- United States

- /

- Metals and Mining

- /

- NYSE:HCC

The Bull Case For Warrior Met Coal (HCC) Could Change Following Broad-Based Surge In Steelmaking Coal Demand - Learn Why

Reviewed by Sasha Jovanovic

- In recent days, Warrior Met Coal has benefited from stronger global demand for steelmaking coal, as infrastructure and manufacturing activity picked up across Europe, South America, and Asia.

- This demand upswing highlights how the company’s focus on metallurgical coal and operational efficiency could be increasingly important for steel producers seeking reliable supply.

- Against this backdrop of rising metallurgical coal demand, we’ll explore how this trend may influence Warrior Met Coal’s cost-led investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Warrior Met Coal Investment Narrative Recap

To own Warrior Met Coal, you need to believe metallurgical coal will remain essential for global steel production and that the company can convert cyclical price strength into solid cash generation despite recent margin pressure. The latest demand-driven share price jump may support the near term catalyst of higher realized pricing and better use of its export footprint, but it does little to resolve the key risk of earnings being highly exposed to future swings in global steel demand and coal prices.

Against this backdrop, Warrior Met Coal’s November 5, 2025 update, which raised full year 2025 coal sales guidance to 9.2–9.6 million short tons and production to 9.4–9.8 million short tons, stands out. Stronger demand conditions help underpin that higher volume outlook, but they also increase the stakes if steel or coal markets soften again and the company has already scaled up production and Blue Creek spending.

However, investors should also weigh how quickly stronger demand can reverse and what that would mean for Warrior Met Coal’s reliance on...

Read the full narrative on Warrior Met Coal (it's free!)

Warrior Met Coal's narrative projects $2.0 billion revenue and $636.5 million earnings by 2028.

Uncover how Warrior Met Coal's forecasts yield a $80.83 fair value, in line with its current price.

Exploring Other Perspectives

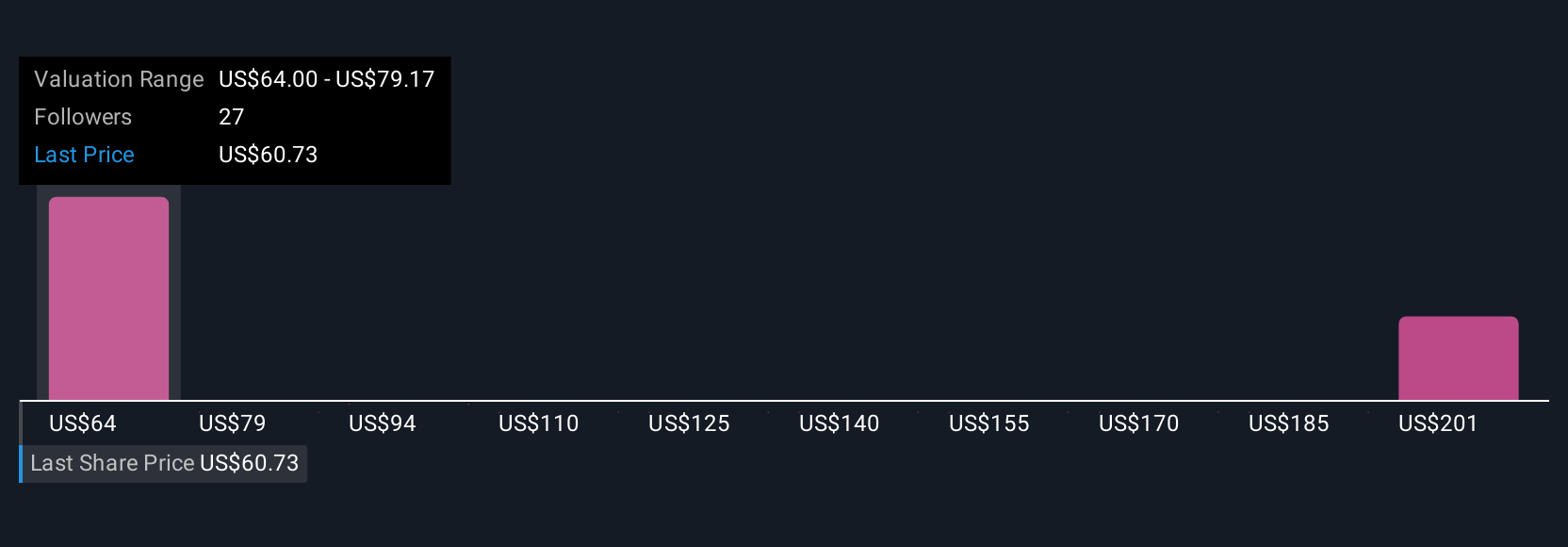

Four members of the Simply Wall St Community now place Warrior Met Coal’s fair value between US$75 and about US$152, underscoring how far opinions can stretch on the same stock. You can weigh those views against the central risk that global steel demand and metallurgical coal prices remain volatile, with meaningful implications for the company’s margins and capital intensive growth plans.

Explore 4 other fair value estimates on Warrior Met Coal - why the stock might be worth as much as 86% more than the current price!

Build Your Own Warrior Met Coal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warrior Met Coal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warrior Met Coal's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026