- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

3 Stocks Estimated To Be Up To 36.7% Below Intrinsic Value Offering Potential Opportunities

Reviewed by Simply Wall St

In recent market developments, the S&P 500 and Dow Jones Industrial Average have experienced declines following a surprising rise in unemployment, while the Nasdaq managed to tick higher, breaking its losing streak. Amid these mixed signals from major indices and economic indicators, investors may find opportunities in stocks that are perceived to be undervalued relative to their intrinsic value. Identifying such stocks requires careful analysis of financial health and growth potential within the context of current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (UMBF) | $118.98 | $233.99 | 49.2% |

| Perfect (PERF) | $1.72 | $3.43 | 49.9% |

| Krystal Biotech (KRYS) | $235.80 | $469.93 | 49.8% |

| Freshworks (FRSH) | $12.39 | $23.62 | 47.6% |

| FirstSun Capital Bancorp (FSUN) | $38.82 | $73.56 | 47.2% |

| First Solar (FSLR) | $254.03 | $482.71 | 47.4% |

| Dingdong (Cayman) (DDL) | $2.82 | $5.45 | 48.3% |

| DexCom (DXCM) | $65.75 | $127.60 | 48.5% |

| Columbia Banking System (COLB) | $28.95 | $57.33 | 49.5% |

| Bloom Energy (BE) | $76.97 | $148.02 | 48% |

We're going to check out a few of the best picks from our screener tool.

Ligand Pharmaceuticals (LGND)

Overview: Ligand Pharmaceuticals Incorporated is a biopharmaceutical company that develops and licenses biopharmaceutical assets globally, with a market cap of approximately $3.83 billion.

Operations: The company's revenue primarily comes from the development and licensing of biopharmaceutical assets, totaling $251.23 million.

Estimated Discount To Fair Value: 15.1%

Ligand Pharmaceuticals appears undervalued based on discounted cash flow analysis, trading at US$194.59 against an estimated fair value of US$229.31. Recent earnings showed a substantial improvement, with third-quarter revenue rising to US$115.46 million and net income reaching US$117.27 million from a loss previously. The company forecasts 2026 revenue between $245 million and $285 million, driven by royalty and Captisol sales, supporting its growth trajectory above the market average.

- The growth report we've compiled suggests that Ligand Pharmaceuticals' future prospects could be on the up.

- Click here to discover the nuances of Ligand Pharmaceuticals with our detailed financial health report.

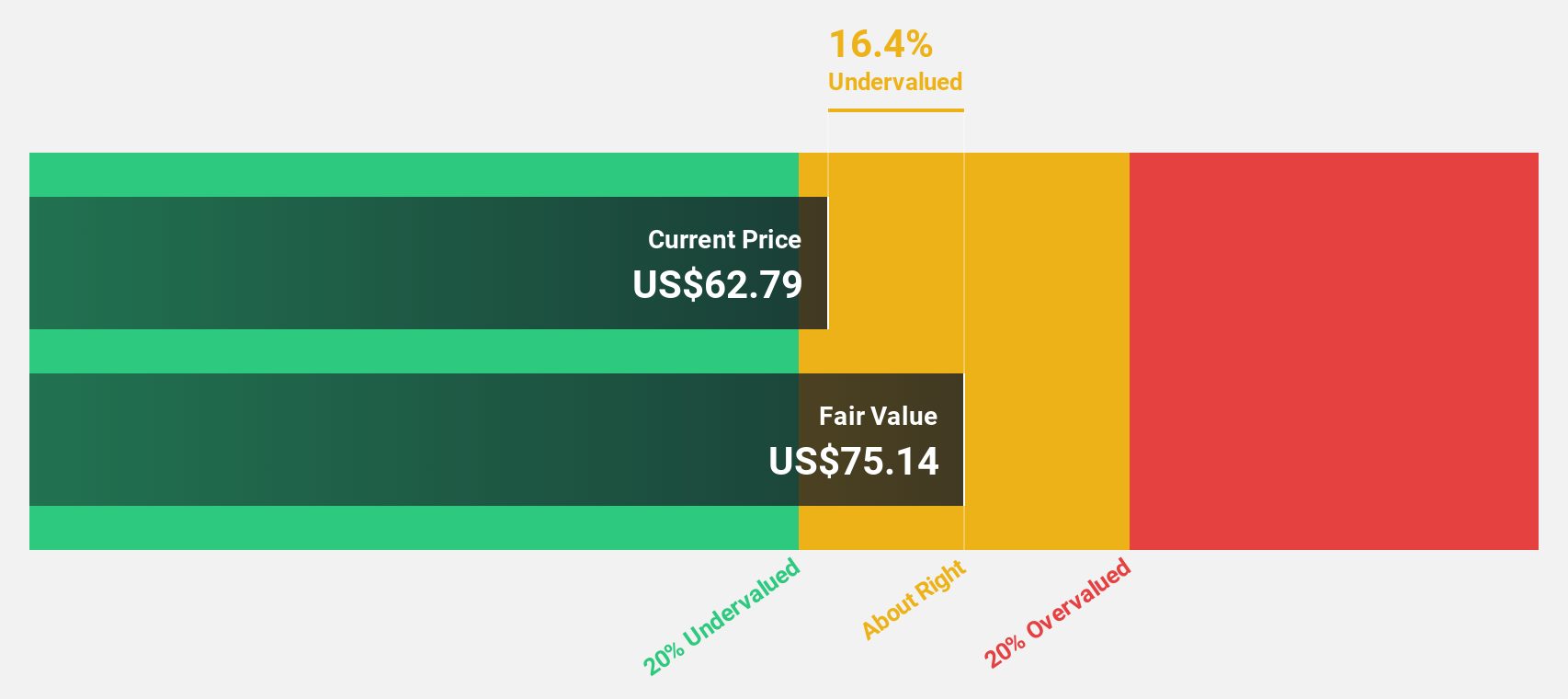

Kroger (KR)

Overview: The Kroger Co. operates as a food and drug retailer in the United States with a market cap of approximately $40.38 billion.

Operations: The company's revenue is primarily derived from its retail operations, which generate $147.23 billion.

Estimated Discount To Fair Value: 15.1%

Kroger, trading at US$63.81, is undervalued based on discounted cash flow analysis with a fair value estimate of US$75.14. Despite a forecasted significant earnings growth rate of 30.4% annually over the next three years, recent financials reveal challenges including a net loss of US$1.32 billion in Q3 2025 and declining profit margins from last year. Additionally, Kroger faces regulatory scrutiny due to infant formula recalls impacting store operations and legal issues related to patent infringement claims.

- Insights from our recent growth report point to a promising forecast for Kroger's business outlook.

- Take a closer look at Kroger's balance sheet health here in our report.

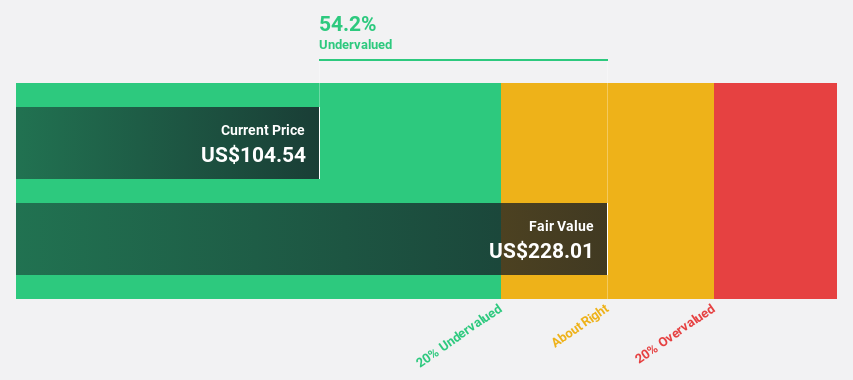

Sociedad Química y Minera de Chile (SQM)

Overview: Sociedad Química y Minera de Chile S.A. is a global producer and seller of specialty plant nutrients and iodine derivatives, with a market cap of approximately $18.83 billion.

Operations: The company's revenue segments include Lithium and Derivatives ($2.08 billion), Iodine and Derivatives ($996.40 million), Specialty Plant Nutrition ($957.03 million), Potassium ($182.60 million), and Industrial Chemicals ($74.26 million).

Estimated Discount To Fair Value: 36.7%

Sociedad Química y Minera de Chile, trading at US$65.92, is undervalued with a fair value estimate of US$104.17 based on discounted cash flow analysis. Recent earnings show strong performance with Q3 sales of US$1.17 billion and net income rising to US$178.42 million from last year’s figures. Despite high debt levels, the company benefits from robust growth forecasts in revenue and profit, supported by strategic partnerships like the one approved with Codelco in China’s lithium market.

- Upon reviewing our latest growth report, Sociedad Química y Minera de Chile's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Sociedad Química y Minera de Chile with our comprehensive financial health report here.

Summing It All Up

- Get an in-depth perspective on all 206 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion