- United States

- /

- Chemicals

- /

- NYSE:IFF

International Flavors & Fragrances (IFF): Exploring Value Opportunities After Recent Share Price Drop

Reviewed by Kshitija Bhandaru

International Flavors & Fragrances (IFF) stock has been under pressure over the past few months, prompting investors to re-examine the company’s outlook as shares decline. The recent drop invites questions about where value might emerge.

See our latest analysis for International Flavors & Fragrances.

It has been a tough stretch for International Flavors & Fragrances shareholders, as the stock’s 1-year total shareholder return sits at -40.72%. While the latest share price of $59.55 reflects cautious sentiment, the downward momentum has been building all year. Shares have been pulled sharply off their highs, and longer-term performance also remains under pressure.

If you’re open to broadening your search beyond the usual names, this could be your moment to discover fast growing stocks with high insider ownership.

With shares trading well below analyst price targets and the company showing signs of improving profitability, the question is whether International Flavors & Fragrances is now a value play or if the market has already priced in any future growth.

Most Popular Narrative: 28.7% Undervalued

With International Flavors & Fragrances closing at $59.55, the most widely followed narrative suggests the stock trades well below its $83.49 fair value. This sets the stage for a potentially compelling recovery story.

Recent divestitures of commodity businesses (e.g., Pharma Solutions, Soy Crush, Concentrates, Lecithin) and the ongoing strategic evaluation of the Food Ingredients segment are increasing IFF's focus on differentiated, higher-margin, innovation-driven products. This supports future margin expansion and higher earnings quality.

What is fueling this fresh valuation? The narrative centers on a new product mix, aggressive margin goals, and a bold timeline for profit transformation. Which numbers actually underpin that $83+ target, and how big are the bets on future growth? Uncover the full story behind these headline predictions.

Result: Fair Value of $83.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in key markets and pressure from low-cost competitors could limit recovery and keep International Flavors & Fragrances’ valuation under pressure.

Find out about the key risks to this International Flavors & Fragrances narrative.

Another View: Multiples Tell a Different Story

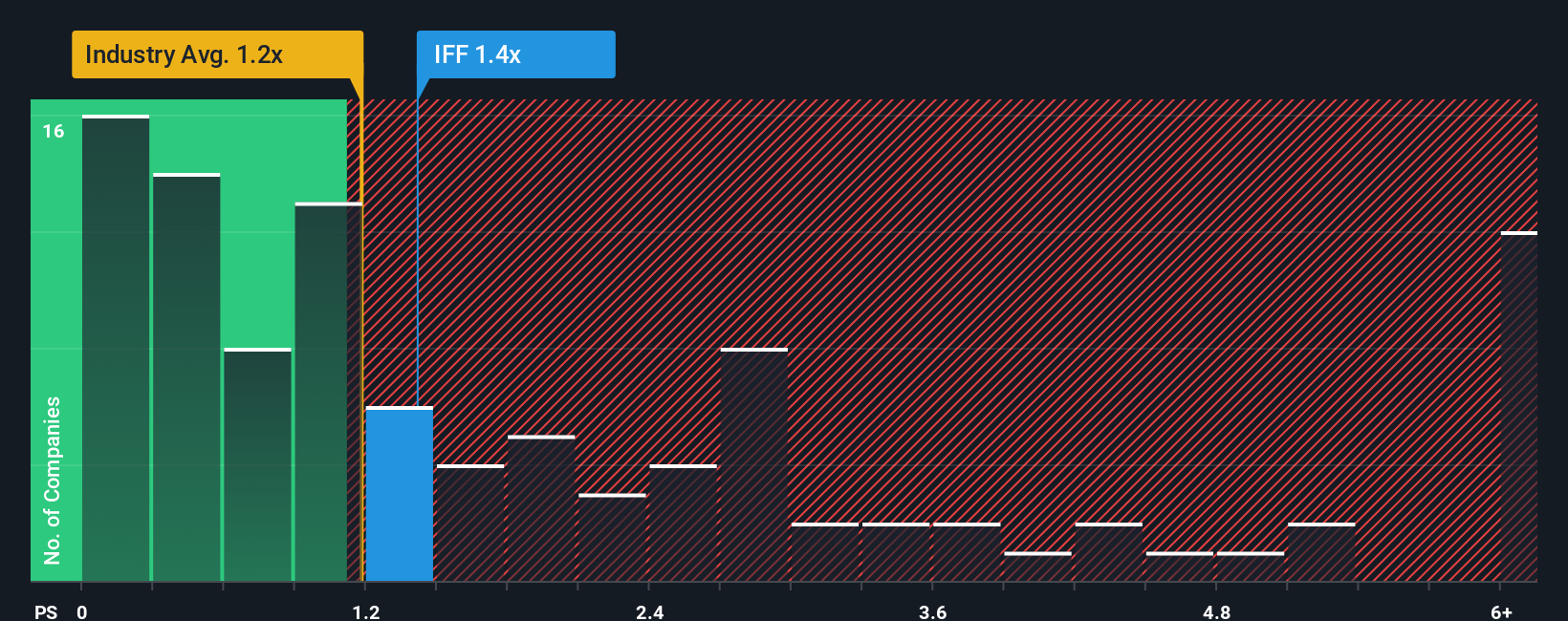

While the fair value estimate highlights a deep discount, looking at valuation multiples paints a more nuanced picture. International Flavors & Fragrances trades at a price-to-sales ratio of 1.4x, which is higher than the US Chemicals industry average of 1.2x but lower than the peer group average of 2x. Compared to its fair ratio of 1.6x, the stock appears reasonably valued, yet sits above the broader sector. Does this balance signal a hidden opportunity, or does it simply reflect industry risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Flavors & Fragrances Narrative

If this angle doesn’t align with your own perspective or you’d rather start with a fresh analysis, you can shape your own outlook in just a few minutes, Do it your way.

A great starting point for your International Flavors & Fragrances research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for the usual picks when you can target companies with real upside? Broaden your approach and uncover promising trends before the crowd catches on.

- Start earning from reliable payers by securing potential income with these 19 dividend stocks with yields > 3% offering yields over 3%.

- Zero in on tomorrow’s breakthroughs by tapping into these 24 AI penny stocks that are advancing new frontiers in artificial intelligence.

- Capitalize on untapped potential with these 899 undervalued stocks based on cash flows that the market may have overlooked. This could give you a head start on value opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IFF

International Flavors & Fragrances

Manufactures and markets food, beverage, health and biosciences, scent, pharma solutions, and complementary adjacent products in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives