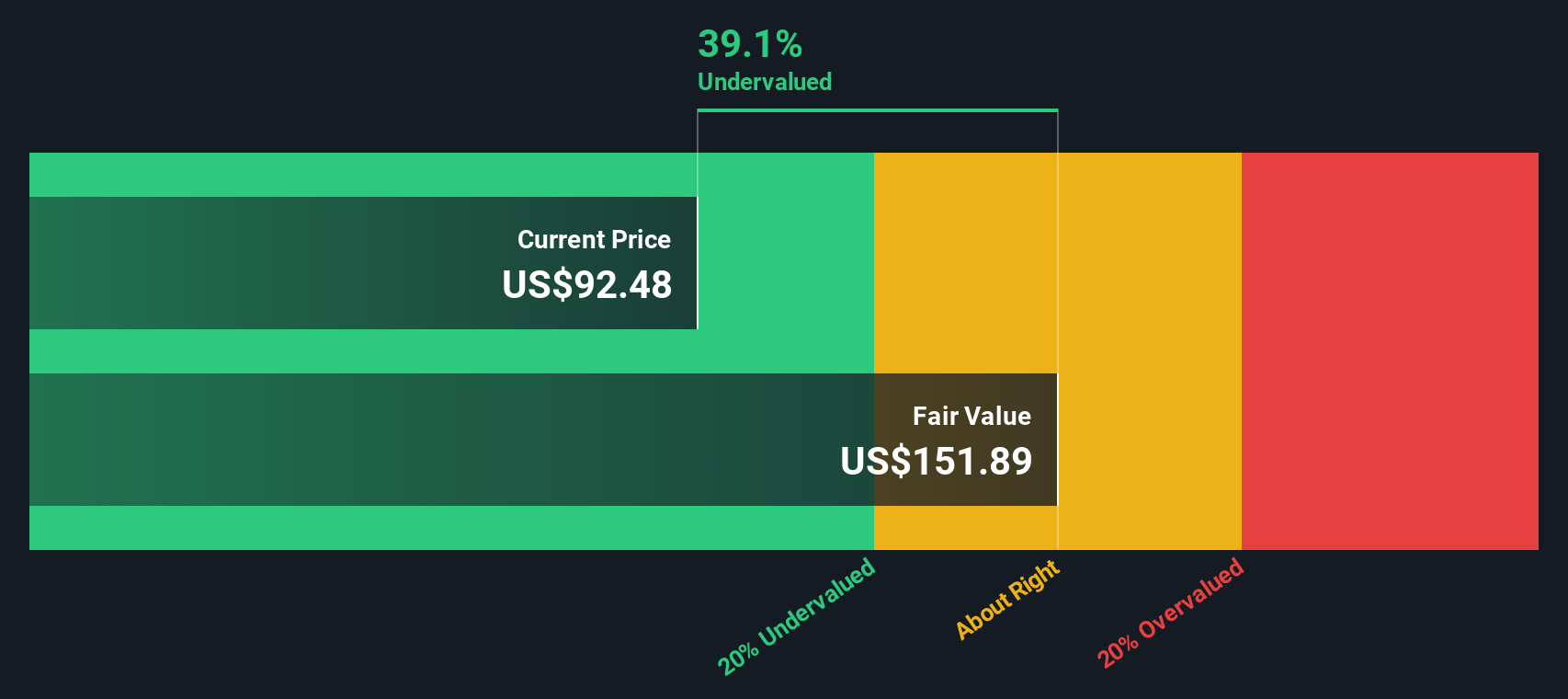

For example, one Baidu Narrative on the Community might assume faster AI driven growth and stronger long term margins, and justify a Fair Value around $152. A more cautious Narrative might lean on weaker advertising trends, thinner profitability and regulatory risk to support a Fair Value closer to $71. Seeing those side by side helps you choose which story you find more convincing and how you want to position your own portfolio.

Do you think there's more to the story for Baidu? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baidu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIDU

Baidu

Provides online marketing and non-marketing value added services through an internet platform in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026