- United States

- /

- Chemicals

- /

- NYSE:LYB

Is Recycling-Led Strategy Amid Analyst Downgrade Altering The Investment Case For LyondellBasell (LYB)?

Reviewed by Sasha Jovanovic

- LyondellBasell Industries recently presented at the Energy LIVE Conference 2025 in Houston, where Vice President Mariane Maximous outlined advances in Americas feedstock, mechanical recycling, and circular and low-carbon solutions.

- At the same time, analysts flagged higher input costs, weak demand, and rising competition, highlighting a tension between LYB’s recycling-led transition plans and current operating pressures.

- We’ll now examine how the analyst downgrade amid cost and demand headwinds may reshape LyondellBasell’s longer-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

LyondellBasell Industries Investment Narrative Recap

To own LyondellBasell, you need to believe its push into circular and low carbon solutions can coexist with a tough petrochemical cycle. The Fermium downgrade and weak Q3 results sharpen the near term focus on input costs and demand as the key catalyst and the main risk, but they do not fundamentally alter the longer term recycling-led pitch laid out at Energy LIVE.

The most relevant recent development here is Fermium Research’s move to cut LYB to Hold with a US$50 target after a 10% Q3 revenue decline and EBITDA loss. That call sits against management’s message of strong cash conversion, ongoing dividends at US$1.37 per quarter and progress toward 2025 to 2026 cash flow goals, framing a clear tension between cyclical pressure and balance sheet support.

Yet investors should be aware that prolonged global overcapacity in key petrochemical chains could still...

Read the full narrative on LyondellBasell Industries (it's free!)

LyondellBasell Industries' narrative projects $29.2 billion revenue and $2.2 billion earnings by 2028. This implies a 9.0% yearly revenue decline but an earnings increase of about $2.1 billion from $150.0 million today.

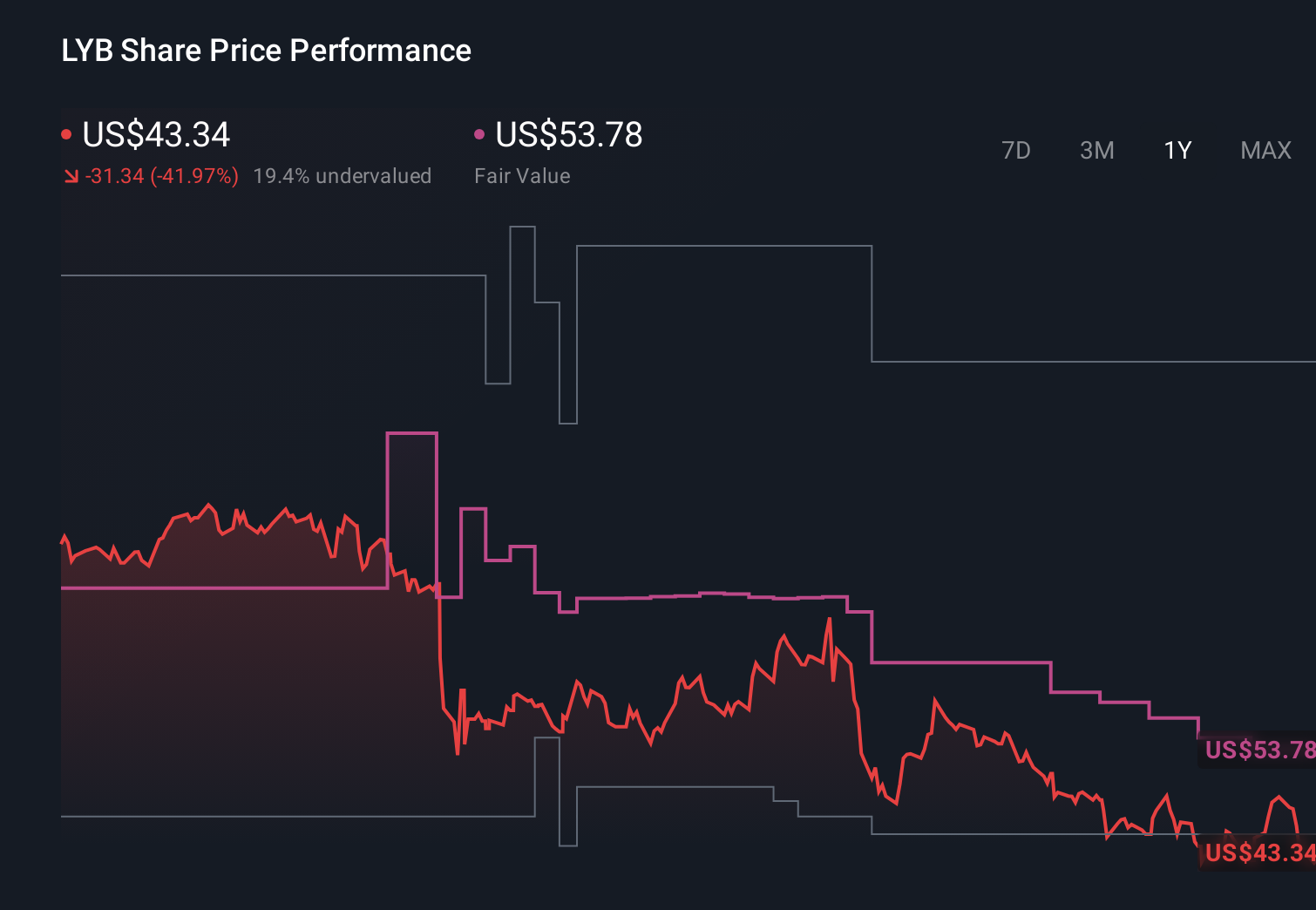

Uncover how LyondellBasell Industries' forecasts yield a $53.78 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Twelve Simply Wall St Community valuations for LyondellBasell span roughly US$38 to US$114 per share, highlighting wide disagreement on upside. Set against that, the risk of a prolonged petrochemical downturn and global overcapacity could keep pressure on margins and make it important to compare several of these viewpoints before forming an opinion.

Explore 12 other fair value estimates on LyondellBasell Industries - why the stock might be worth 14% less than the current price!

Build Your Own LyondellBasell Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LyondellBasell Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free LyondellBasell Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LyondellBasell Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion