- United States

- /

- Chemicals

- /

- OTCPK:BLGO

US Penny Stocks: 3 Hidden Gems With Market Caps As Low As $4M

Reviewed by Simply Wall St

As the U.S. stock market takes a breather from recent record highs, investors are exploring diverse opportunities to capitalize on potential growth areas. Penny stocks, despite being an old term, continue to offer intriguing possibilities for those willing to look beyond the surface. These smaller or newer companies can provide a unique mix of value and growth potential when supported by robust financials, making them appealing options for discovering hidden gems in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.36 | $1.96B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.85 | $6.03M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $144.14M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.97 | $90.69M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.24 | $8.83M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.5309 | $51.48M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.83 | $2.39B | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9244 | $84.37M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Rapid Micro Biosystems (NasdaqCM:RPID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rapid Micro Biosystems, Inc. is a life sciences technology company that offers products for detecting microbial contamination in the manufacturing of pharmaceuticals, medical devices, and personal care products globally, with a market cap of $44.76 million.

Operations: The company's revenue is derived from its Systems and Related LIMS Connection Software, Consumables, and Services segment, totaling $26.17 million.

Market Cap: $44.76M

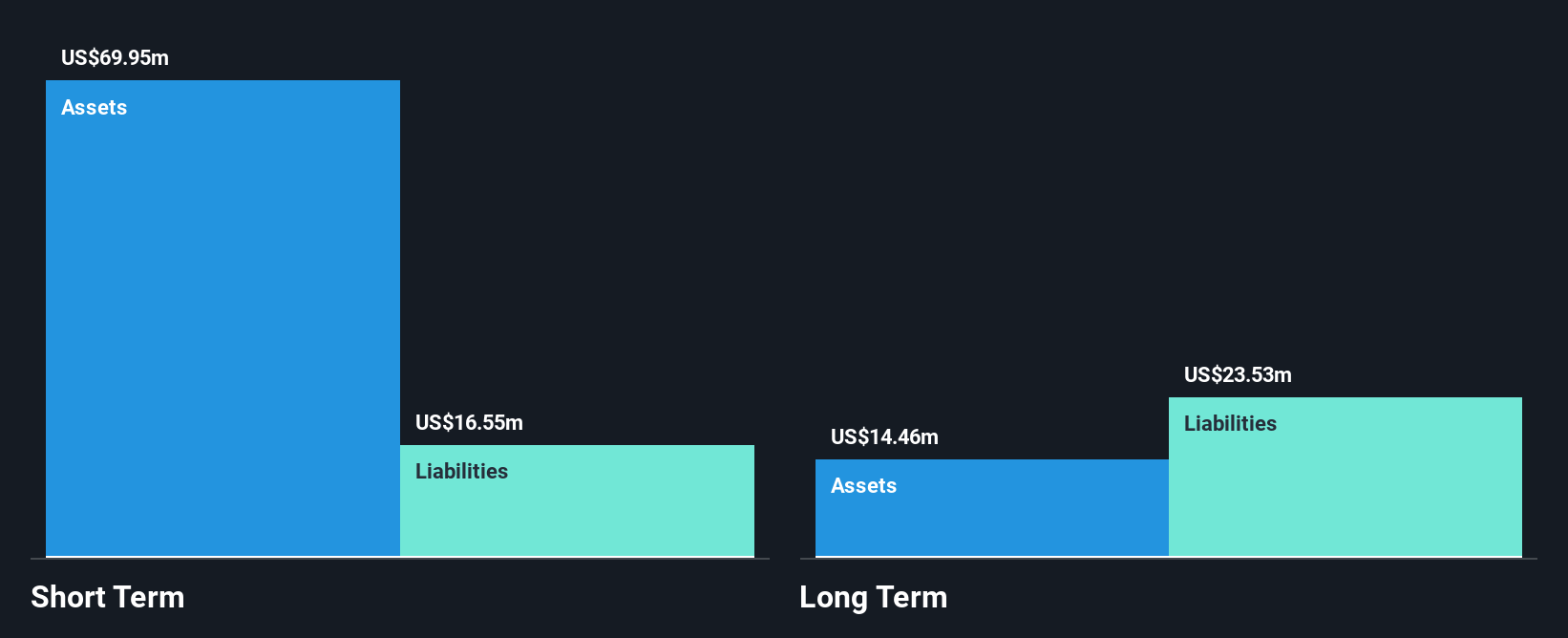

Rapid Micro Biosystems, Inc. is navigating the penny stock landscape with a market cap of US$44.76 million and reported revenues of US$26.17 million from its Systems and Related LIMS Connection Software, Consumables, and Services segment. Despite being unprofitable with increasing losses over five years, it maintains a solid cash position with short-term assets exceeding both short- and long-term liabilities significantly. The company is debt-free, has not diluted shareholders recently, and forecasts revenue growth of 18.45% annually while reaffirming its 2024 revenue guidance at US$27 million amidst stable weekly volatility in its stock price.

- Click to explore a detailed breakdown of our findings in Rapid Micro Biosystems' financial health report.

- Evaluate Rapid Micro Biosystems' prospects by accessing our earnings growth report.

Power REIT (NYSEAM:PW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Power REIT is a specialized real estate investment trust focusing on sustainable infrastructure assets like Controlled Environment Agriculture, Renewable Energy, and Transportation, with a market cap of $4.92 million.

Operations: The company's revenue is derived from its commercial real estate segment, amounting to $3.15 million.

Market Cap: $4.92M

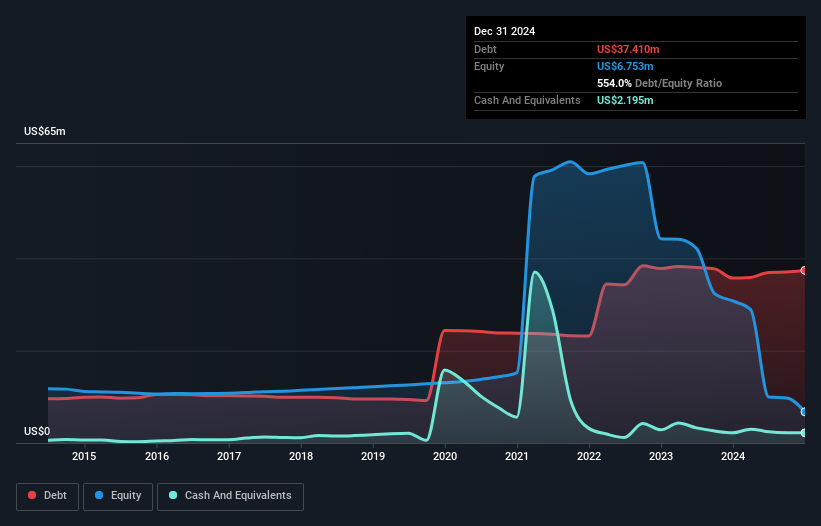

Power REIT, with a market cap of US$4.92 million, is navigating challenges in the penny stock arena. The company recently restated its equity to comply with NYSE American listing requirements, boosting its total equity to approximately US$10 million. Despite generating revenue of US$3.15 million from sustainable infrastructure assets, Power REIT remains unprofitable and faces significant debt issues with a high net debt to equity ratio of 356.1%. The company's short-term assets exceed both short- and long-term liabilities, providing some financial stability amidst increased share price volatility over recent months.

- Click here and access our complete financial health analysis report to understand the dynamics of Power REIT.

- Gain insights into Power REIT's historical outcomes by reviewing our past performance report.

BioLargo (OTCPK:BLGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BioLargo, Inc. invents, develops, and commercializes various platform technologies with a market cap of $58.72 million.

Operations: The company's revenue is primarily derived from its ONM Environmental segment, contributing $16.50 million, and the BLEST segment, which accounts for $3.09 million.

Market Cap: $58.72M

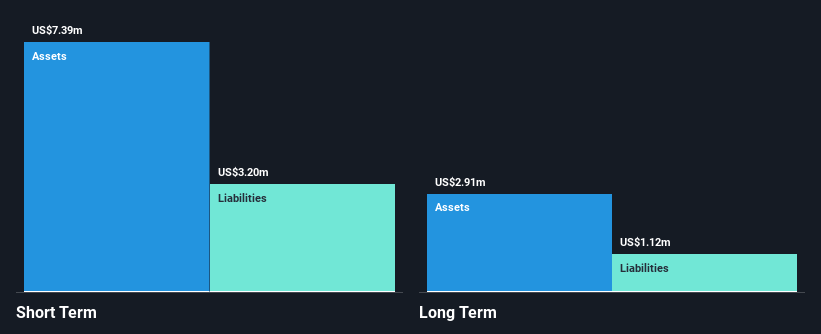

BioLargo, Inc., with a market cap of US$58.72 million, is making strides in the penny stock sector despite ongoing unprofitability. The company reported third-quarter revenue of US$4.35 million, up from US$2.67 million a year ago, and reduced its net loss to US$0.537 million from US$1.2 million previously. BioLargo's seasoned management team and positive shareholder equity suggest improving financial health, while its short-term assets comfortably cover liabilities. However, shareholders have experienced dilution over the past year as the company continues to invest in growth initiatives like its Cellinity battery technology for renewable energy storage solutions.

- Take a closer look at BioLargo's potential here in our financial health report.

- Explore BioLargo's analyst forecasts in our growth report.

Make It Happen

- Unlock more gems! Our US Penny Stocks screener has unearthed 703 more companies for you to explore.Click here to unveil our expertly curated list of 706 US Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade BioLargo, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BioLargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:BLGO

BioLargo

BioLargo, Inc. invents, develops, and commercializes various platform technologies.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives