- United States

- /

- Metals and Mining

- /

- NYSE:AMR

Alpha Metallurgical Resources (AMR): Valuation Check After 2026 Guidance, Capex Plans and Insider Buying

Reviewed by Simply Wall St

Alpha Metallurgical Resources (AMR) just laid out its 2026 playbook, pairing detailed coal volume and cost guidance with fresh capex plans and insider buying that together give investors a clearer view of management’s conviction.

See our latest analysis for Alpha Metallurgical Resources.

The fresh 2026 guidance and mixed insider activity land against a backdrop where the share price sits at $186.65, with a robust 30 day share price return of 17.72 percent but a weaker 1 year total shareholder return of negative 11.85 percent. This suggests near term momentum is improving even as the longer term picture remains more subdued.

If you are weighing Alpha’s guidance against other opportunities in cyclical names, this could be a good moment to explore fast growing stocks with high insider ownership for ideas with strong insider alignment.

With shares trading slightly above analyst targets but below intrinsic value estimates, Alpha’s muted long term returns and hefty volume plans raise the real question: is this an overlooked value setup, or is the market already pricing in the next upcycle?

Most Popular Narrative Narrative: 1.2% Overvalued

Compared with the latest fair value estimate of $184.50, Alpha’s $186.65 close implies only a marginal premium, setting up a finely balanced valuation debate.

Global underinvestment and persistent supply constraints in metallurgical coal mining (compounded by recent industry idlings and bankruptcies) are likely to elevate future prices and market share for well-capitalized producers like Alpha, pointing to potential upside for future revenue and margins as demand recovers or steadies, especially in high-growth markets like India and Brazil.

To see what underpins this tightly priced call on Alpha’s future, note that the growth path, margin reset, and low implied earnings multiple are all hiding in plain sight.

Result: Fair Value of $184.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural shifts toward scrap based steelmaking and potential regulatory tightening could cap met coal demand and compress Alpha’s longer term earnings power.

Find out about the key risks to this Alpha Metallurgical Resources narrative.

Another Angle On Value

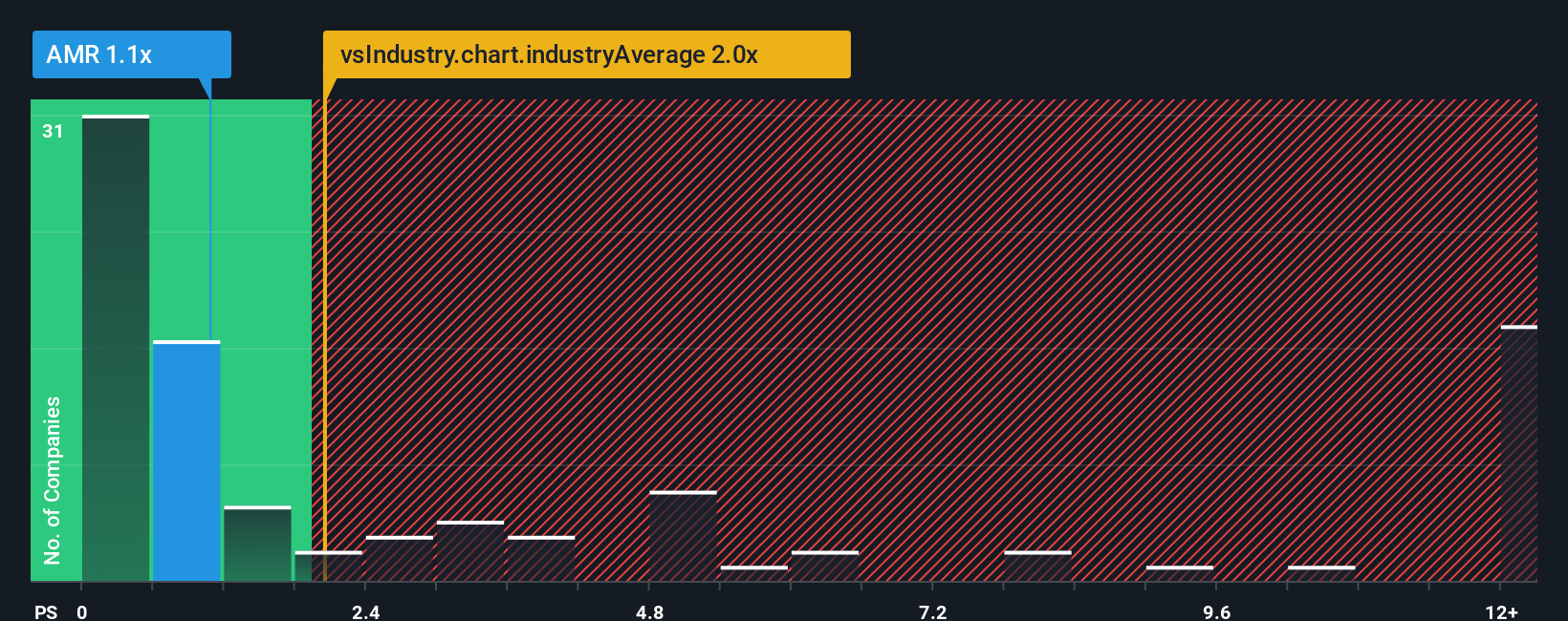

While the narrative calls Alpha slightly overvalued versus a fair value of $184.50, its price to sales ratio of 1.1 times looks cheaper than both the US Metals and Mining industry at 1.6 times and peers at 1.7 times. It is, however, slightly above a 0.9 times fair ratio, leaving investors to decide whether this is a value gap or a warning sign.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alpha Metallurgical Resources Narrative

If you see Alpha’s story differently or want to dig into the numbers yourself, you can build a tailored view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Alpha Metallurgical Resources.

Looking for your next smart investing angle?

Use the Simply Wall St Screener today to uncover fresh opportunities beyond Alpha, before other investors move in and the most compelling setups get priced away.

- Capture early momentum in resilient small caps by targeting these 3633 penny stocks with strong financials with balance sheets and cash flows that can support real growth, not just hype.

- Position your portfolio for long term structural shifts by focusing on these 25 AI penny stocks powering breakthroughs in automation, data analytics, and intelligent infrastructure.

- Identify potential mispricings before the crowd notices by scanning these 915 undervalued stocks based on cash flows where intrinsic value and current share prices still meaningfully diverge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMR

Alpha Metallurgical Resources

A mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)