- United States

- /

- Metals and Mining

- /

- NYSEAM:UAMY

Is United States Antimony’s Surge Justified After Record 57% Weekly Gain?

Reviewed by Bailey Pemberton

Thinking about whether to buy, hold, or sell United States Antimony? You’re not alone. With shares closing at $12.21 and delivering jaw-dropping gains—up 57.5% over just the last week, and an incredible 605.8% year-to-date—this stock has certainly caught the market’s attention. If you zoom out even further, the story gets even wilder: United States Antimony is up 1663.7% in the past year, and an astonishing 3313.5% over three years. It’s safe to say, this is not your average stock chart.

But what’s driving these moves? Investors are clearly seeing something in United States Antimony, and the buzz can be traced in part to shifting sentiment around supply chains and critical minerals. With growing interest in domestic sources of antimony due to global market uncertainties, this company has benefited from a renewed focus on strategic materials. That said, the stock price action also suggests a fresh perception of the company’s risk and growth potential. Is it all justified by fundamentals, or is hype running ahead of reality?

When it comes to valuation, things get interesting. On a standard value score, where the company earns a point for each criteria in which it’s found to be undervalued, United States Antimony currently scores a 2 out of 6. That suggests some aspects of the share price may be running hot, even as other metrics look cheap.

So, how do you make sense of a stock that’s breaking records but posts a mixed valuation score? Let’s break down each method analysts use to value a company like United States Antimony. And be sure to stick around until the end, where we’ll unpack an often-overlooked way to really understand what this company is worth.

United States Antimony scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: United States Antimony Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach is especially useful for companies like United States Antimony, which operate in industries with large swings in profitability and growth potential.

Looking at United States Antimony specifically, its latest reported Free Cash Flow (FCF) is -$6.88 Million, meaning the company is currently burning cash. However, analysts project a dramatic turnaround, with FCF expected to reach $79 Million by the end of 2028. Beyond this point, further growth projections are extrapolated, with estimates rising above $310 Million by 2035. All cash flows are presented in US dollars ($).

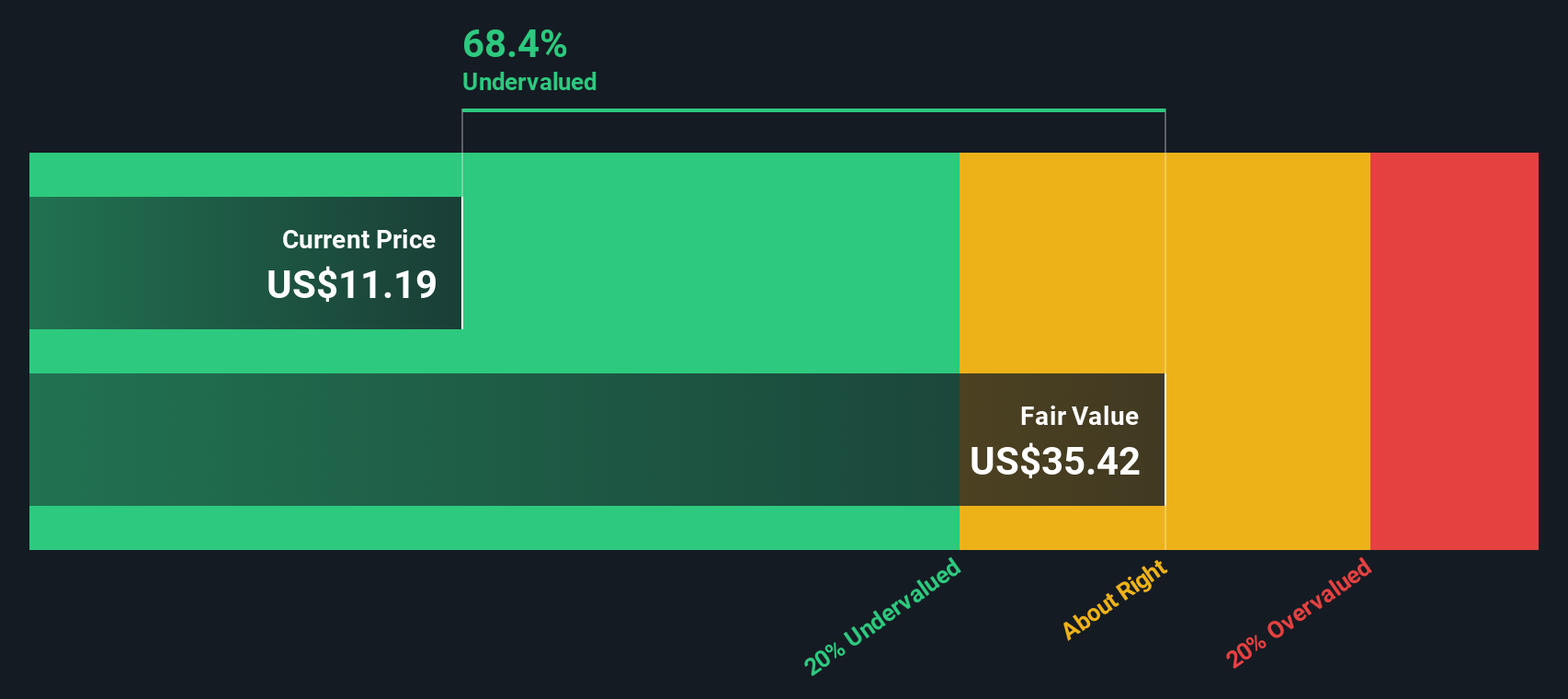

Based on these projections, the DCF analysis calculates an intrinsic value of $35.08 per share. With the current share price at $12.21, United States Antimony is trading at a 65.2% discount to its estimated fair value. This suggests it may be substantially undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United States Antimony is undervalued by 65.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: United States Antimony Price vs Book

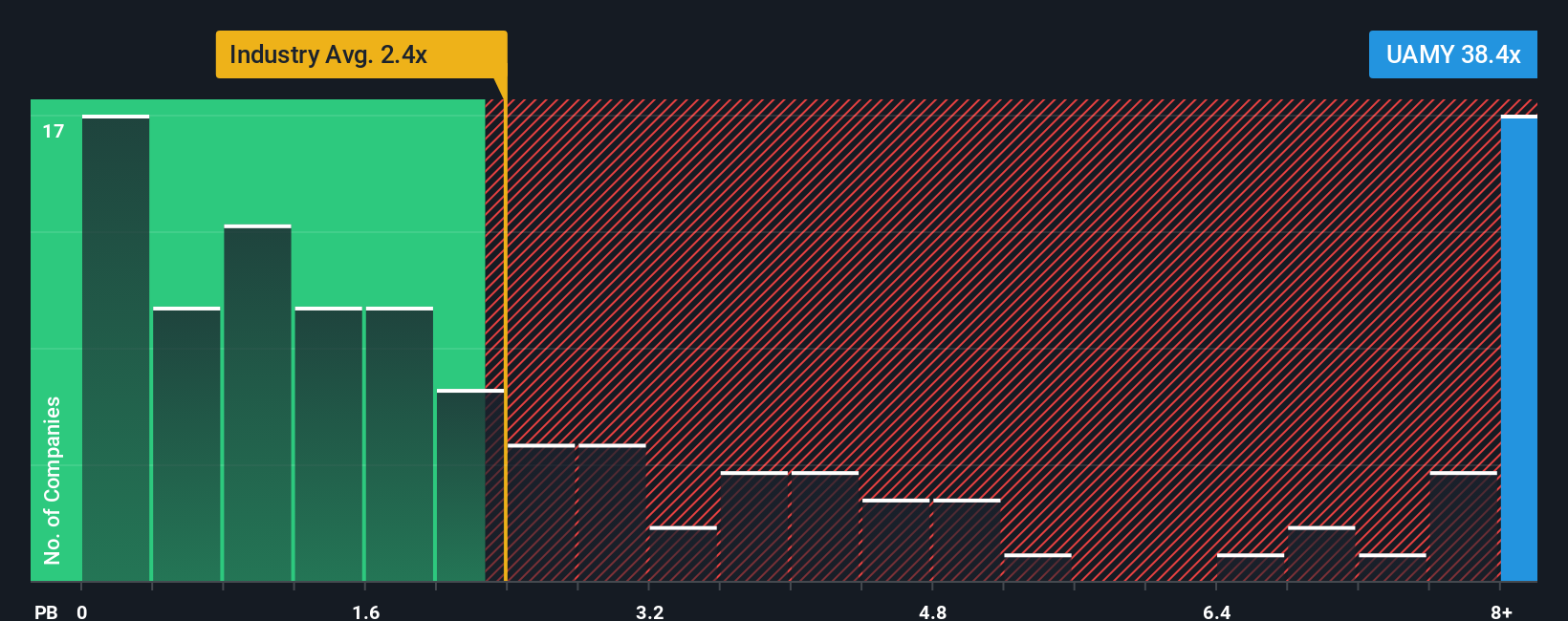

The Price-to-Book (P/B) ratio is often a solid valuation metric for companies in industries like metals and mining, especially when profits can be volatile or even negative. This metric compares a company’s market value to its net assets, giving investors a glimpse of how much they're paying for each dollar of assets on the balance sheet. However, it’s important to remember that growth prospects and company risk can impact what counts as a “fair” P/B ratio. Fast-growing, high-potential companies tend to justify higher multiples, while riskier or slower-growing firms usually command lower ones.

United States Antimony’s current P/B ratio stands at 41.92x, which is a very high figure by any measure. This is significantly above both the industry average for metals and mining (2.31x) and the average of its peers (13.03x). At a glance, this might make the stock look extremely expensive compared to similar companies.

This is where the “Fair Ratio” comes in, a proprietary Simply Wall St metric that estimates the P/B multiple the company deserves given its specific growth outlook, profitability, industry, size, and risk profile. Unlike industry or peer comparisons that overlook these nuances, the Fair Ratio adjusts for features unique to United States Antimony, offering a more tailored and accurate benchmark.

Since the Fair Ratio for United States Antimony is not provided but the current P/B is far above both the industry and peer averages, it is likely the stock remains overvalued on this metric. Investors should be cautious about paying such a steep premium for the company’s net assets without a compelling growth or profitability case.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United States Antimony Narrative

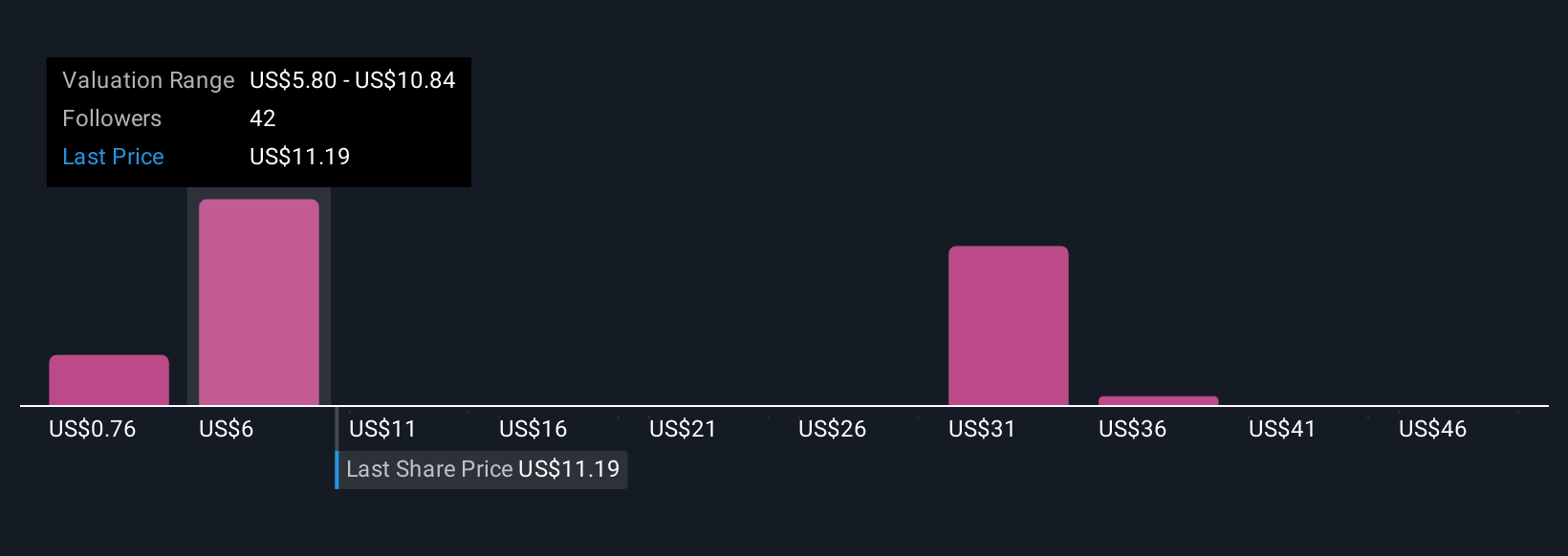

Earlier, we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative connects your view of United States Antimony’s story, including its opportunities, risks, and outlook, to a specific financial forecast for revenue, earnings, and margins. This process then translates that into your own fair value for the stock.

Put simply, a Narrative is your personal investing hypothesis, combining “why” you think the company will perform a certain way with “how” that plays out in the numbers. This approach makes sense of the headlines and metrics by anchoring them in a clear, evidence-based scenario. This can help you move from just tracking prices to making informed, conviction-based decisions.

Narratives are free, easy to use, and available on Simply Wall St’s Community page, where millions of investors compare outlooks and fair values in real time. Each Narrative shows a fair value, compares it with today’s share price, and updates automatically as new information, such as fresh earnings or breaking news, is released.

For example, one investor might expect United States Antimony to secure major government contracts, expand processing, and earn higher margins, supporting a fair value above $7.50. Another might believe regulatory delays and supply chain risks will keep growth in check, justifying a far lower value closer to the current share price. Narratives allow you to see both perspectives and decide which story and valuation makes sense for you.

Do you think there's more to the story for United States Antimony? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UAMY

United States Antimony

Produces and sells antimony, zeolite, and precious metals in the United States and Canada.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives