- United States

- /

- Chemicals

- /

- NYSE:IFF

International Flavors & Fragrances (NYSE:IFF) Increases Tender Offer Limits for Debt Purchase

Reviewed by Simply Wall St

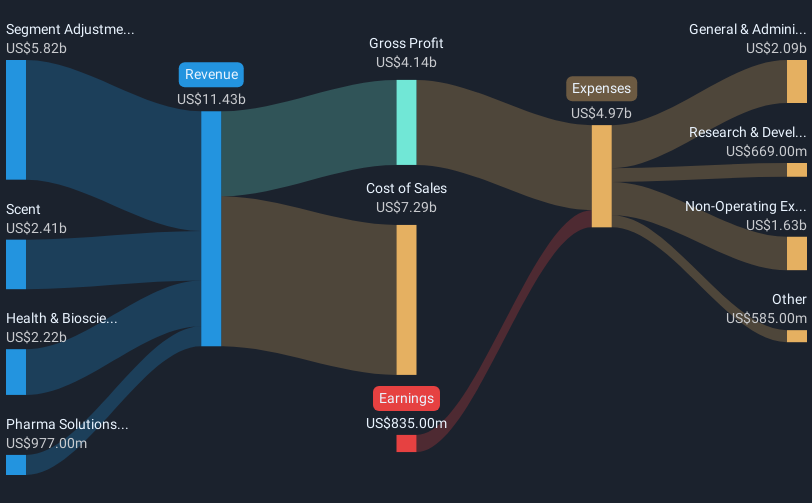

International Flavors & Fragrances (NYSE:IFF) recently announced revised tender offer caps for its debt financing, potentially impacting investor sentiment. The company's decision to use proceeds from its Pharma Solutions divestiture to fund these purchases could indicate a strategic focus on debt management. Over the past month, IFF’s stock price increased by approximately 5.02%, aligning with the broader market trends, where the S&P 500 and other major indexes experienced gains. Despite reporting a first-quarter net loss, the company's active debt management might have supported its share price resilience amidst generally positive market movements.

International Flavors & Fragrances has 1 possible red flag we think you should know about.

International Flavors & Fragrances' recent move to revise tender offer caps for its debt financing, directly connected to the utilization of proceeds from its Pharma Solutions divestiture, can be viewed as a calculated step toward streamlining financial obligations. This intention might potentially foster investor confidence, reflecting operational discipline that aligns with the company’s broader objectives of focusing on debt management and reinvestment in high-growth areas. Over the past year, IFF's total shareholder returns were negative, declining 20.79%. This occurred amidst underperformance relative to both the broader U.S. market, which yielded a 10.6% return, and the U.S. Chemicals industry, which experienced a 9.1% decline over the same period.

The news regarding IFF’s debt management strategy may influence projected revenue and earnings growth by improving financial flexibility and enabling greater focus on its end-to-end operations. Analysts forecast IFF's revenue to decrease by 0.7% annually over the next three years, with profit margins expected to improve. Currently trading at a discount to the analyst consensus price target, the company's shares present a 14.9% difference from the target of US$93.11. Such positioning could indicate market anticipation of stronger performance from IFF, contingent on their successful execution of cost control measures and reinvestment strategies as noted in recent company actions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IFF

International Flavors & Fragrances

Manufactures and markets food, beverage, health and biosciences, scent, pharma solutions, and complementary adjacent products in the United States, Europe, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives