- United States

- /

- Chemicals

- /

- NYSE:ECL

Ecolab (ECL) Valuation Check After 12% Dividend Hike and 34th Straight Annual Increase

Reviewed by Simply Wall St

Ecolab (ECL) just extended its long dividend growth streak by approving a 12% increase to its quarterly payout, and that kind of steady cash return tends to catch long term investors’ attention.

See our latest analysis for Ecolab.

The latest move comes with the share price around $263.6 and supported by a solid year to date, with a 14.15% share price return and a three year total shareholder return of 92.24%, suggesting ongoing bullish momentum rather than signs of fatigue.

If Ecolab’s combination of growth and dividends has your attention, this could be a good moment to explore healthcare stocks as potential complementary ideas in your portfolio.

Yet with Ecolab trading just below analyst targets after a powerful multi year run, investors must weigh its dependable dividend and earnings growth against a rich valuation. Is there still upside left, or is future expansion already priced in?

Most Popular Narrative Narrative: 9.6% Undervalued

With Ecolab last closing at $263.60 against a narrative fair value of about $291.75, the current setup leans toward upside if assumptions hold.

The analysts have a consensus price target of $286.1 for Ecolab based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $325.0, and the most bearish reporting a price target of $243.0.

Curious how mid single digit growth, rising margins, and a rich future earnings multiple still point to upside from here? Unpack the full narrative to see why.

Result: Fair Value of $291.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer industrial demand and persistent macro uncertainty around tariffs and specialty chemicals volumes could pressure margins and challenge the upbeat earnings trajectory.

Find out about the key risks to this Ecolab narrative.

Another Way To Look At Value

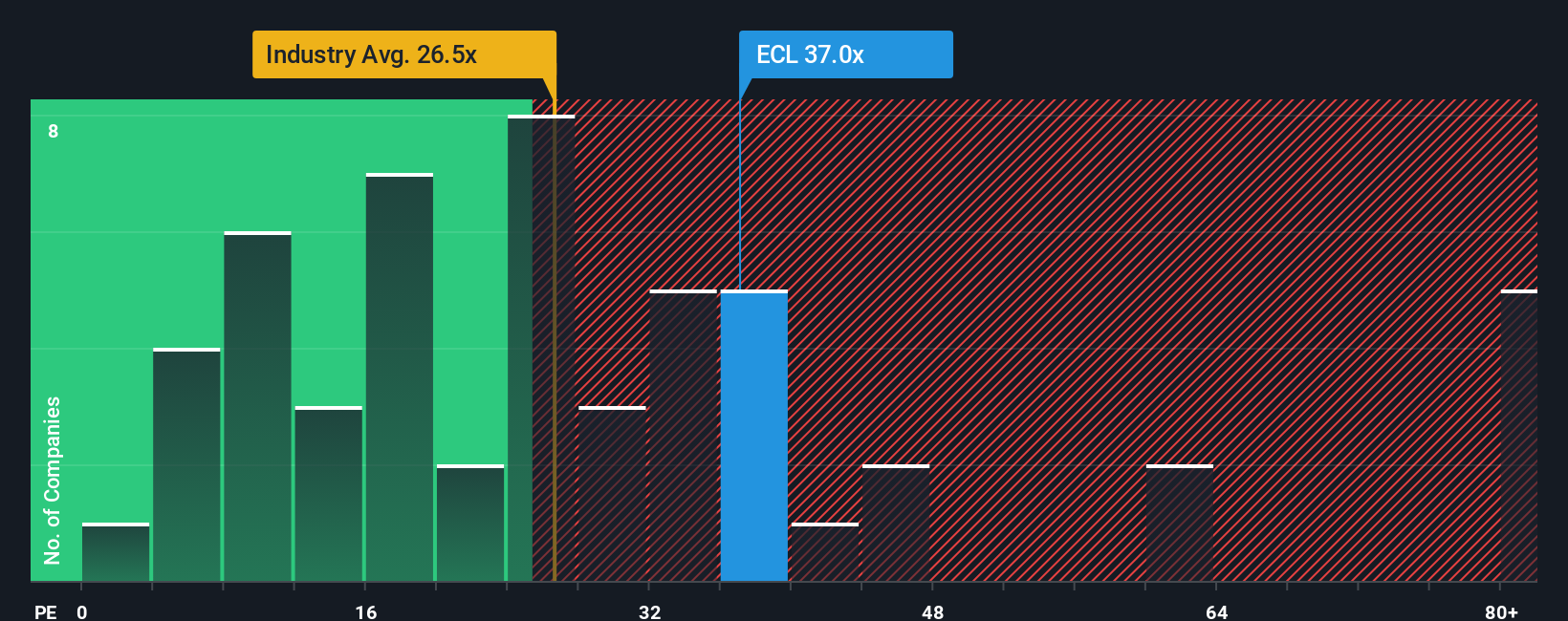

On earnings, the picture looks tougher. Ecolab trades on a P E of about 37.6 times, well above the US chemicals industry at roughly 24 times and our fair ratio of 25.3 times. This suggests meaningful downside risk if sentiment cools before earnings catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ecolab Narrative

If you see the numbers differently or want to dive into the assumptions yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Ecolab research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, seize this chance to strengthen your watchlist with focused ideas from the Simply Wall Street Screener tailored to different growth and income priorities.

- Capture potential bargains by targeting companies trading below their intrinsic value through these 907 undervalued stocks based on cash flows that spotlight compelling cash flow opportunities.

- Ride powerful digital trends by using these 80 cryptocurrency and blockchain stocks to zero in on businesses building infrastructure and services around blockchain and cryptocurrencies.

- Boost your income stream by scanning these 13 dividend stocks with yields > 3% that combine attractive yields with the balance sheets needed to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)