Key Takeaways

- Major new projects, green technology demand, and supply chain trends position the company for production growth, strong sales, and reduced risk exposure.

- Leading cost efficiency, operational discipline, and ESG investments are expected to strengthen margins, stakeholder support, and valuation.

- Ongoing geopolitical, regulatory, operational, and demand risks threaten Southern Copper’s growth, profitability, and ability to expand successfully amid rising capital costs and evolving industry pressures.

Catalysts

About Southern Copper- Engages in mining, exploring, smelting, and refining copper and other minerals in Peru, Mexico, Argentina, Ecuador, and Chile.

- The expanding pipeline of major brownfield and greenfield projects, specifically Tía María and Los Chancas, positions Southern Copper for significant production growth beginning in 2027, with projected copper output rising above one million tons by 2028 and reaching approximately 1,080,000 tons by 2030, which is likely to materially elevate total revenue as volumes increase.

- Intensifying global investments in renewable energy, electric vehicles, artificial intelligence, and related green technologies are driving a rapid increase in copper demand, with per-unit copper requirements for renewable installations far exceeding those of traditional infrastructure, strengthening the outlook for higher sales volumes and sustained pricing power.

- Southern Copper’s industry-leading cost structure—demonstrated by a cash cost after by-product credits declining to a projected range of $0.75 to $0.80 per pound—combined with operational discipline and productivity gains from new zinc capacity and consistent investments in efficiency, is likely to drive margin expansion and robust earnings even through commodity cycles.

- The company’s deepening local stakeholder engagement and ESG leadership—inclusive of recognized investments in education, water usage, and community infrastructure—may further secure operational continuity, preferential access to project approvals, and capital, ultimately supporting both top-line growth and higher valuation multiples.

- Supply chain regionalization and “friend-shoring” trends, along with the lack of copper tariffs between Mexico, Peru, and the United States, are shifting global procurement preferences toward North and Latin American miners, which should benefit Southern Copper through enhanced demand stability, lower geopolitical risk, and potentially premium contract pricing—bolstering long-term revenue visibility.

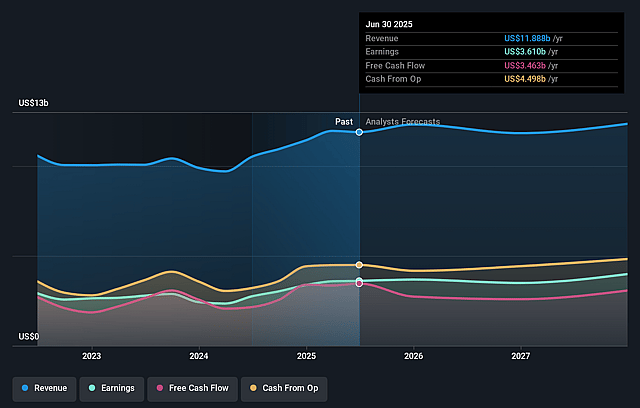

Southern Copper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Southern Copper compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Southern Copper's revenue will grow by 4.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 30.4% today to 36.0% in 3 years time.

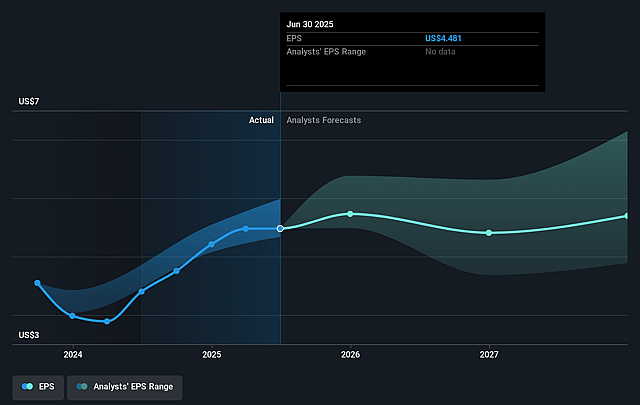

- The bullish analysts expect earnings to reach $4.9 billion (and earnings per share of $6.26) by about September 2028, up from $3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.5x on those 2028 earnings, up from 22.5x today. This future PE is greater than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Southern Copper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Southern Copper’s heavy concentration of mining assets in Peru and Mexico exposes the company to heightened sovereign, regulatory, and resource nationalism risks, as ongoing instability and incidents such as the illegal miner attacks at Los Chancas could result in production interruptions, operational shutdowns, or revenue volatility that undermine long-term earnings.

- The company’s ambitious multi-year capital commitments, with annual capital expenditures expected to grow from 1.5 billion dollars in 2025 to 2.7 billion dollars through 2028, combined with the need for ongoing mine modernization and upgrades, raise the risk that escalating sustaining capital investments and aging infrastructure will pressure net margins and reduce free cash flow.

- Southern Copper’s expansion plans, especially for major projects like Tia Maria and Los Chancas, continue to face risks from environmental and social opposition, permitting delays, and unresolved land issues, suggesting a persistent threat of stalled or cancelled projects that would constrain future revenue growth and production volumes.

- The global push for stricter environmental regulations and increased stakeholder scrutiny of ESG practices could drive higher compliance costs and capital requirements for water and tailings management, potentially limiting Southern Copper’s ability to expand and putting downward pressure on profit margins and returns on invested capital.

- Long-term industry and market trends, including the structural risk of substitution from materials such as recycled metals and aluminum, and the adoption of advanced polymers in key end-use sectors, could cap copper demand growth, leading to lower realized revenues and limiting the company’s ability to achieve future earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Southern Copper is $124.57, which represents two standard deviations above the consensus price target of $95.25. This valuation is based on what can be assumed as the expectations of Southern Copper's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $128.7, and the most bearish reporting a price target of just $66.63.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $13.7 billion, earnings will come to $4.9 billion, and it would be trading on a PE ratio of 25.5x, assuming you use a discount rate of 7.6%.

- Given the current share price of $99.91, the bullish analyst price target of $124.57 is 19.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.