- United States

- /

- Metals and Mining

- /

- NYSEAM:IE

Ivanhoe Electric (IE) Up 15.8% After Copper Output Surge and Smelter Launch Plans—Has the Thesis Shifted?

Reviewed by Sasha Jovanovic

- Ivanhoe Electric Inc. reported in the past that its third quarter copper production rose by 57 percent to 71,226 tons, maintaining its full-year guidance of 370,000 to 420,000 tons.

- The company is also preparing to start operations at Africa's largest and most environmentally advanced direct-to-blister copper smelter, which is expected to lower operational cash costs.

- We'll explore what increased copper production and the upcoming smelter launch mean for Ivanhoe Electric's investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Ivanhoe Electric's Investment Narrative?

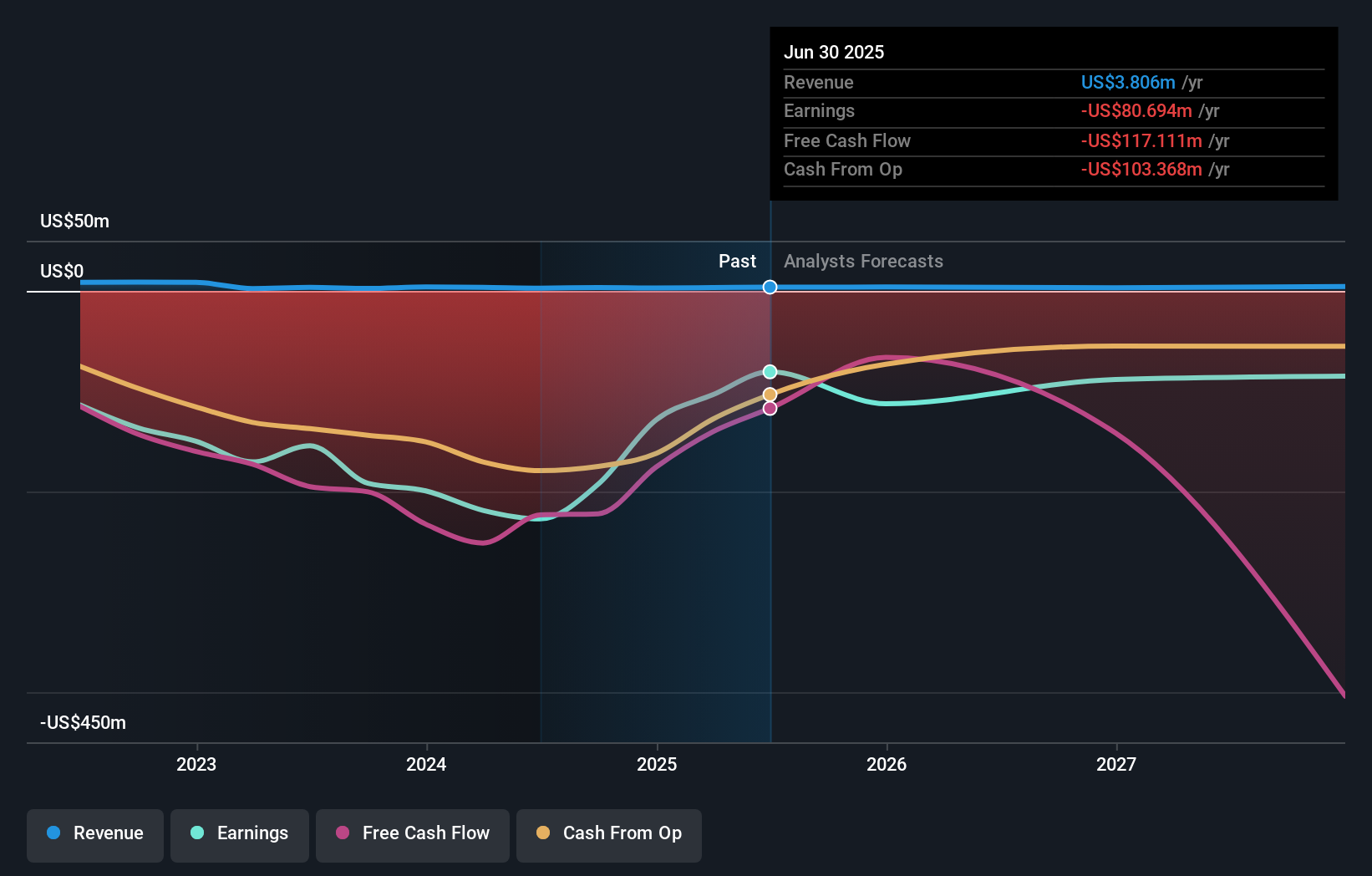

To own Ivanhoe Electric shares, you need a strong belief in the future of large-scale copper production and the potential rewards from scaling up in an early-growth mining company. The company’s recent surge in copper output and the soon-to-launch smelter suggest its most important near-term catalyst is cost reduction and possibly improved margins, both key in the sector, especially as Ivanhoe seeks to move toward profitability. Short term, the upside from these operational milestones appears to be material, as seen by the share price rally and renewed market confidence in its full-year targets. However, the business remains unprofitable, with high cash burn, limited revenue, and a high price-to-book ratio relative to the industry. For now, the risks from running out of cash or failing to deliver on output targets remain front and center, even as catalysts shift more clearly toward operational execution. Still, current cash runway concerns are vital for investors to understand before forming a view.

Our valuation report here indicates Ivanhoe Electric may be overvalued.Exploring Other Perspectives

Explore 2 other fair value estimates on Ivanhoe Electric - why the stock might be worth as much as 10% more than the current price!

Build Your Own Ivanhoe Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ivanhoe Electric research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Ivanhoe Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ivanhoe Electric's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:IE

Ivanhoe Electric

A mineral exploration company, focuses on developing mines from mineral deposits primarily in the United States.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives