- United States

- /

- Metals and Mining

- /

- NYSE:AA

Alcoa (AA): Reassessing Valuation After Optimistic Outlook on Aluminum Market Recovery and Cyclical Upside Potential

Reviewed by Simply Wall St

Alcoa (AA) heads into its Dec. 2 Resourcing Tomorrow conference slot with a tailwind, as investors reassess the stock alongside a recovering aluminum and alumina backdrop and renewed interest in cyclical commodities.

See our latest analysis for Alcoa.

The latest 30 day share price return of 22.75 percent, building on a 37.32 percent 90 day gain and 21.45 percent year to date move, shows momentum picking up as investors lean into Alcoa’s leverage to an aluminum upcycle. Its 5 year total shareholder return of 119.47 percent underlines how powerful these cycles can be when sentiment turns.

If this cyclical swing has your attention, it may also be worth exploring fast growing stocks with high insider ownership as another way to spot under the radar opportunities where conviction and growth are already lining up.

Yet with Alcoa now trading above consensus targets after a powerful run, the key question is whether the market is still underestimating its earnings power in a metals upturn or already pricing in the next leg of growth.

Most Popular Narrative: 11.7% Overvalued

With Alcoa last closing at 46.14 dollars against a narrative fair value of 41.29 dollars, the story leans on higher growth and richer future multiples.

Revenue growth has increased significantly, moving from roughly 1.63 percent to about 3.28 percent annually in the long term model.

Curious why a slow grind in margins still supports a much higher future earnings multiple and upgraded growth runway, all at a steeper discount rate?

Result: Fair Value of $41.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, powerful decarbonization tailwinds and the successful scaling of EcoLum and ELYSIS could support structurally higher demand, margins, and a sustained premium multiple.

Find out about the key risks to this Alcoa narrative.

Another Angle on Valuation

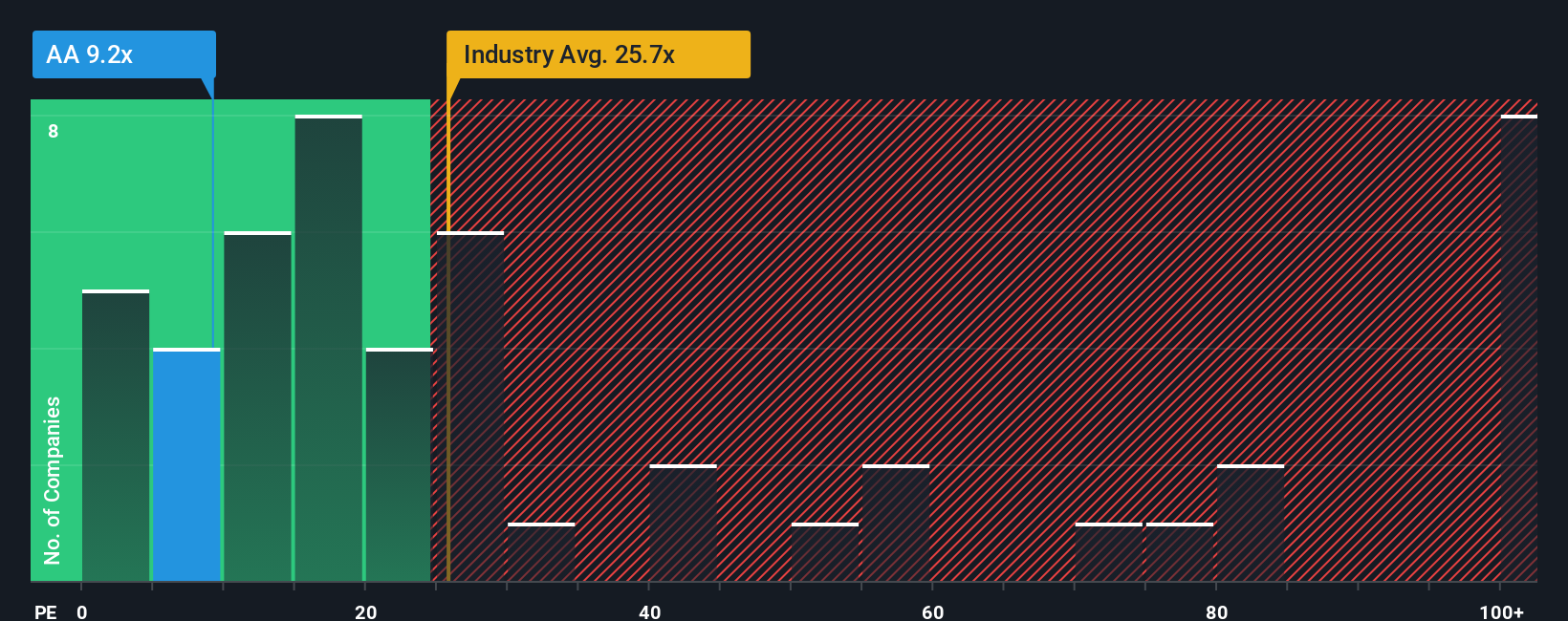

Set against that narrative fair value of 41.29 dollars, Alcoa's 10.6 times price to earnings ratio looks modest beside the US Metals and Mining average of 24.5 times and a fair ratio of 16.7 times. This hints at potential upside if sentiment normalizes, or a possible value trap if earnings slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alcoa Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more smart ideas?

Do not stop at one opportunity. You can quickly scan a world of data-backed ideas using the Simply Wall St Screener to strengthen your portfolio.

- Capture potential mispricings by reviewing these 908 undervalued stocks based on cash flows where robust cash flows may not yet be fully recognized in current share prices.

- Ride powerful secular trends by targeting innovation-focused names through these 26 AI penny stocks built around transformative artificial intelligence themes.

- Assess reliable income streams by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with supportive underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AA

Alcoa

Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)