- United States

- /

- Specialty Stores

- /

- NYSE:VSCO

Exploring 3 Prominent Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it is up 11% over the past year with earnings forecasted to grow by 14% annually. In this environment, identifying small-cap stocks with strong fundamentals and insider buying can be an effective strategy for investors seeking opportunities in potentially undervalued companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.5x | 3.0x | 46.77% | ★★★★★☆ |

| S&T Bancorp | 11.0x | 3.8x | 43.90% | ★★★★☆☆ |

| Barrett Business Services | 20.9x | 0.9x | 46.64% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 32.12% | ★★★★☆☆ |

| Niagen Bioscience | 60.2x | 7.9x | 21.01% | ★★★☆☆☆ |

| Columbus McKinnon | 54.0x | 0.5x | 32.73% | ★★★☆☆☆ |

| MVB Financial | 13.1x | 1.7x | 41.34% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -47.95% | ★★★☆☆☆ |

| Montrose Environmental Group | NA | 0.9x | 7.27% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -430.26% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Advantage Solutions (NasdaqGS:ADV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Advantage Solutions operates as a provider of outsourced sales and marketing services with a focus on branded, retailer, and experiential services and has a market cap of approximately $1.42 billion.

Operations: The company's revenue primarily comes from Branded Services, Retailer Services, and Experiential Services. Over recent periods, its gross profit margin has shown fluctuations, with a notable decrease to 12.44% by the end of 2024. Operating expenses are significant and include general and administrative costs as well as depreciation and amortization expenses.

PE: -1.0x

Advantage Solutions, a smaller company in the U.S. market, recently reported a first-quarter sales drop to US$821.79 million from US$861.41 million year-on-year, with net losses widening to US$56.13 million from US$5.31 million previously. Despite these challenges, insider confidence is evident through share purchases between October and December 2024 totaling 1.18 million shares for US$3.87 million, suggesting belief in future potential amidst leadership changes and strategic shifts in their business model under new executives like Dean General and Daniel Gore.

- Navigate through the intricacies of Advantage Solutions with our comprehensive valuation report here.

Explore historical data to track Advantage Solutions' performance over time in our Past section.

Topgolf Callaway Brands (NYSE:MODG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Topgolf Callaway Brands operates in the sports and entertainment industry, focusing on golf-related products and services, with a market capitalization of approximately $3.7 billion.

Operations: Topgolf Callaway Brands generates revenue primarily from three segments: Topgolf, Golf Equipment, and Active Lifestyle. The company has experienced fluctuations in its gross profit margin, reaching 45.37% at one point but more recently recorded at 31.70%. Operating expenses are a significant component of costs, with General & Administrative Expenses consistently forming a substantial portion of these costs over the periods observed.

PE: -0.9x

Topgolf Callaway Brands, a smaller player in its industry, recently reported Q1 2025 revenues of US$1.09 billion, slightly down from last year. Net income also saw a decrease to US$2.1 million from US$6.5 million previously. Despite this dip, insider confidence is evident with recent share purchases by executives in early 2025, signaling potential optimism about future prospects. The company has partnered with Verizon for exclusive customer experiences and anticipates full-year revenues between US$4 billion and US$4.185 billion for 2025.

- Take a closer look at Topgolf Callaway Brands' potential here in our valuation report.

Gain insights into Topgolf Callaway Brands' past trends and performance with our Past report.

Victoria's Secret (NYSE:VSCO)

Simply Wall St Value Rating: ★★★☆☆☆

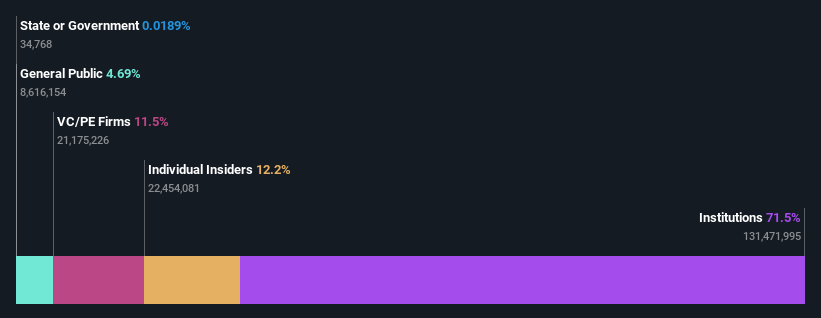

Overview: Victoria's Secret is a specialty retailer known for its lingerie, beauty products, and apparel with operations primarily in the retail segment and a market capitalization of approximately $2.51 billion.

Operations: Victoria's Secret generates revenue primarily through its retail specialty segment, with recent figures showing $6.23 billion in sales. The company has seen fluctuations in its net income margin, reaching a high of 11.34% and a low of 1.65%. Operating expenses are significant, with general and administrative costs consistently around $1.53 billion to $1.54 billion over the recent periods analyzed.

PE: 11.4x

Victoria's Secret, a smaller company in the U.S. market, shows potential despite its high debt and volatile share price. Recent leadership changes aim to drive growth with seasoned executives like Anne Stephenson and Ali Dillion assuming key roles. Earnings for the last quarter reached US$2.1 billion, slightly up from the previous year, while net income increased to US$193 million. The company's strategic moves suggest a focus on brand evolution and customer engagement amidst financial challenges.

- Dive into the specifics of Victoria's Secret here with our thorough valuation report.

Assess Victoria's Secret's past performance with our detailed historical performance reports.

Taking Advantage

- Explore the 105 names from our Undervalued US Small Caps With Insider Buying screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSCO

Victoria's Secret

Operates as a specialty retailer of women’s intimate, and other apparel and beauty products worldwide.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives