- United States

- /

- Metals and Mining

- /

- NYSEAM:IDR

A Fresh Look at Idaho Strategic Resources (IDR) Valuation Following $20 Million Equity Offering Announcement

Reviewed by Kshitija Bhandaru

Idaho Strategic Resources (IDR) just announced a $20 million follow-on equity offering, drawing investor attention. This move typically signals plans to raise fresh capital, which often sparks questions around future growth opportunities and share value.

See our latest analysis for Idaho Strategic Resources.

Momentum around Idaho Strategic Resources has been building fast, as seen in the 44.7% jump in its 30-day share price return and an impressive 315% year-to-date move. While recent news of the equity offering made waves, this follows a powerful run where investors who held for the past year saw a 184% total shareholder return. Those in for the full five years enjoyed gains bordering on tenfold. Investors are clearly responding to both the company’s expansion moves and growing optimism about its prospects.

If this kind of rapid momentum has you looking for your next opportunity, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

After a meteoric run, investors are left wondering if Idaho Strategic Resources’ stock is still a bargain waiting to be seized, or if recent gains have already priced in the company’s next chapter of growth.

Price-to-Earnings of 71.6x: Is it justified?

Idaho Strategic Resources’ stock now trades at a price-to-earnings ratio of 71.6x, which marks it as richly valued when compared to peers. At a last close price of $43.85, the market is demanding a substantial premium for its earnings stream.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay today for a dollar of current earnings. For metals and mining companies, this ratio helps gauge market optimism regarding future profit growth, operational stability, or potential sector tailwinds that could support higher earnings in the future.

This premium becomes more evident when compared to sector benchmarks. IDR’s P/E is not only above its peer average (56.1x), but also significantly higher than the broader US Metals and Mining industry average (24.6x). The market’s appetite for these shares appears to price in a growth trajectory or profitability profile that is much more ambitious than the industry norm. Regression-based analysis suggests a lower fair price-to-earnings ratio (20.7x), indicating that market expectations are running well ahead of fundamental benchmarks.

Explore the SWS fair ratio for Idaho Strategic Resources

Result: Price-to-Earnings of 71.6x (OVERVALUED)

However, risks remain, such as lofty valuations and a stock price that is notably above analyst targets. Both of these factors could trigger a shift in investor sentiment.

Find out about the key risks to this Idaho Strategic Resources narrative.

Another View: Discounted Cash Flow Perspective

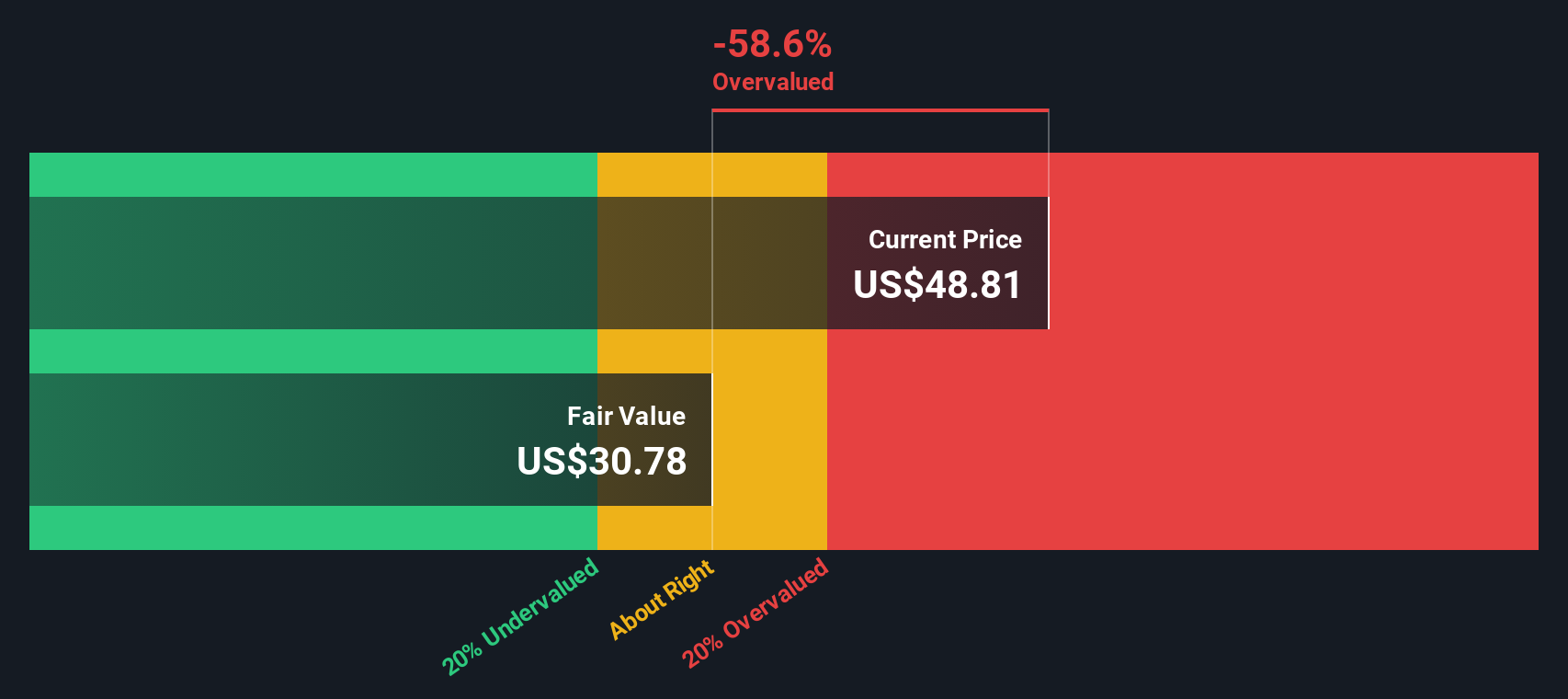

Looking beyond earnings multiples, our DCF model offers a different perspective by estimating what Idaho Strategic Resources' shares should be worth today based on expected future cash flows. According to this method, the stock trades well above its DCF fair value, suggesting it could be overvalued using this lens. Which approach is likely to prove right as the market digests new developments?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Idaho Strategic Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Idaho Strategic Resources Narrative

If these conclusions don’t quite fit your outlook or you like to dive deeper yourself, you can quickly create your own narrative based on the facts: Do it your way

A great starting point for your Idaho Strategic Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Supercharge your investing strategy by tapping into stocks with game-changing potential. Don’t miss your chance to spot the next big winner before everyone else.

- Uncover remarkable up-and-comers with strong financials when you check out these 3586 penny stocks with strong financials, designed for those seeking substantial growth stories.

- Target future market leaders at the intersection of innovation and healthcare by starting with these 33 healthcare AI stocks, which highlights breakthroughs in AI-powered medicine.

- Secure lasting income and stability by reviewing these 19 dividend stocks with yields > 3%, a resource packed with opportunities yielding over 3% for those seeking steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:IDR

Idaho Strategic Resources

A resource-based company, engages in the exploration, development, and extraction of gold, silver, and base metal mineral resources in the North Idaho.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives