- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF): Evaluating Valuation as Tariff Policy on UK Steel Remains in Focus

Reviewed by Kshitija Bhandaru

If you’re wondering how to play Cleveland-Cliffs (CLF) right now, you’re not alone. Shares have dropped for a second straight day as investors digest news surrounding President Trump’s trip to the UK, where steel trade talks are front and center. The U.S. government’s fresh signal that tariffs on UK steel will stay in place, rather than being scrapped, could have lasting effects for American steelmakers like CLF, whose fortunes are often tied to trade policy moves like this one.

This isn’t the first twist for Cleveland-Cliffs investors this year. The stock is up over 12% in the past month and has soared more than 63% in the past 3 months, despite a recent pullback. Still, year-to-date returns sit at 23%, while the past year has seen a slight decline. Those numbers hint at building momentum lately, even as the company’s long-term performance has seesawed along with shifting headlines and market sentiment.

So after this latest dip and several weeks of strong momentum, is Cleveland-Cliffs presenting an attractive entry point, or is the market simply pricing in future growth?

Most Popular Narrative: 3.9% Overvalued

According to the most widely followed narrative, Cleveland-Cliffs appears slightly overvalued relative to its calculated fair value today. The consensus view brings together expectations of improved cost control, a supportive trade policy environment, and changing industry dynamics.

Strategic footprint optimization, internal coke and feedstock integration, and direct moves to lower fixed costs and SG&A have already resulted in unit cost reductions. Ongoing initiatives are expected to deliver further cost savings, driving enhanced free cash flow, lower leverage, and a structurally higher earnings profile through improved operating margins.

Want to know the key drivers behind this valuation? The core factors are a bold set of financial forecasts, future margin expansion, a major turnaround in profitability, and a valuation multiple typically reserved for industry leaders. Curious which numbers need to fall into place for analysts’ sums to work? Unpack the full narrative to find out what makes this price target tick.

Result: Fair Value of $11.31 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, softer steel demand or reduced tariff protections could quickly undermine these optimistic forecasts. This could place pressure on Cleveland-Cliffs’ margins and stock price.

Find out about the key risks to this Cleveland-Cliffs narrative.Another Perspective: The SWS DCF Model Offers a Different Take

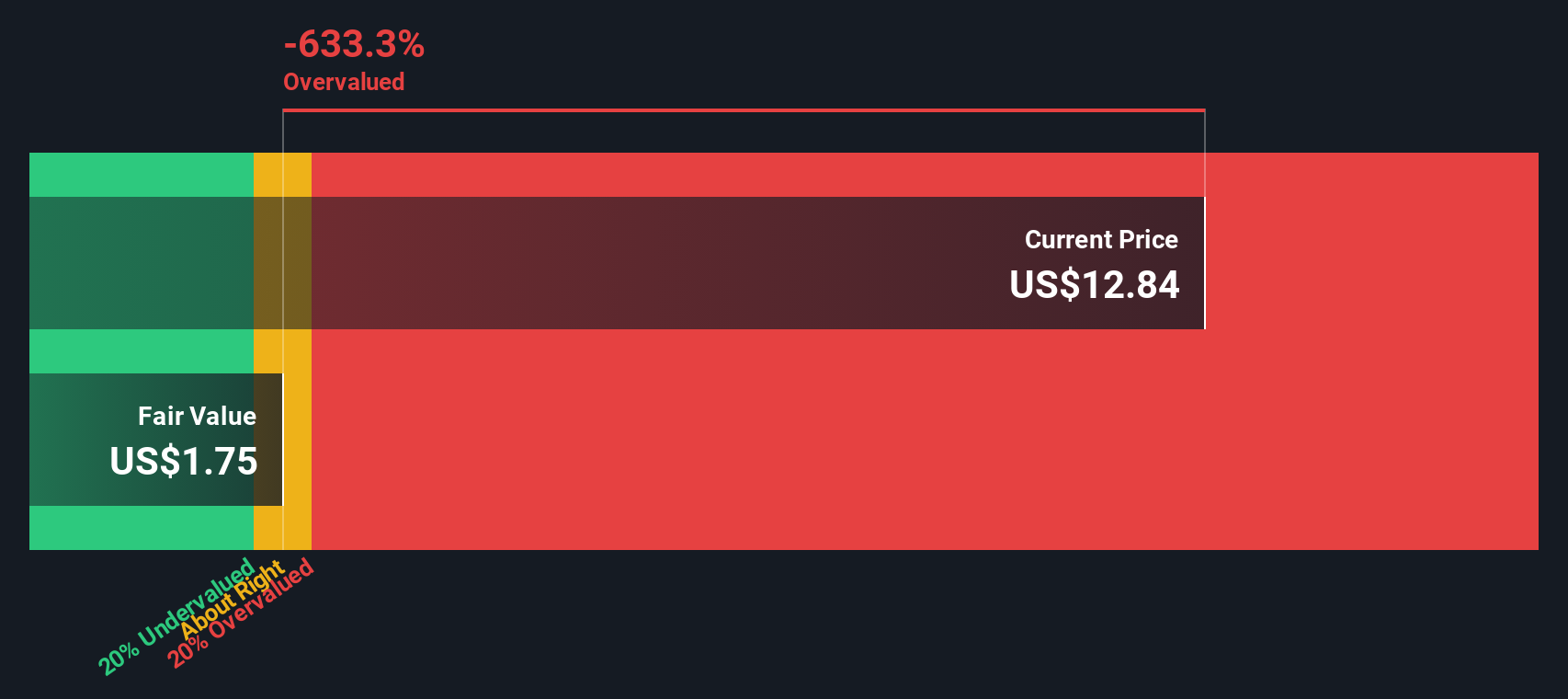

Looking at Cleveland-Cliffs through our DCF model, a very different story emerges from the market-driven approach above. This cash flow model suggests the shares could be priced even higher than fundamentals justify. Which view will ultimately win out?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Cleveland-Cliffs to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Cleveland-Cliffs Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the best opportunities rarely come from standing still. Give yourself an edge by targeting stocks with unique qualities and powerful trends. Don’t get left behind while others snap up the most promising ideas available now.

- Tap into future tech growth and market disruptors by checking out AI penny stocks. These companies are unlocking the potential of artificial intelligence to transform entire industries.

- Benefit from steady income streams and inflation protection by browsing dividend stocks with yields > 3%. This collection features businesses consistently rewarding shareholders with robust dividend yields.

- Capitalize on overlooked market bargains with undervalued stocks based on cash flows. This selection highlights stocks trading below their true value based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives