- United States

- /

- Metals and Mining

- /

- NYSE:RS

Improved Earnings Required Before Reliance, Inc. (NYSE:RS) Shares Find Their Feet

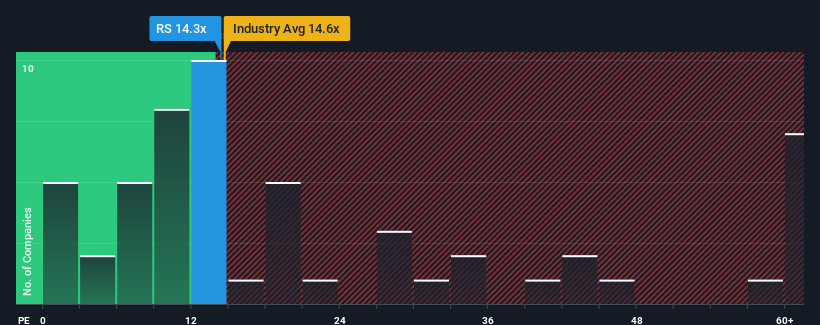

Reliance, Inc.'s (NYSE:RS) price-to-earnings (or "P/E") ratio of 14.3x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 35x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Reliance has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Reliance

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Reliance would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 60% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 5.7% per year as estimated by the seven analysts watching the company. Meanwhile, the broader market is forecast to expand by 10% per annum, which paints a poor picture.

With this information, we are not surprised that Reliance is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Reliance's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Reliance's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Reliance has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RS

Reliance

Operates as a diversified metal solutions provider and the metals service center company in the United States, Canada, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives