- United States

- /

- Metals and Mining

- /

- NYSE:DRD

Assessing DRDGOLD (NYSE:DRD) Valuation Following Steady Share Price Gains and Earnings Growth

Reviewed by Kshitija Bhandaru

Price-to-Earnings of 19x: Is it justified?

Based on the price-to-earnings (P/E) ratio, DRDGOLD appears undervalued relative to both its peer group and the broader Metals and Mining industry. The company's P/E ratio of 19x is lower than the peer average of 30.4x and the US Metals and Mining industry average of 23.8x.

The price-to-earnings ratio is a key valuation tool that compares a company's share price to its earnings per share. For resource-focused sectors such as mining, it helps investors understand how much they are paying for current earnings, especially compared to industry standards and projected future growth.

This lower-than-average multiple suggests that the market may be discounting DRDGOLD’s earnings potential, possibly creating an opportunity for investors if growth trends continue. The current valuation appears justified when considering the company’s rapid earnings growth and sector outperformance.

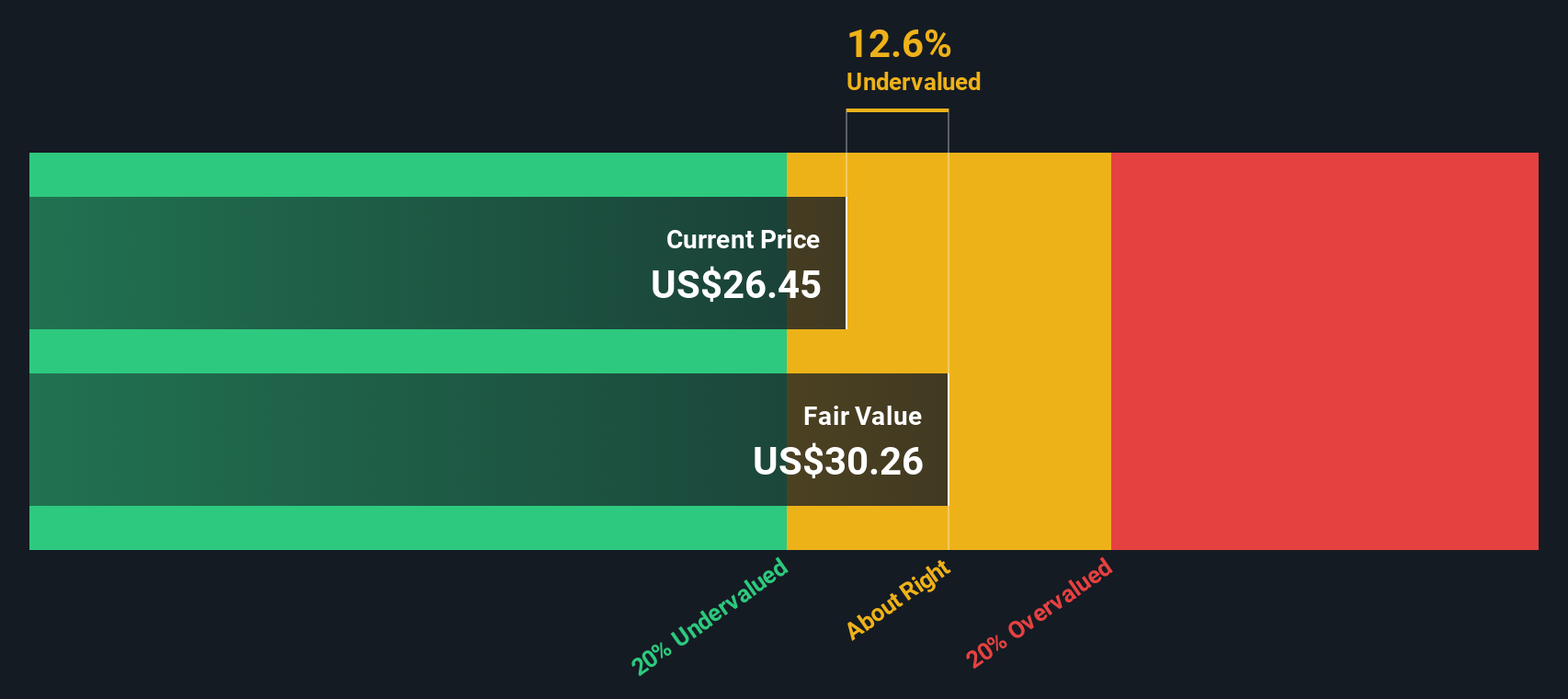

Result: Fair Value of $30.48 (UNDERVALUED)

See our latest analysis for DRDGOLD.However, shifting market dynamics and fluctuating commodity prices remain key risks that could challenge DRDGOLD’s current growth trajectory and valuation outlook.

Find out about the key risks to this DRDGOLD narrative.Another View: Our DCF Model Perspective

Taking a step back from earnings multiples, our SWS DCF model also points to DRDGOLD being undervalued at current prices. Both methods suggest value. However, could external factors shift this outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DRDGOLD Narrative

If you’re interested in drawing your own conclusions or prefer hands-on research, it’s quick and easy to develop your own view of DRDGOLD, all in under three minutes. Do it your way

A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss your chance to get ahead by using the Simply Wall Street screener to tap into unique investment ideas that fit your strategy and open up fresh possibilities.

- Spot value plays with strong cash flow by checking out stocks that may be overlooked and unlocked for growth in our undervalued stocks based on cash flows.

- Catch the trends transforming healthcare by narrowing your search to companies innovating with artificial intelligence and reshaping patient care through our healthcare AI stocks.

- Build a future-focused portfolio with a selection of quantum computing stocks driving breakthroughs in computation and real-world technology solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)