- United States

- /

- Metals and Mining

- /

- NYSE:FCX

A Look at Freeport-McMoRan's (FCX) Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

Freeport-McMoRan (FCX) shares have shown some movement over the past month, gaining roughly 16%. Investors keeping an eye on the mining sector may be curious about what is behind this recent upswing in the stock price.

See our latest analysis for Freeport-McMoRan.

Freeport-McMoRan’s 16% share price gain this past month suggests that optimism may be returning after a challenging spell, though its total shareholder return over the past year is still down more than 10%. In the bigger picture, momentum has picked up recently; however, the stock's longer-term gains are even more notable, with a robust 36% three-year and an impressive 142% five-year total shareholder return.

If Freeport-McMoRan’s recent surge has you looking for more opportunity, this could be a good time to broaden your search and discover fast growing stocks with high insider ownership.

But after such a swift rally, does Freeport-McMoRan still offer undervalued potential for investors, or has the market already factored in the company’s future growth prospects, leaving little room for upside?

Most Popular Narrative: 11.5% Undervalued

Freeport-McMoRan's widely followed narrative places its fair value at $46.77, which suggests notable upside from the current price of $41.37. This value is shaped by a mixture of upgraded profit margin outlooks and higher revenue growth forecasts following recent operational and industry shifts.

Freeport's new Indonesian smelter, starting up ahead of schedule and expected to reach full capacity by year-end, will make the company a fully integrated global copper producer. This is expected to lower operating costs, capture more downstream value, and reduce exposure to export duties. These changes may directly support higher future margins and cash flows.

Want to know the growth blueprint behind this high valuation? The bull case rides on surging profitability, premium pricing, and a blueprint for margin expansion that is usually reserved for sector leaders. Wondering which mix of revenue surprises and margin ambitions tip the scales here? Dive into the full narrative to see what is fueling this price target.

Result: Fair Value of $46.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as further operational setbacks in Indonesia or regulatory pressures could quickly shift sentiment and challenge the optimistic growth outlook.

Find out about the key risks to this Freeport-McMoRan narrative.

Another View: What Does the Market Multiple Indicate?

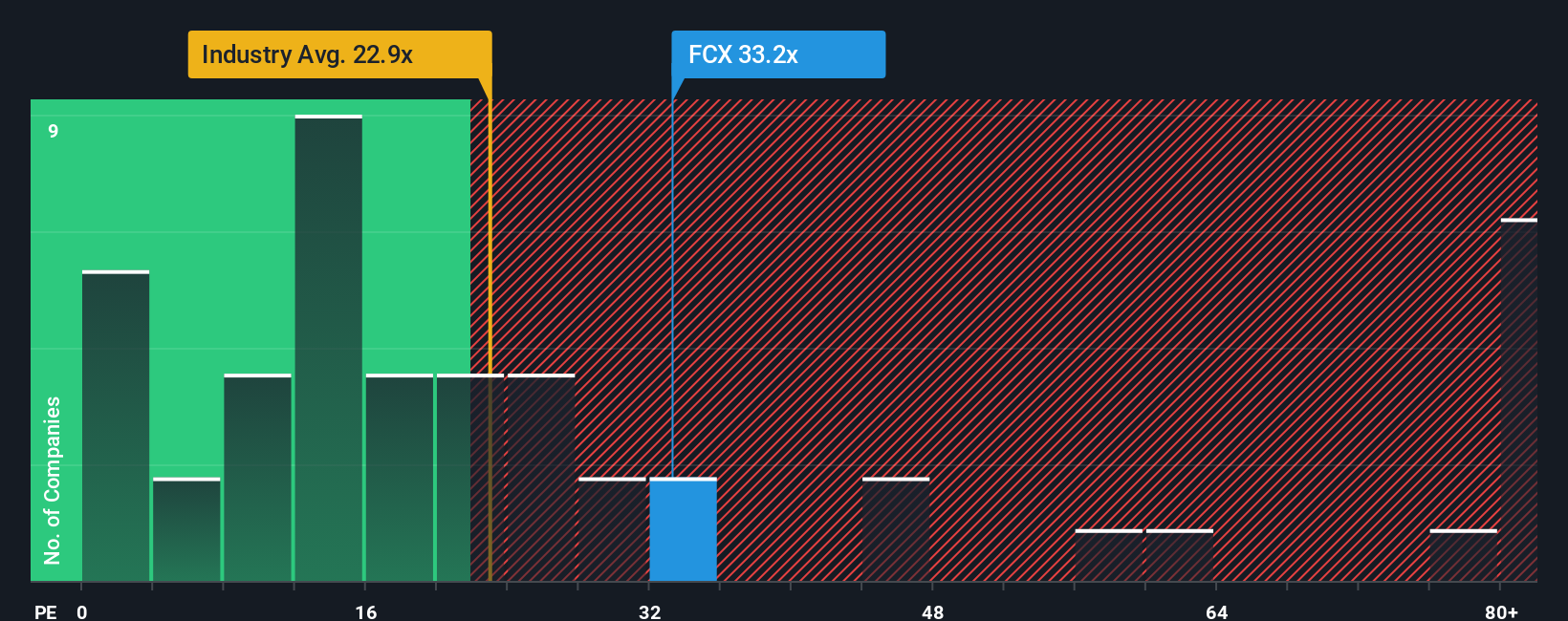

Looking from a different angle, Freeport-McMoRan’s current price-to-earnings ratio is 28.8x. This is notably higher than the US Metals and Mining industry average of 25.2x and its closest peers at 22.2x. However, it remains below the company’s fair ratio of 36.6x, suggesting investors are paying a premium versus the sector but not to an extreme level. Does this premium price reflect genuine long-term upside or just market optimism chasing recent gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freeport-McMoRan Narrative

If you see things differently or want to put your own findings to the test, building your own story from the data takes just minutes. Do it your way.

A great starting point for your Freeport-McMoRan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock your full potential as an investor by exploring handpicked opportunities designed to help you get ahead. Act now so you never miss the next breakthrough.

- Tap into potential market leaders by checking out these 27 AI penny stocks poised to shape the future with artificial intelligence advancements.

- Strengthen your portfolio with passive income by assessing these 17 dividend stocks with yields > 3% offering attractive yield and robust financials.

- Get ahead of the curve with early access to these 28 quantum computing stocks pioneering innovations in computing and technology transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)