- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Freeport-McMoRan (FCX): Reassessing Valuation After Grasberg Safety Lawsuits and Class Action Deadlines

Reviewed by Simply Wall St

Why legal headlines around Grasberg are suddenly front and center

Freeport-McMoRan (FCX) is back in the spotlight as a series of class action lawsuits zeroes in on alleged safety misrepresentations at its Grasberg Block Cave mine and the stock reaction that followed.

See our latest analysis for Freeport-McMoRan.

Despite the legal overhang, investors have been leaning back into the stock. A 17.1% 1 month share price return has helped push year to date share price gains higher, while multi year total shareholder returns remain firmly positive. This signals that long term momentum is still intact.

If this kind of risk reward trade off has you thinking about where else capital could work harder, it may be worth scanning fast growing stocks with high insider ownership for other compelling ideas.

With copper prices surging and analysts turning more bullish even as lawsuits mount, investors now face a tougher call: is Freeport McMoRan still trading below its true worth, or has the market already priced in future growth?

Most Popular Narrative: 0.8% Undervalued

With Freeport McMoRan closing at $48.11 against a narrative fair value of $48.52, the story hinges on how future copper economics unfold.

Brownfield expansions in North and South America (e.g., Bagdad, El Abra, Lone Star) leverage existing infrastructure and Freeport's experience to deliver low risk, high return volume growth. These initiatives are positioned to bring 2.5 billion pounds of new copper supply online in structurally tight markets, directly impacting future revenues and earnings growth.

Want to see what justifies paying up for a mature copper miner? The narrative leans on accelerating earnings, wider margins, and a future multiple typically associated with higher growth sectors. Curious which specific growth and profitability assumptions are doing the heavy lifting in that fair value math? Click through to unpack the full playbook behind this price.

Result: Fair Value of $48.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering Grasberg operational uncertainty and potential shifts in Indonesian policy could quickly erode margin gains that are implied in today’s upbeat valuation narrative.

Find out about the key risks to this Freeport-McMoRan narrative.

Another Lens on Value: Rich Multiples, Deeper Discount

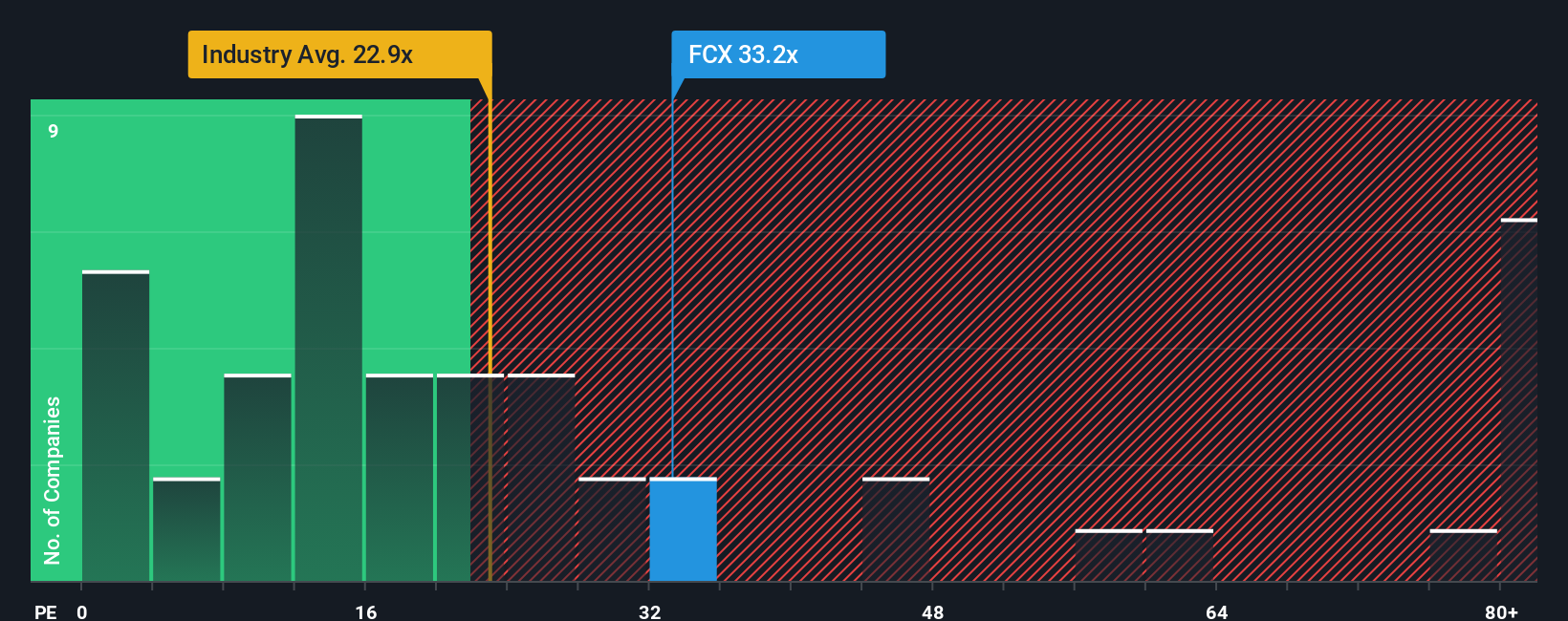

While the narrative fair value suggests only a small 0.8% upside, today’s 33.5x earnings multiple looks stretched versus peers at 22.7x and a fair ratio of 28x. That premium hints at downside risk if sentiment cools, even though our broader work still flags FCX as deeply undervalued. Which signal would you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freeport-McMoRan Narrative

If you want to stress test these assumptions and back your own view with the numbers, you can build a custom narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Freeport-McMoRan.

Ready for your next investing move?

Before you move on, consider scanning a few hand picked stock ideas on Simply Wall Street that could sharpen your portfolio’s risk reward profile.

- Capture potential mispricing by running through these 904 undervalued stocks based on cash flows, which may offer stronger upside than today’s headline names.

- Harness powerful secular themes with these 25 AI penny stocks, positioned to benefit from accelerating demand for intelligent automation.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3%, which can help support returns even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026