- United States

- /

- Metals and Mining

- /

- NasdaqGS:TMC

TMC the Metals (TMC) Reports Increased Net Loss For Q2 2025

Reviewed by Simply Wall St

TMC the Metals (TMC) recently reported a significant increase in net loss for Q2 2025, alongside the announcement of amendments to its equity incentive plan in an August shareholder meeting. Over the last quarter, the company experienced a 22% price increase, diverging from its challenging earnings performance. This positive market movement occurred amidst a broader uptrend, as major indexes reached record highs. Overall, despite TMC's financial struggles, the favorable market conditions and strategic financial engagements like private placements may have mitigated negative sentiment, contributing to the share price rise.

Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

Over a three-year period, TMC the Metals achieved a total return of 442.50%, a substantial increase. In contrast to its yearly performance, TMC outpaced both the US Metal and Mining industry, which showed a 22.1% return, and the general market, which recorded a 17.5% increase over the past year.

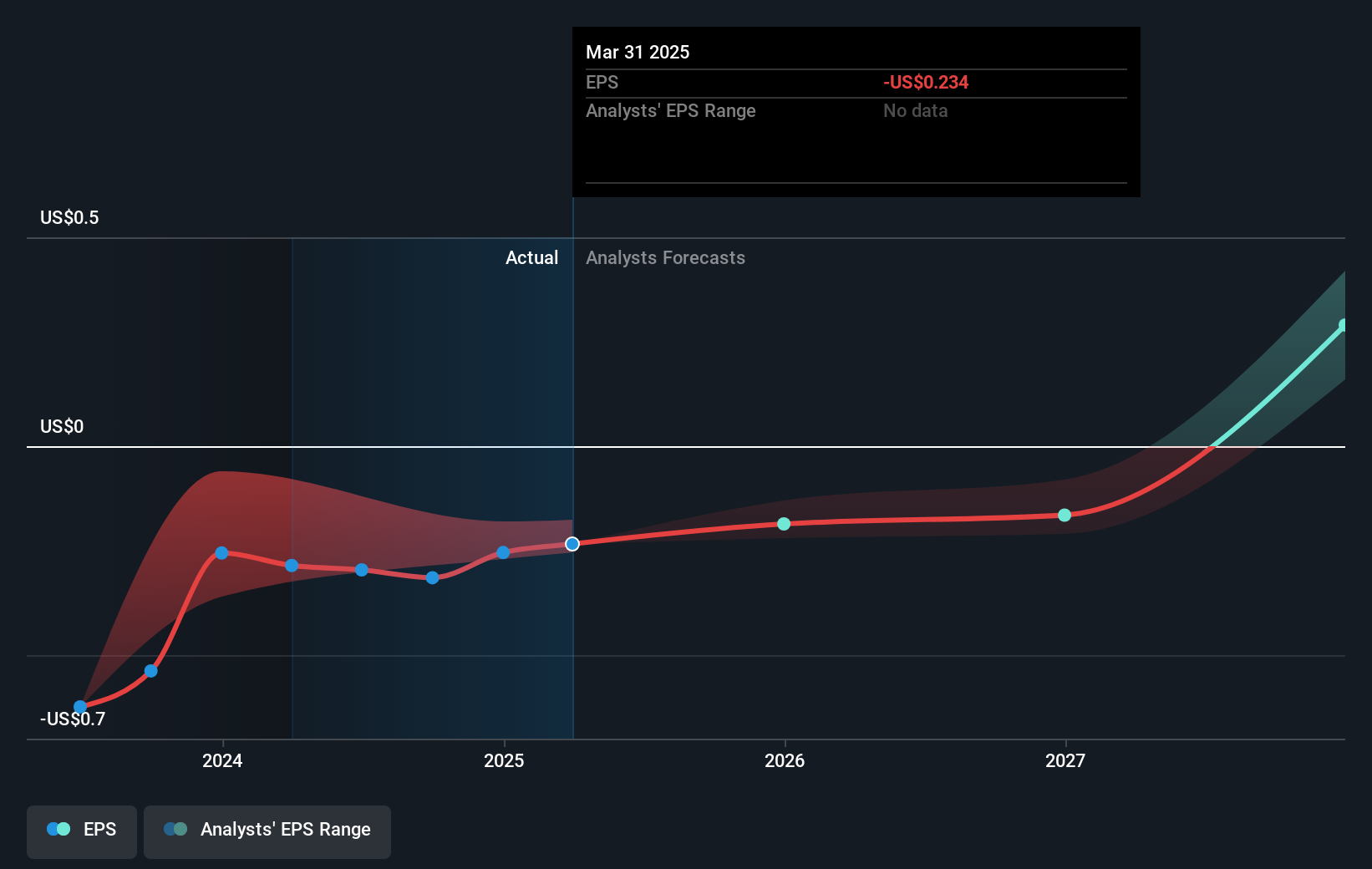

The recent 22% uptick in share price, alongside challenging earnings reports, highlights the complexity of TMC’s financial picture. The increased net loss in Q2 2025 raises questions about future revenue and earnings potential, although analysts forecast earnings growth of 70.25% annually. This projection, however, comes with analyst uncertainty due to a wide range of estimates. TMC's share price remains discounted from the US$8.75 consensus price target, suggesting the market sees potential for upside despite its current challenges. As TMC aims to become profitable over the next three years, evaluating the impact of its equity incentive amendment and market confidence will be crucial.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TMC the metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMC

TMC the metals

A deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California.

Moderate risk with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)