- United States

- /

- Metals and Mining

- /

- NYSE:SCCO

Should Southern Copper’s (SCCO) $15 Billion Investments and Zinc Ramp-Up Prompt Investor Action?

Reviewed by Sasha Jovanovic

- In recent days, Southern Copper attracted renewed analyst attention following upgrades sparked by copper market supply disruptions and the company’s continued stable operations, as well as announcements of over US$15 billion in new capital investments across its projects in Mexico and Peru. The Buenavista zinc concentrator recently reached full capacity, a shift anticipated to boost zinc production by 31% in 2025 and enhance both revenue and margins going forward.

- Southern Copper’s expanding production in Mexico and Peru reflects a calculated response to global copper supply pressures, with fresh investments and operational improvements setting the stage for improved financial performance and increased analyst confidence.

- We’ll examine how the ramp-up of the Buenavista zinc concentrator and capital investment surge may influence Southern Copper’s investment case.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Southern Copper Investment Narrative Recap

To be a shareholder in Southern Copper today, you have to believe that strong global copper demand and operational stability will continue to drive long-term growth, even as near-term market volatility and cost pressures remain. The recent surge in analyst upgrades reflects optimism around Southern Copper’s consistent performance and new investments, but the company’s high valuation and exposure to supply-demand imbalances mean that the biggest immediate catalyst, copper market tightness, may be balanced by the risk of higher operating costs. The impact of the latest news is positive but doesn’t materially alter the key risk that rising expenses could weigh on margins.

Among recent announcements, the ramp-up of the Buenavista zinc concentrator stands out. Now operating at full capacity, it is projected to deliver a 31% increase in zinc production in 2025, which could support revenue and margins amid tight market conditions. This operational milestone gives the company extra resilience at a time when supply chain disruptions are drawing renewed attention from analysts and investors alike.

On the other hand, shareholders should pay close attention to the company’s elevated operating expenses and the risk they pose to near-term profitability if...

Read the full narrative on Southern Copper (it's free!)

Southern Copper's narrative projects $13.0 billion revenue and $4.3 billion earnings by 2028. This requires 3.1% yearly revenue growth and a $0.7 billion earnings increase from $3.6 billion.

Uncover how Southern Copper's forecasts yield a $97.31 fair value, a 22% downside to its current price.

Exploring Other Perspectives

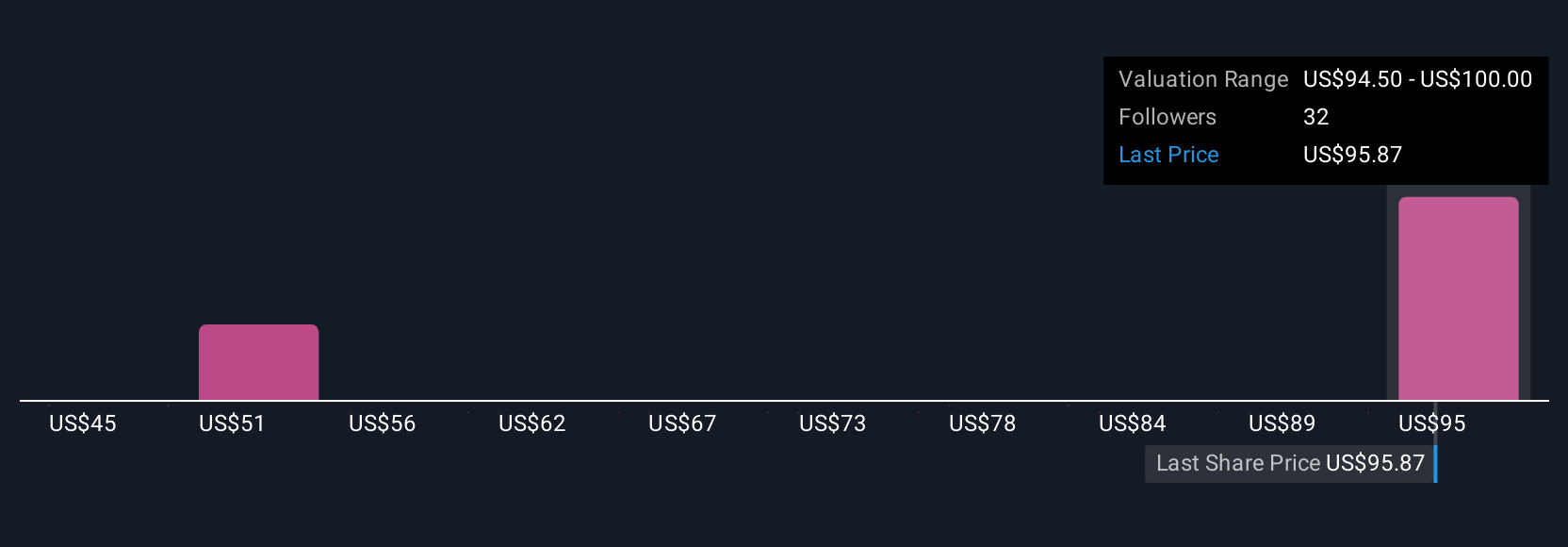

Six private investors from the Simply Wall St Community place Southern Copper’s fair value estimates between US$45 and US$124.57 per share. Against these varied targets, rising operating costs could influence actual returns, reminding you to explore a range of perspectives before making investment decisions.

Explore 6 other fair value estimates on Southern Copper - why the stock might be worth as much as $124.57!

Build Your Own Southern Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southern Copper research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southern Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southern Copper's overall financial health at a glance.

No Opportunity In Southern Copper?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCCO

Southern Copper

Engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives