- United States

- /

- Metals and Mining

- /

- NYSE:HL

Hecla Mining (HL): Revisiting Valuation After S&P MidCap 400 Addition and High-Grade Nevada Gold Discovery

Reviewed by Simply Wall St

Hecla Mining (HL) has jumped onto traders’ screens after two catalysts hit at once: upcoming inclusion in the S&P MidCap 400 Index and a new high grade gold discovery at its Nevada Midas property.

See our latest analysis for Hecla Mining.

Those twin catalysts land on top of an already powerful run, with Hecla’s share price up 21.12 percent over 30 days and posting a standout 257.60 percent year to date share price return. Longer term total shareholder returns above 200 percent suggest momentum is still very much building rather than fading.

If Hecla’s surge has you rethinking your metals exposure, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

Yet with shares now trading above Wall Street’s target and intrinsic value screens still flagging a discount, is Hecla an overheated momentum play or a rare chance to buy future growth before the market fully prices it in?

Most Popular Narrative: 29.3% Overvalued

With Hecla Mining last closing at $18.81 versus a most popular narrative fair value of $14.55, the story leans toward optimism that the market is already pricing in substantial upside.

Analysts have nudged their price target on Hecla Mining slightly higher, from $14.40 to $14.55, citing modestly increased long term return expectations reflected in a higher discount rate and slightly richer forward valuation multiples.

Curious what justifies paying up for a miner whose long term model hinges on ambitious profitability, rich future multiples, and aggressive growth assumptions baked into that target? The full narrative lays out the bold forecasts.

Result: Fair Value of $14.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steadily rising capital needs at key mines and potential permitting delays could strain free cash flow and challenge the lofty profitability assumptions behind today’s valuation.

Find out about the key risks to this Hecla Mining narrative.

Another Angle on Value

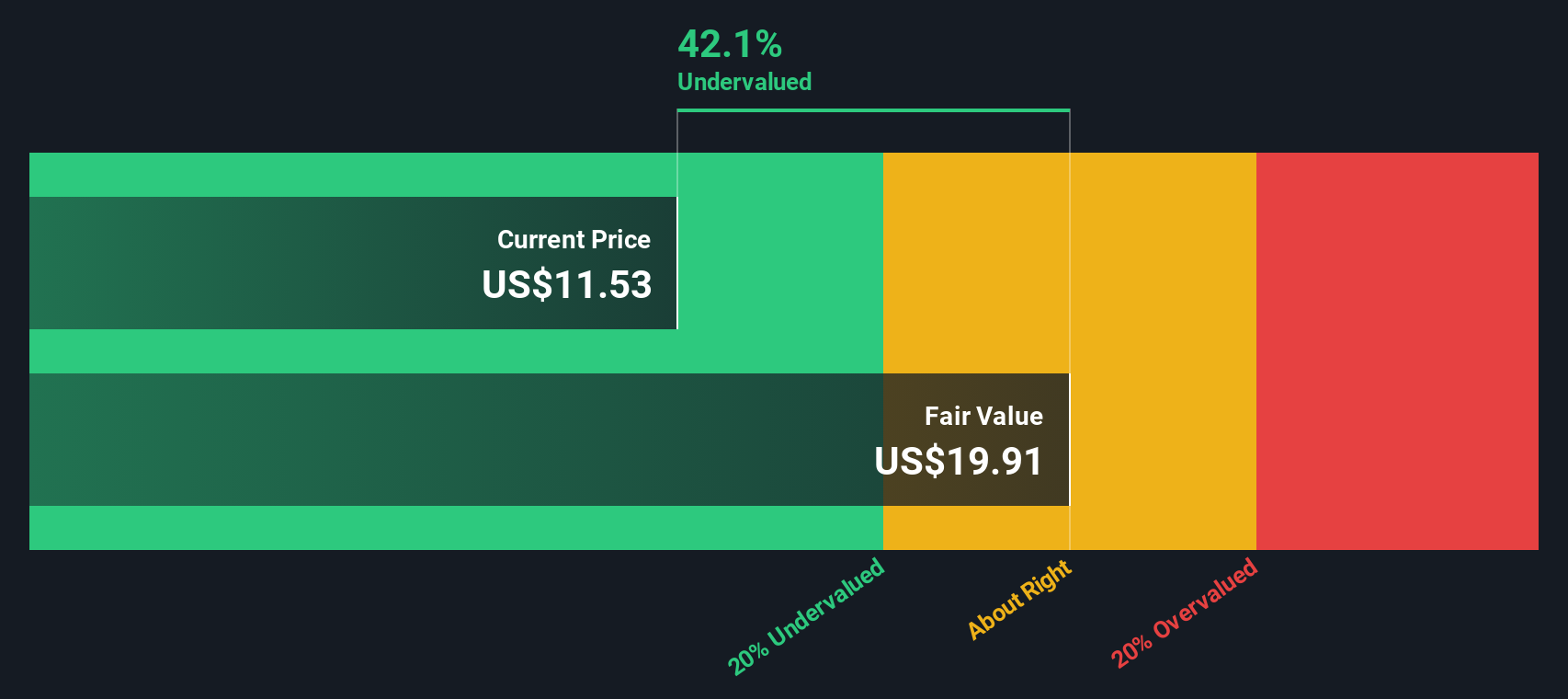

Our DCF model points in the opposite direction to the narrative based fair value, suggesting Hecla could be trading at a steep discount. With the share price around $18.81 versus a DCF fair value estimate near $41.38, are short term fears masking a longer term opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hecla Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hecla Mining Narrative

If you see Hecla differently or want to stress test the assumptions yourself, you can quickly build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Hecla Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next big idea?

Before momentum shifts again, consider planning your next moves with fresh, data backed stock ideas from the Simply Wall Street Screener to help you stay one step ahead.

- Explore potential rebound opportunities by targeting companies trading below their estimated cash flow value with these 907 undervalued stocks based on cash flows.

- Focus on breakthroughs in automation, data, and software by reviewing innovators screened through these 26 AI penny stocks.

- Support your income strategy by finding companies that pay dividends using these 13 dividend stocks with yields > 3% to target yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hecla Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HL

Hecla Mining

Provides precious and base metals in the United States, Canada, Japan, Korea, and China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)