- United States

- /

- Metals and Mining

- /

- NYSE:HCC

We Ran A Stock Scan For Earnings Growth And Warrior Met Coal (NYSE:HCC) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Warrior Met Coal (NYSE:HCC), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Warrior Met Coal

How Quickly Is Warrior Met Coal Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, Warrior Met Coal has achieved impressive annual EPS growth of 46%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that, last year, Warrior Met Coal's revenue from operations was lower than its revenue, so that could distort our analysis of its margins. The music to the ears of Warrior Met Coal shareholders is that EBIT margins have grown from 36% to 46% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

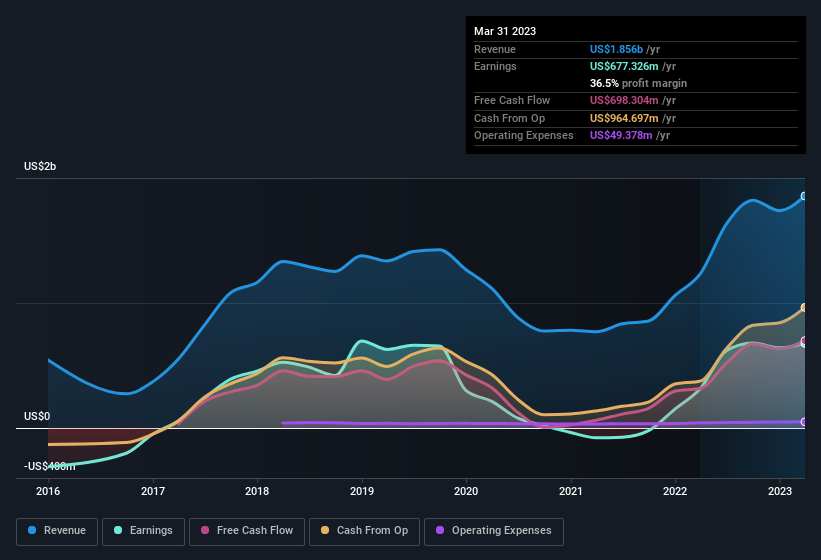

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Warrior Met Coal?

Are Warrior Met Coal Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in Warrior Met Coal in the previous 12 months. With that in mind, it's heartening that Lisa Schnorr, the company insider of the company, paid US$48k for shares at around US$32.01 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Warrior Met Coal.

On top of the insider buying, it's good to see that Warrior Met Coal insiders have a valuable investment in the business. Indeed, they hold US$27m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 1.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Warrior Met Coal Deserve A Spot On Your Watchlist?

Warrior Met Coal's earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Warrior Met Coal belongs near the top of your watchlist. You still need to take note of risks, for example - Warrior Met Coal has 2 warning signs (and 1 which is concerning) we think you should know about.

Keen growth investors love to see insider buying. Thankfully, Warrior Met Coal isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives