- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF): Valuation Insights After Upsized Debt Offering Signals Renewed Investor Confidence

Reviewed by Kshitija Bhandaru

Cleveland-Cliffs (CLF) made headlines after it decided to increase the size of its planned offering of senior unsecured notes. The fresh funds are set to pay down its asset-based lending facility. This move signals investor interest and confidence in the company’s balance sheet and future direction.

See our latest analysis for Cleveland-Cliffs.

After floating and upsizing its debt offering, Cleveland-Cliffs has seen its share price jump 15.9% over the past month and an impressive 38.2% year-to-date. This suggests that momentum is building. While the short-term share price return stands out, total shareholder return over the past year is just 0.3%. This indicates that recent gains are helping the company regain its footing after a challenging stretch. This renewed optimism seems to reflect confidence in the company’s ability to manage debt and leverage domestic steel demand.

If Cleveland-Cliffs’ latest moves have you watching for fresh opportunities, this is a great chance to discover fast growing stocks with high insider ownership.

With shares riding strong recent gains, the key question becomes whether Cleveland-Cliffs remains undervalued compared to its fundamentals, or if the market is already pricing in all the anticipated growth and turnaround potential.

Most Popular Narrative: 13.9% Overvalued

Cleveland-Cliffs’ last close of $13.18 sits noticeably above the most commonly cited fair value estimate of $11.57. This narrative brings together analyst views on the company’s prospects, pricing power, and key sector forces driving where shares should be trading.

Strategic footprint optimization, internal coke and feedstock integration, and direct moves to lower fixed costs and SG&A have already resulted in unit cost reductions. Ongoing initiatives are expected to deliver further cost savings, driving enhanced free cash flow, lower leverage, and a structurally higher earnings profile through improved operating margins.

Are ongoing cost cuts and efficiency drives enough to justify this high market price? The full narrative examines pivotal assumptions on margins and future profit multiples, with one ambitious leap at the heart of this fair value. Curious what’s fueling the optimism? Find out how the bullish thesis is built.

Result: Fair Value of $11.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Cleveland-Cliffs’ reliance on continued tariff protection and the risk of rising domestic supply could quickly shift the outlook if conditions change.

Find out about the key risks to this Cleveland-Cliffs narrative.

Another View: What Multiples Say

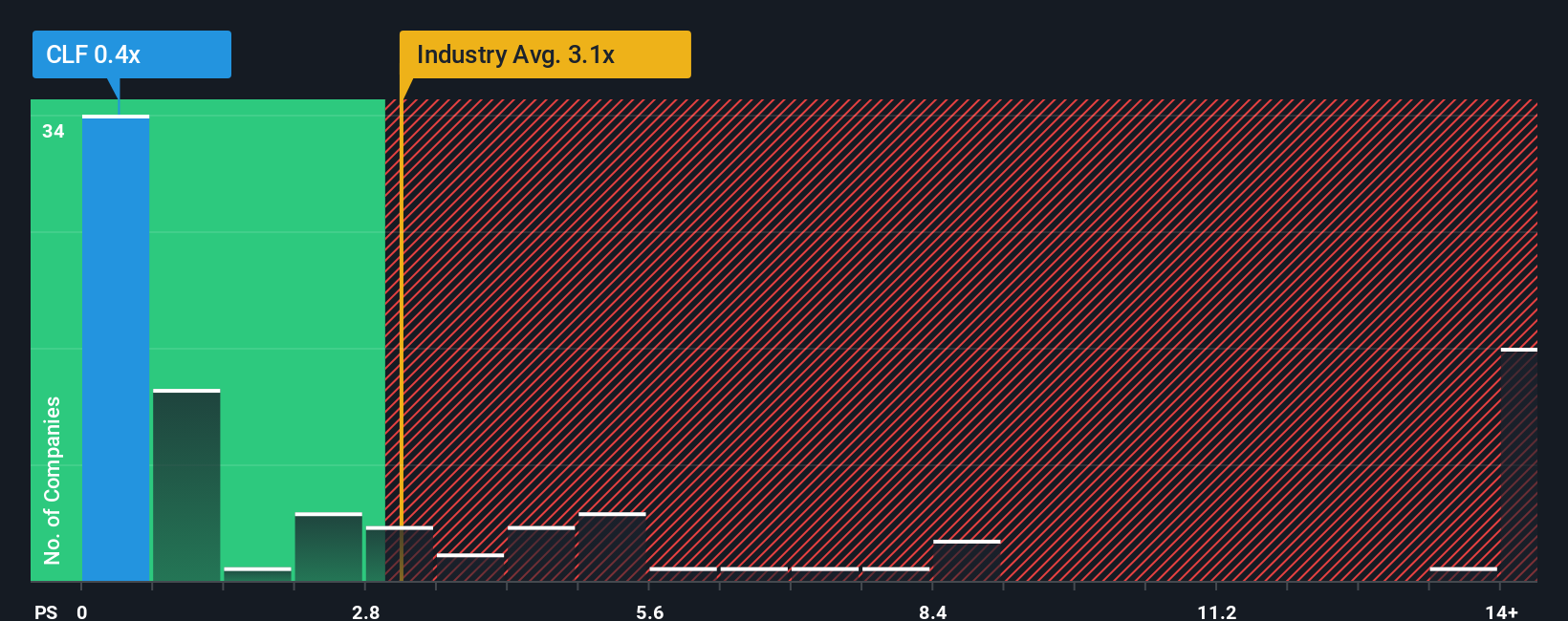

While analysts suggest Cleveland-Cliffs' share price is slightly above fair value, looking at commonly used price-to-sales ratios tells a different story. The company trades at just 0.4x sales, which is well below the US Metals and Mining industry average of 3x and peer average of 1.6x. Even compared to the fair ratio of 0.8x, shares appear attractively priced. Does this gap mean the market is overlooking an upside opportunity, or are there deeper risks keeping valuation low?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cleveland-Cliffs Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own take on Cleveland-Cliffs in just minutes, and Do it your way.

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop. Use the Simply Wall Street Screener to spot hidden gems, exciting sectors, and unique opportunities before everyone else catches on. Don’t let fresh possibilities pass you by.

- Uncover high yields and reliable returns with these 19 dividend stocks with yields > 3%, designed to spotlight companies rewarding shareholders with stable income streams.

- Step into the future by tracking innovation with these 24 AI penny stocks, identifying businesses shaping the next wave of artificial intelligence breakthroughs.

- Seize the chance to spot value with these 901 undervalued stocks based on cash flows, featuring stocks trading below their intrinsic worth according to projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives