Last Update 01 Dec 25

Fair value Increased 0.45%SCCO: Delays At Tia Maria Will Restrict Gains Despite Ongoing Supply Tightness

Analysts have raised their price target for Southern Copper slightly, from $117.76 to $118.29. This adjustment is based on ongoing supply disruptions in the copper market and expectations for higher precious metal prices, which are seen as supportive of the company's outlook.

Analyst Commentary

Recent street research on Southern Copper reflects both optimism and caution among analysts, driven by ongoing supply constraints and shifting price projections in the metals market. The following summarizes the key bullish and bearish takeaways impacting the company's near- and medium-term outlook.

Bullish Takeaways- Bullish analysts cite persistent supply disruptions at several major mines as likely to keep copper markets tight through 2026. This is seen as supporting strong price momentum and company performance.

- Several price target increases reflect expectations for elevated copper and precious metal prices. These expectations translate into higher projected EBITDA and valuation uplifts over the next two years.

- The company continues to deliver robust free cash flow, which is viewed as supporting its attractive dividend policy and offering resilience even in a volatile market.

- Upgrades in analyst ratings suggest an improving execution outlook. There are fewer avenues for investors to access copper beta and increased confidence that Southern Copper can benefit from sector tailwinds.

- Bearish analysts remain cautious due to continued project delays, notably with Tia Maria, which may pressure earnings growth in the latter part of the decade.

- Some firms maintain a neutral or negative stance despite price target hikes. This signals concerns about execution risks and valuation relative to peers.

- While the company is well-positioned in the current cycle, select analysts prefer alternative sector names on valuation grounds. Southern Copper’s premium is cited as a potential constraint on further multiple expansion.

What's in the News

- The U.S. Department of the Interior has added copper and silver to its list of "critical minerals," increasing the likelihood that future U.S. tariff policies could include these materials (Financial Times).

- Southern Copper reported lower total copper production for the third quarter of 2025 at 234,892 tonnes, down from 252,219 tonnes a year ago. Production of molybdenum, zinc, and silver increased over the same period.

- The Board of Directors authorized a quarterly cash dividend of $0.90 per share and a stock dividend of 0.0085 shares per share, payable on November 28, 2025, to shareholders of record as of November 12, 2025.

- Southern Copper completed a significant share buyback totaling 119,497,767 shares, or 13.68% of shares outstanding, for $2.93 billion under a program initiated in 2008.

Valuation Changes

- The Fair Value Estimate has increased slightly from $117.76 to $118.29 per share.

- The Discount Rate has risen marginally from 8.14% to 8.18%.

- Revenue Growth projections are essentially unchanged, remaining at approximately 4.80%.

- The Net Profit Margin is stable, with only a negligible decrease from 31.40% to 31.40%.

- The Future P/E ratio has inched higher from 27.36x to 27.51x.

Key Takeaways

- Substantial capital investments and efficient operations are expected to drive significant production growth, enhancing revenue and net margins.

- Tight market conditions and low inventory levels may boost copper prices, positively impacting Southern Copper's revenue and profitability.

- Southern Copper is vulnerable to U.S.-China tensions, rising costs, and operational disruptions, risking revenue and margins despite planned significant capital expenditure.

Catalysts

About Southern Copper- Engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile.

- Southern Copper has announced substantial capital investments totaling over $15 billion, including projects in Mexico and Peru, which are expected to drive future production growth and potentially boost revenue significantly.

- The company's Buenavista zinc concentrator is now operating at full capacity, anticipated to drive a 31% increase in zinc production in 2025, likely enhancing revenues and improving net margins due to efficient operations.

- Expansion projects such as Tia Maria, Los Chancas, and Michiquillay are progressing, with expectations for additional production capacity, which could positively impact revenue and earnings starting in 2027 through 2030.

- Operational efficiencies and a strong focus on cost control have led to a reduction in cash costs, with expectations to sustain low costs between $0.75 to $0.80 per pound of copper in 2025, potentially boosting net margins and earnings.

- Tight copper market conditions, with expectations of supply-demand deficits and low inventory levels, could maintain or increase copper prices, positively impacting Southern Copper's revenue and profitability.

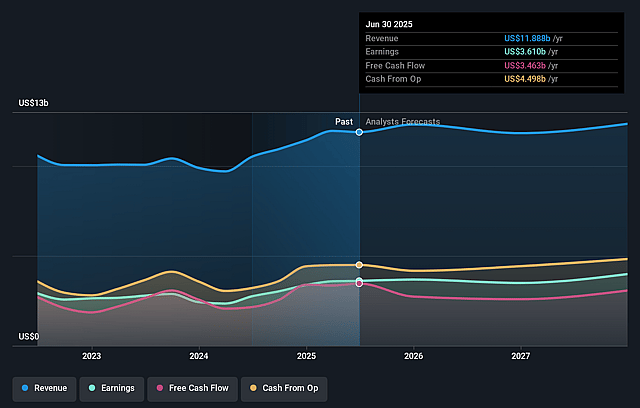

Southern Copper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Southern Copper's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 30.4% today to 33.3% in 3 years time.

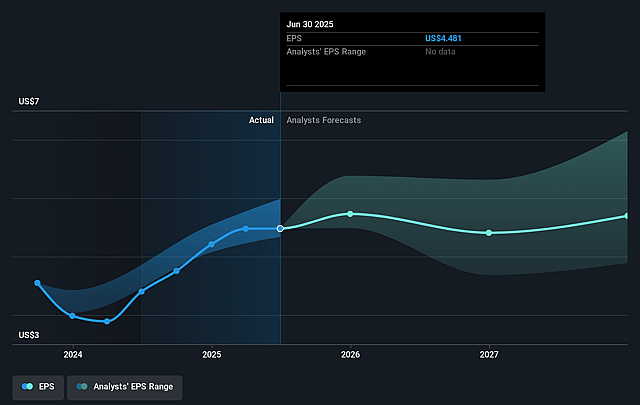

- Analysts expect earnings to reach $4.3 billion (and earnings per share of $5.24) by about September 2028, up from $3.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $4.8 billion in earnings, and the most bearish expecting $3.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, down from 22.5x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Southern Copper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Southern Copper faces the risk of an intense commercial war between the U.S. and China, which could adversely affect global economic growth and subsequently reduce copper demand. This could potentially impact revenue and earnings.

- The significant arbitrage difference between COMEX and LME prices, largely driven by the potential for a 25% tariff on U.S. imports, presents uncertainty. If such tariffs are implemented, they could affect Southern Copper’s ability to sell profitably in the U.S. market, impacting revenue and profit margins.

- An increase in operating costs and expenses, which rose by 12% due to factors like inventory consumption and material costs, may hurt net margins despite sales growth.

- The company's significant capital expenditure plans over the next decade, exceeding $15 billion, could pressure cash flow and require careful financial management to maintain profitability.

- Community issues and disruptions, such as the incidents with illegal miners at the Los Chancas project, pose operational risks and could delay project timelines, adversely affecting future production and revenue projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $95.247 for Southern Copper based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $128.7, and the most bearish reporting a price target of just $66.63.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $13.0 billion, earnings will come to $4.3 billion, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 7.6%.

- Given the current share price of $99.91, the analyst price target of $95.25 is 4.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.