- United States

- /

- Metals and Mining

- /

- NYSE:MP

Has MP Materials Rally Gone Too Far After 266% Surge in 2025?

Reviewed by Bailey Pemberton

- If you have been wondering whether MP Materials is still a smart way to play the rare earths theme after its huge run, this breakdown will help you decide if the current price still offers value or if most of the upside is already priced in.

- The stock has surged an eye catching 266.1% year to date and 206.2% over the last 12 months, even after a modest pullback of around 3% over the past week and month, which naturally raises questions about how much future upside is left versus downside risk.

- That move has been fueled by growing investor attention on US based rare earth supply security and MP Materials strategic role as a domestic producer at a time when geopolitical tensions and clean energy policies are reshaping commodity demand. At the same time, shifting sentiment across the broader materials and EV supply chain has added extra volatility, making it even more important to separate story from valuation reality.

- Despite the strong share price performance, MP Materials only scores 1 out of 6 on our valuation checks, suggesting that by most traditional measures it does not screen as obviously undervalued yet. Next we will walk through the main valuation approaches behind that score and then circle back to an even better way to judge what MP might really be worth.

MP Materials scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MP Materials Discounted Cash Flow (DCF) Analysis

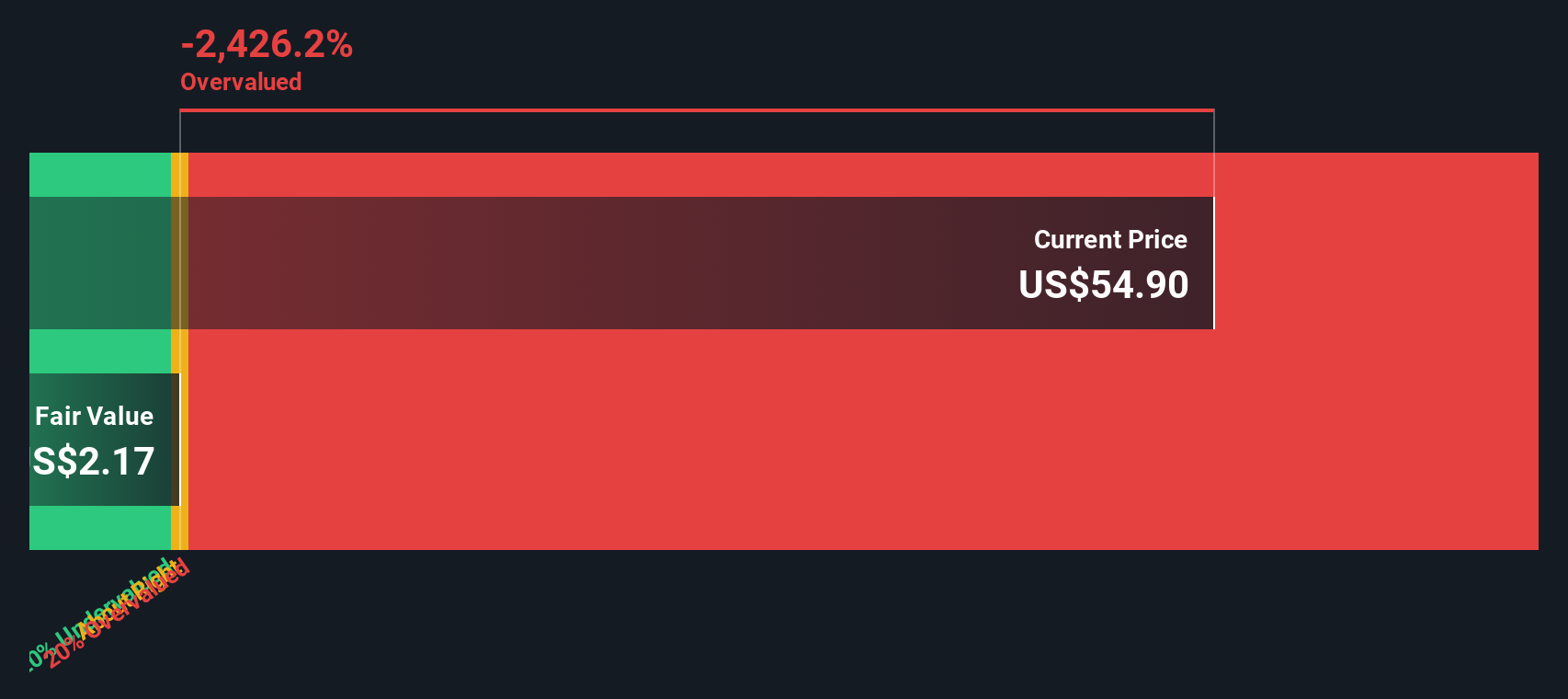

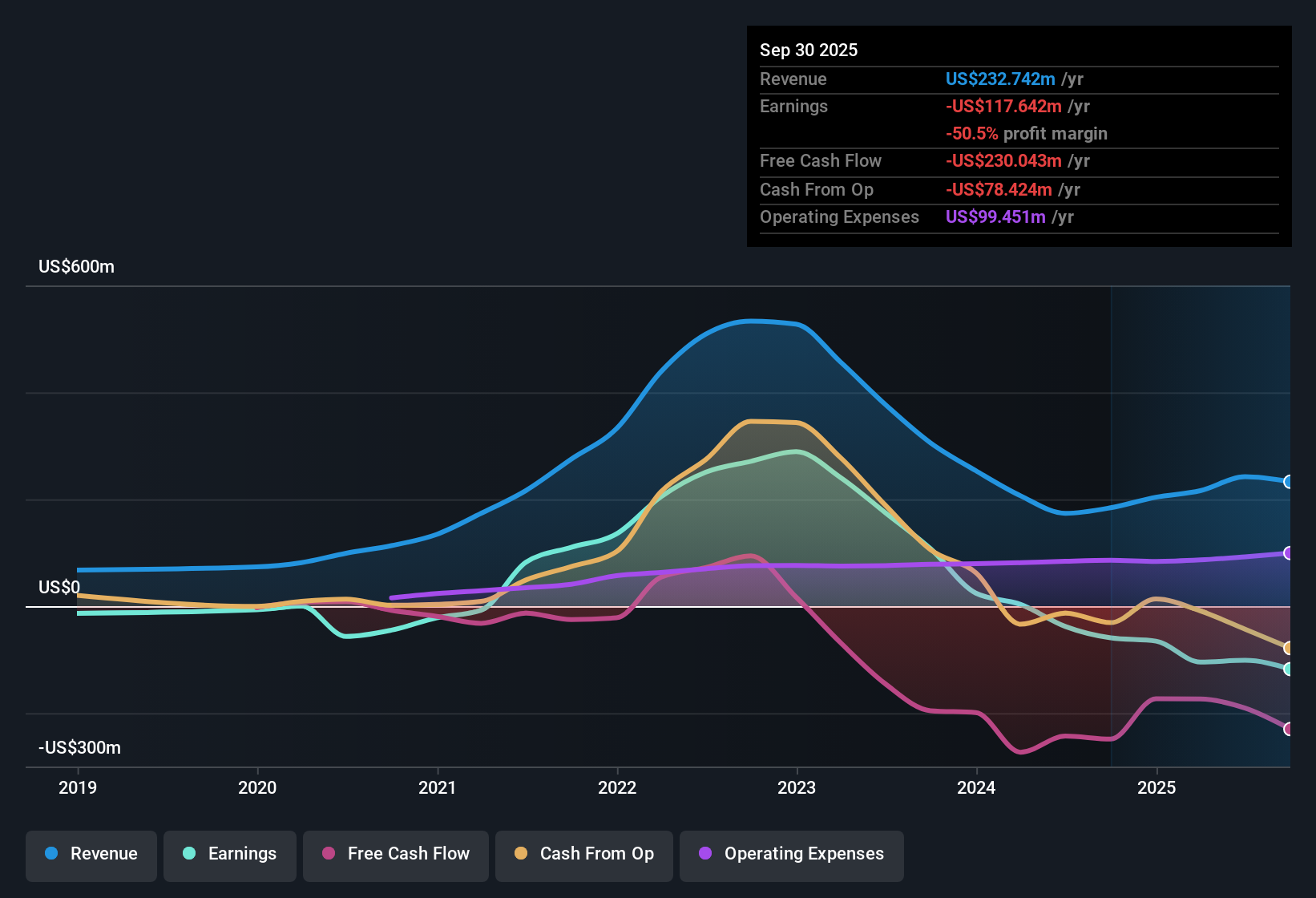

The Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today in $ terms. For MP Materials, the 2 stage Free Cash Flow to Equity model starts from a last twelve months free cash flow of roughly negative $294.5 Million, reflecting heavy investment and early stage economics rather than mature profitability.

Analysts see free cash flow improving to about $22.7 Million by 2027, with further years extrapolated to reach around $243.5 Million in 2035. These ten year projections, combined with an assumed cost of equity, are brought back to a present value, giving an estimated intrinsic value of about $16.16 per share.

Compared with the current share price, this implies MP Materials is roughly 271.4% overvalued on a DCF basis. This suggests that investors are paying far ahead of the modeled cash flow recovery and growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MP Materials may be overvalued by 271.4%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: MP Materials Price vs Sales

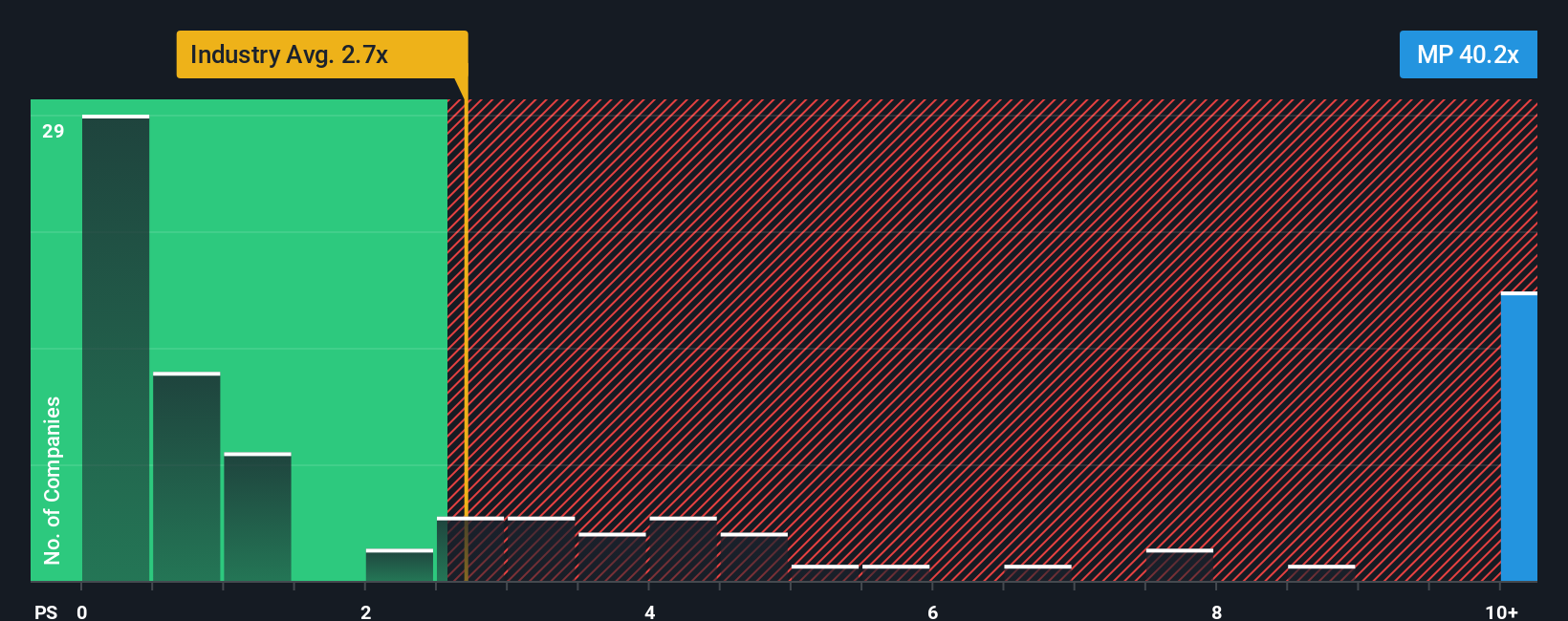

For companies where earnings are still volatile or negative, the price to sales ratio is often a more useful yardstick than price to earnings, because it focuses on the value investors place on each dollar of current revenue rather than uncertain profits.

In general, higher growth and lower risk can justify a richer multiple. Slower growth or greater uncertainty should pull that multiple closer to or below the market and industry norms. MP Materials currently trades on a lofty 45.70x price to sales ratio, far above the Metals and Mining industry average of about 2.01x and a peer average of roughly 0.79x, which already signals a lot of optimism is priced in.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what multiple a stock should trade on after factoring in its growth outlook, profitability, industry, market cap and risk profile. For MP, that Fair Ratio is a much lower 2.63x, which suggests that even after allowing for its strategic position and growth potential, the current 45.70x sales multiple looks stretched rather than justified.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MP Materials Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect the story you believe about MP Materials to specific assumptions for its future revenue, earnings and margins, and then convert that into a Fair Value you can compare to today’s share price to decide whether to buy, hold or sell.

On Simply Wall St’s Community page, Narratives are easy to build and explore, letting millions of investors spell out why they think MP’s Saudi refinery venture, government backed contracts and magnet capacity expansion will drive substantial upside, or alternatively, why execution, customer concentration and regulatory risks could cap its potential and justify a much lower value.

Each Narrative links a clearly described thesis to a dynamic financial forecast. When new earnings, guidance or news is released, the Fair Value updates automatically. This means that a bullish MP view, with higher long term growth and margins and a Fair Value around 79.29 dollars, can sit right alongside a more cautious scenario with lower growth, thinner margins and a meaningfully lower Fair Value. This gives you a transparent range of perspectives to benchmark your own view against.

Do you think there's more to the story for MP Materials? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion