- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Will Cleveland-Cliffs' (CLF) Expanded Debt Raise Reshape Its Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- On October 10, 2025, Cleveland-Cliffs Inc. issued an additional US$275 million of 7.625% Senior Guaranteed Notes due 2034 in a private placement, expanding on a previous US$850 million offering to help repay borrowings under its asset-based lending facility.

- This move provides Cleveland-Cliffs with enhanced financial flexibility, allowing the company to strengthen its capital structure and support operational initiatives while managing interest expenses.

- We'll examine how this expanded debt offering is poised to impact Cleveland-Cliffs' investment narrative, particularly regarding its improved liquidity and capital allocation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cleveland-Cliffs Investment Narrative Recap

Owning Cleveland-Cliffs today means believing that U.S. steel tariffs, automotive reshoring, and cost efficiencies can support a turnaround in earnings and margin expansion. The company’s recent US$275 million senior notes issuance further enhances liquidity but does not meaningfully change near-term catalysts, such as Q3 earnings and auto steel demand, or address the primary risk from potential tariff changes.

Of Cleveland-Cliffs’ recent announcements, the upcoming Q3 earnings release on October 20, 2025, stands out as most relevant for short-term investors. This event could provide important clarity on how the company’s capital structure moves, including the latest debt financing, might influence its profitability and leverage trajectory.

However, it is important to keep in mind that should U.S. trade policy shift, especially if steel tariffs are reduced or removed, investors should be aware of...

Read the full narrative on Cleveland-Cliffs (it's free!)

Cleveland-Cliffs' outlook anticipates $22.5 billion in revenue and $590.0 million in earnings by 2028. This scenario assumes annual revenue growth of 6.8% and an earnings increase of $2.29 billion from current earnings of -$1.7 billion.

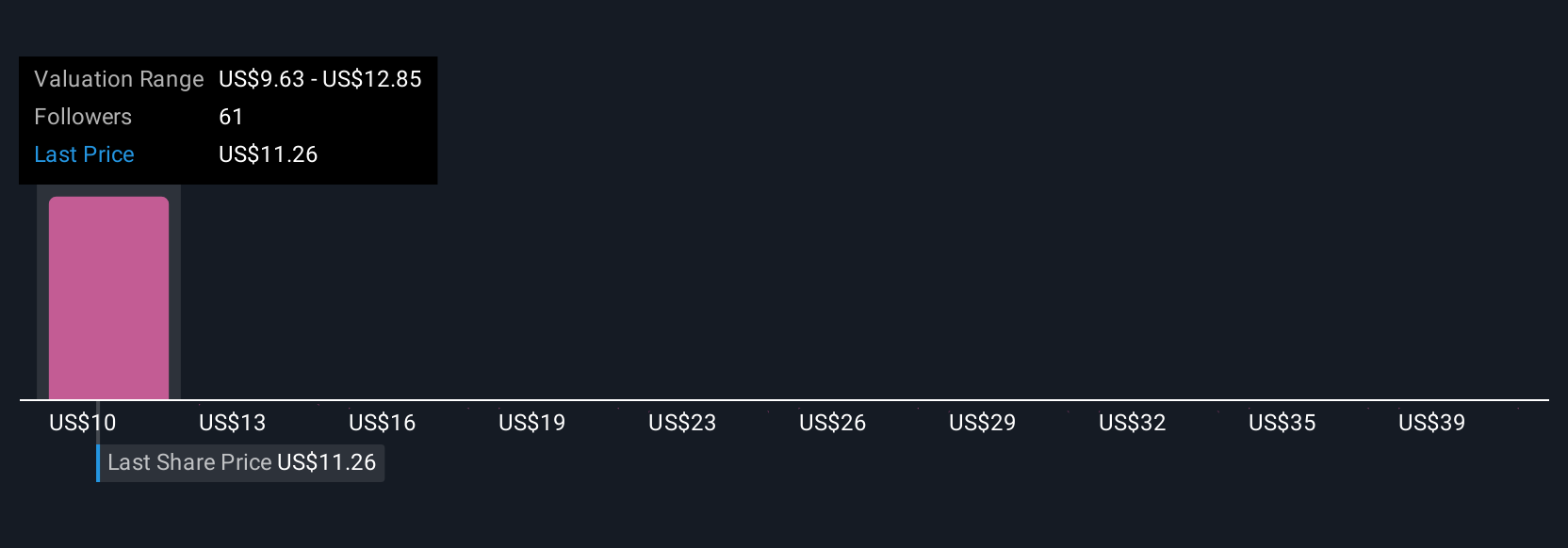

Uncover how Cleveland-Cliffs' forecasts yield a $11.57 fair value, a 16% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 9 fair value estimates for Cleveland-Cliffs, ranging from US$1.19 to US$57.48 per share. With such varied opinions, it is clear that views differ widely on future profitability, particularly as Cleveland-Cliffs’ business remains tied to the future of steel tariffs and evolving U.S. trade policy.

Explore 9 other fair value estimates on Cleveland-Cliffs - why the stock might be worth over 4x more than the current price!

Build Your Own Cleveland-Cliffs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cleveland-Cliffs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cleveland-Cliffs' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)