- United States

- /

- Construction

- /

- NYSE:ORN

3 Undervalued Small Caps With Insider Action In US

Reviewed by Simply Wall St

The United States market has remained flat over the last week but is up 29% over the past year, with earnings expected to grow by 15% annually in the coming years. In this environment, identifying small-cap stocks that are perceived as undervalued and exhibit insider activity can offer potential opportunities for investors seeking to capitalize on these dynamics.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 13.8x | 2.9x | 34.01% | ★★★★☆☆ |

| McEwen Mining | 4.7x | 2.4x | 38.86% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.7x | 34.54% | ★★★★☆☆ |

| German American Bancorp | 16.3x | 5.4x | 39.78% | ★★★☆☆☆ |

| USCB Financial Holdings | 18.9x | 5.4x | 48.98% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -242.99% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Tilray Brands | NA | 1.4x | -70.18% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -74.22% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -96.59% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

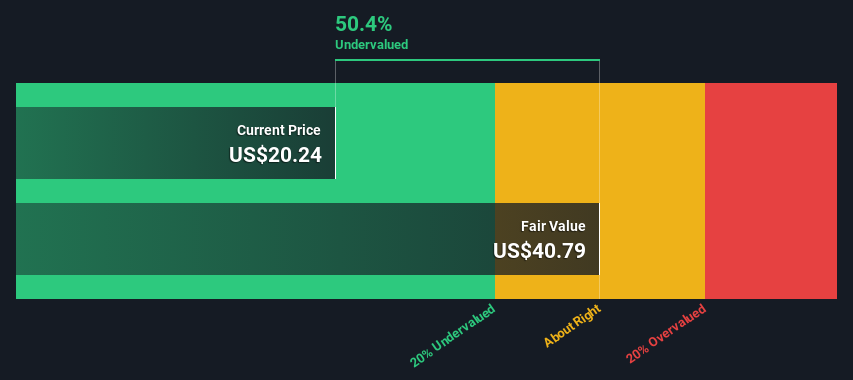

Sleep Number (NasdaqGS:SNBR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sleep Number is a company specializing in designing, manufacturing, and retailing innovative sleep solutions, including adjustable mattresses and bedding accessories, with a market capitalization of approximately $0.47 billion.

Operations: Sleep Number generates revenue primarily from its retail home furnishing segment, with a recent gross profit margin of 58.80%. The company's cost structure includes significant expenses in sales and marketing, research and development, and general administrative areas.

PE: -11.2x

Sleep Number, amidst its financial challenges, is drawing attention due to insider confidence and strategic changes. Patrick Hopf's recent purchase of 45,000 shares for US$653,700 suggests belief in the company's potential. Despite a volatile share price and reliance on external borrowing, earnings are projected to grow by over 73% annually. Recent leadership transitions and activist involvement aim to steer the company towards renewed growth. However, with declining sales reported this year, future prospects hinge on effective execution of these strategic initiatives.

- Click to explore a detailed breakdown of our findings in Sleep Number's valuation report.

Assess Sleep Number's past performance with our detailed historical performance reports.

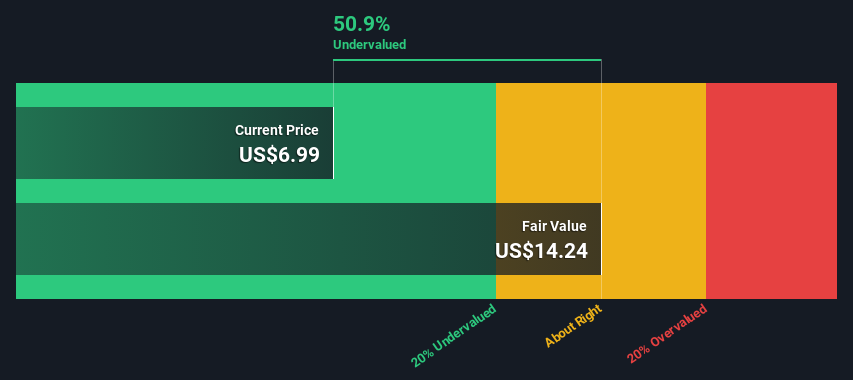

McEwen Mining (NYSE:MUX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: McEwen Mining is a company engaged in the exploration and production of precious metals with operations primarily in Canada, Mexico, and the USA, and it has a market capitalization of approximately $1.10 billion.

Operations: McEwen Mining generates revenue primarily from operations in the USA, Canada, and Mexico. Over recent periods, the company has experienced a notable improvement in net income margin, reaching 51.59% as of September 2024. Despite fluctuations in gross profit margin, which was recorded at 33.18% for the same period, operational efficiencies and reductions in costs of goods sold have contributed to this positive trend in profitability.

PE: 4.7x

McEwen Mining, a smaller player in the mining sector, has been making strides with its Grey Fox deposit, revealing promising high-grade gold results. Recent assays show 10.2 g/t Au over 11.1 meters at Whiskey Jack, suggesting potential for significant mineralization akin to Japan's Hishikari Mine. Despite a net loss of US$2.08 million in Q3 2024, insider confidence is evident through recent share purchases this year by key figures within the company. With ongoing exploration and strategic drilling set for early 2025, McEwen aims to unlock further value from its assets and potentially enhance production capabilities amidst fluctuating earnings forecasts and revenue growth expectations.

- Navigate through the intricacies of McEwen Mining with our comprehensive valuation report here.

Review our historical performance report to gain insights into McEwen Mining's's past performance.

Orion Group Holdings (NYSE:ORN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Orion Group Holdings operates in the construction industry, focusing on marine and concrete services, with a market capitalization of $0.15 billion.

Operations: Orion Group Holdings generates revenue primarily from its Marine and Concrete segments, with recent figures showing a total of $781.11 million. The company's gross profit margin has shown fluctuations, reaching 10.73% by the end of September 2024. Operating expenses have been significant, with general and administrative expenses recorded at $78.14 million in the same period.

PE: -26.3x

Orion Group Holdings, a smaller company in the U.S. market, has shown potential for growth with earnings expected to rise 124.53% annually. Despite relying on external borrowing, recent insider confidence is evident from share purchases over the past year. The company reported a turnaround with US$4.26 million net income in Q3 2024 compared to a loss last year and secured significant contracts totaling US$111.2 million starting in 2025, suggesting promising future prospects despite some financial challenges.

- Unlock comprehensive insights into our analysis of Orion Group Holdings stock in this valuation report.

Understand Orion Group Holdings' track record by examining our Past report.

Seize The Opportunity

- Navigate through the entire inventory of 50 Undervalued US Small Caps With Insider Buying here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Orion Group Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORN

Orion Group Holdings

Operates as a specialty construction company in the infrastructure, industrial, and building sectors in the United States, Alaska, Hawaii, Canada, and the Caribbean Basin.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives