- United States

- /

- Metals and Mining

- /

- NYSE:CMC

Investors Aren't Buying Commercial Metals Company's (NYSE:CMC) Earnings

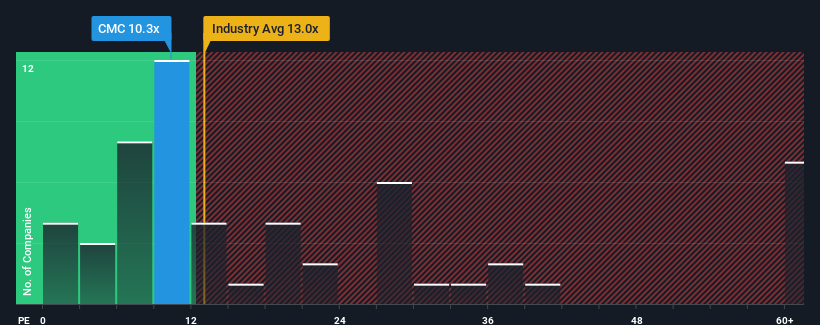

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider Commercial Metals Company (NYSE:CMC) as an attractive investment with its 10.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Commercial Metals has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Commercial Metals

Is There Any Growth For Commercial Metals?

In order to justify its P/E ratio, Commercial Metals would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's bottom line. Even so, admirably EPS has lifted 80% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 3.8% each year during the coming three years according to the eight analysts following the company. With the market predicted to deliver 10% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Commercial Metals' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Commercial Metals' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Commercial Metals' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Commercial Metals you should be aware of.

If these risks are making you reconsider your opinion on Commercial Metals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CMC

Commercial Metals

Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives